- Japan

- /

- Life Sciences

- /

- TSE:2395

3 Stocks Estimated To Be Undervalued In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices reaching record highs, investors are closely monitoring the implications of potential policy changes on growth and inflation. Amidst this backdrop of optimism and uncertainty, identifying undervalued stocks becomes crucial for those looking to capitalize on market opportunities while navigating evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| IMAGICA GROUP (TSE:6879) | ¥475.00 | ¥946.51 | 49.8% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.81 | 50% |

| Appier Group (TSE:4180) | ¥1700.00 | ¥3393.06 | 49.9% |

| Dynavox Group (OM:DYVOX) | SEK66.50 | SEK132.84 | 49.9% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Proficient Auto Logistics (NasdaqGS:PAL) | US$10.00 | US$19.92 | 49.8% |

| Nayuki Holdings (SEHK:2150) | HK$1.59 | HK$3.17 | 49.9% |

| Dometic Group (OM:DOM) | SEK61.15 | SEK121.72 | 49.8% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3915.00 | ¥7790.88 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.14 | €16.25 | 49.9% |

Let's uncover some gems from our specialized screener.

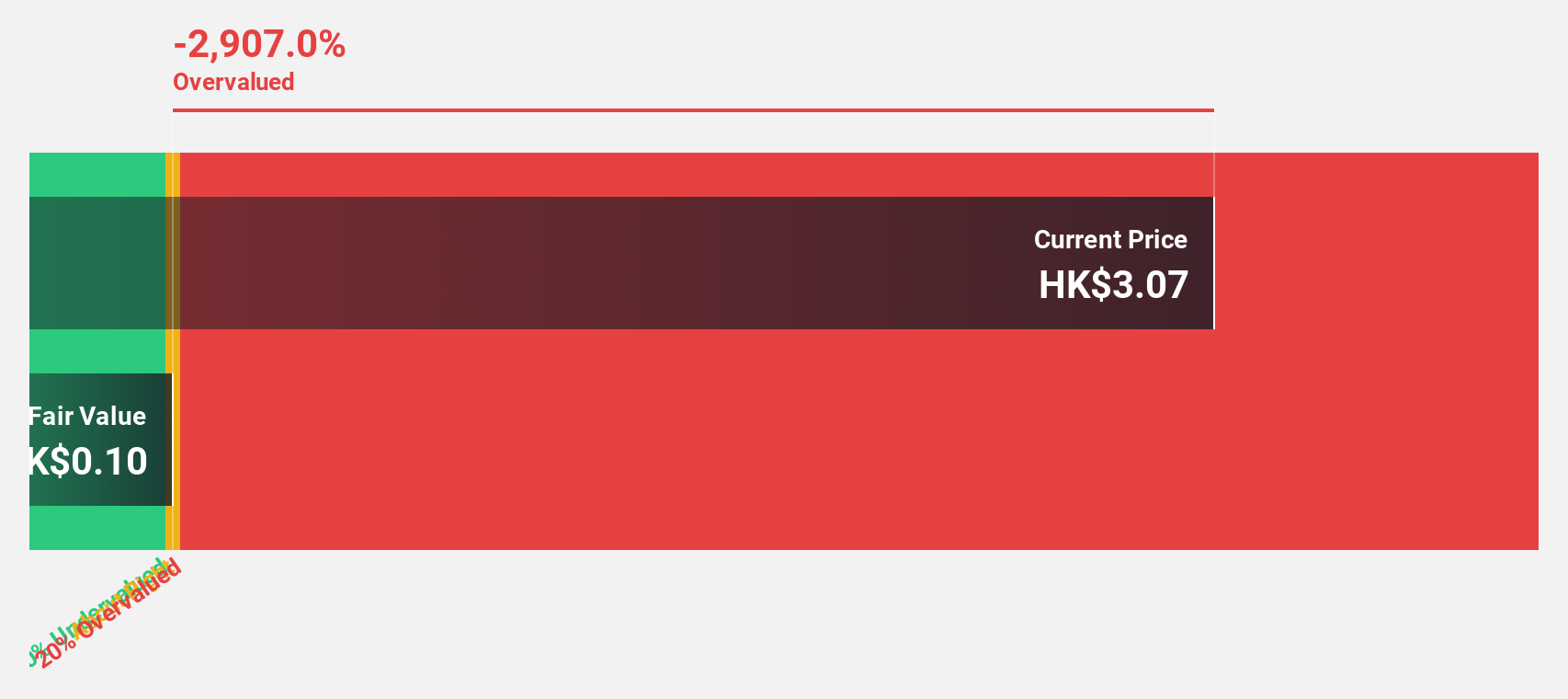

Guangzhou Automobile Group (SEHK:2238)

Overview: Guangzhou Automobile Group Co., Ltd. operates in the research, development, manufacture, and sale of vehicles and motorcycles, along with parts and components, while also providing commercial and financial services in Mainland China and internationally; it has a market cap of HK$77.39 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 49.2%

Guangzhou Automobile Group is trading at a significant discount to its estimated fair value of HK$6.16, with shares currently around HK$3.13. Despite recent declines in sales and net income, the company's earnings are forecast to grow significantly at 31.9% annually, outpacing the Hong Kong market's growth rate. However, profit margins have decreased from last year and dividends are not well covered by earnings or cash flows, indicating potential financial challenges ahead.

- According our earnings growth report, there's an indication that Guangzhou Automobile Group might be ready to expand.

- Click here to discover the nuances of Guangzhou Automobile Group with our detailed financial health report.

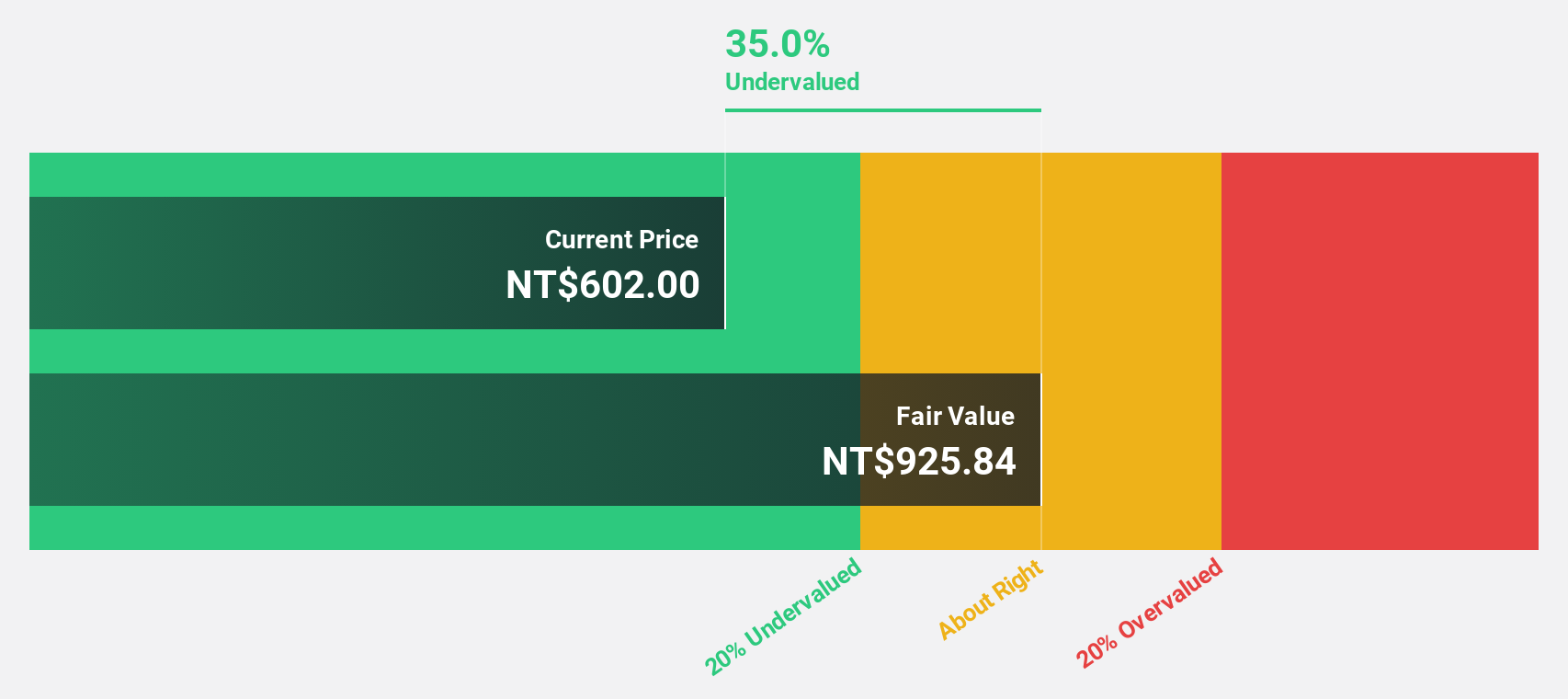

Parade Technologies (TPEX:4966)

Overview: Parade Technologies, Ltd. is a fabless semiconductor company operating in South Korea, China, Taiwan, Japan, and internationally with a market cap of NT$54.15 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, totaling NT$15.95 billion.

Estimated Discount To Fair Value: 34.7%

Parade Technologies is trading at NT$694, significantly below its estimated fair value of NT$1062.1, indicating it may be undervalued based on cash flows. Recent earnings show strong growth, with third-quarter sales rising to TWD 4.40 billion from TWD 3.71 billion a year ago and net income increasing to TWD 761.7 million from TWD 611.93 million. However, the company's dividend track record remains unstable despite robust earnings growth forecasts exceeding market averages.

- In light of our recent growth report, it seems possible that Parade Technologies' financial performance will exceed current levels.

- Take a closer look at Parade Technologies' balance sheet health here in our report.

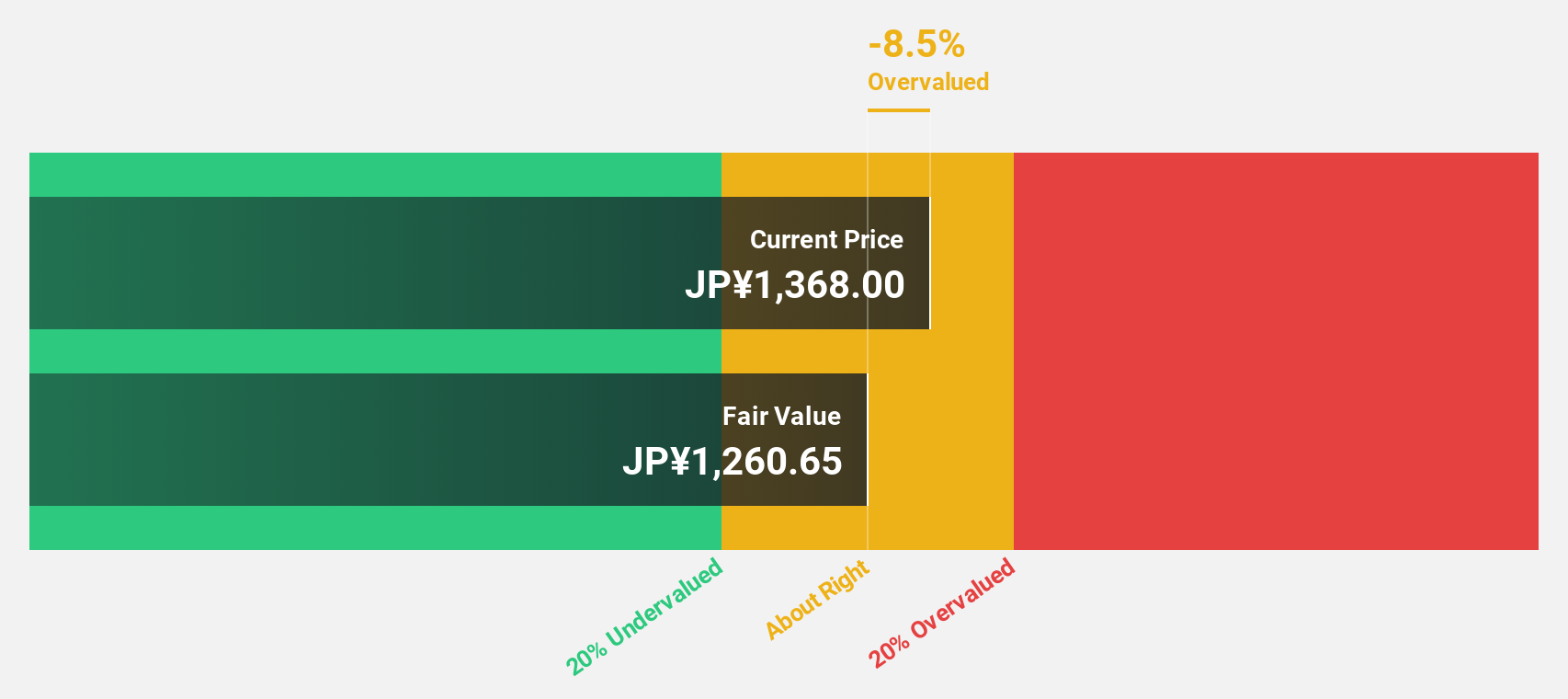

Shin Nippon Biomedical Laboratories (TSE:2395)

Overview: Shin Nippon Biomedical Laboratories, Ltd. is a contract research organization involved in transactional research and medipolis businesses both in Japan and internationally, with a market cap of ¥59.28 billion.

Operations: Shin Nippon Biomedical Laboratories generates revenue through its transactional research and medipolis businesses, operating both domestically in Japan and on an international scale.

Estimated Discount To Fair Value: 25.5%

Shin Nippon Biomedical Laboratories is trading at ¥1482, which is 25.5% below its estimated fair value of ¥1990.48, highlighting potential undervaluation based on cash flows. Despite high non-cash earnings and significant forecasted earnings growth of 29% annually, the dividend yield of 3.37% isn't well covered by free cash flows. Recent strategic collaboration with Astellas Pharma aims to bolster drug discovery efforts, potentially enhancing long-term revenue prospects in the life sciences sector.

- The growth report we've compiled suggests that Shin Nippon Biomedical Laboratories' future prospects could be on the up.

- Navigate through the intricacies of Shin Nippon Biomedical Laboratories with our comprehensive financial health report here.

Taking Advantage

- Click this link to deep-dive into the 896 companies within our Undervalued Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2395

Shin Nippon Biomedical Laboratories

A contract research organization, engages in the transactional research and medipolis businesses in Japan and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives