- Japan

- /

- Entertainment

- /

- TSE:9766

Konami Group Corporation's (TSE:9766) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

It is hard to get excited after looking at Konami Group's (TSE:9766) recent performance, when its stock has declined 6.8% over the past month. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to Konami Group's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Konami Group

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Konami Group is:

13% = JP¥52b ÷ JP¥408b (Based on the trailing twelve months to December 2023).

The 'return' is the yearly profit. One way to conceptualize this is that for each ¥1 of shareholders' capital it has, the company made ¥0.13 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Konami Group's Earnings Growth And 13% ROE

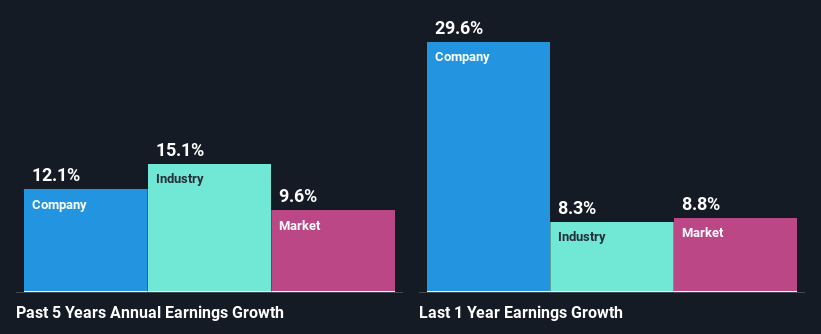

To begin with, Konami Group seems to have a respectable ROE. Further, the company's ROE compares quite favorably to the industry average of 8.8%. Probably as a result of this, Konami Group was able to see a decent growth of 12% over the last five years.

Next, on comparing Konami Group's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 15% over the last few years.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Konami Group is trading on a high P/E or a low P/E, relative to its industry.

Is Konami Group Using Its Retained Earnings Effectively?

Konami Group has a healthy combination of a moderate three-year median payout ratio of 30% (or a retention ratio of 70%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

Moreover, Konami Group is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Conclusion

On the whole, we feel that Konami Group's performance has been quite good. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Konami Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9766

Konami Group

Primarily engages in the digital entertainment, amusement, gaming and systems, and sports businesses in Japan, Asia/Oceania countries, the United States, and Europe.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives