Investors Continue Waiting On Sidelines For GNI Group Ltd. (TSE:2160)

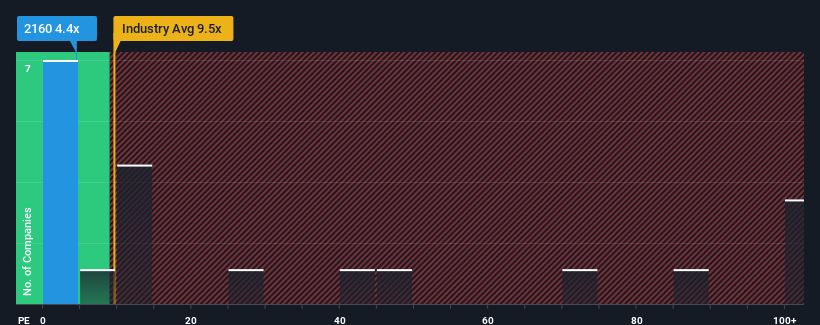

GNI Group Ltd.'s (TSE:2160) price-to-sales (or "P/S") ratio of 4.4x might make it look like a strong buy right now compared to the Biotechs industry in Japan, where around half of the companies have P/S ratios above 12.9x and even P/S above 61x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for GNI Group

What Does GNI Group's P/S Mean For Shareholders?

Recent times have been pleasing for GNI Group as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think GNI Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is GNI Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as GNI Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 57% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 141% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 40% per annum as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 32% per year, which is noticeably less attractive.

In light of this, it's peculiar that GNI Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does GNI Group's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at GNI Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for GNI Group (1 doesn't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2160

GNI Group

Engages in the research, development, manufacture, and sale of pharmaceutical drugs in Japan and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives