- Japan

- /

- Interactive Media and Services

- /

- TSE:2371

Kakaku.com And 2 Other High Growth Tech Stocks in Japan

Reviewed by Simply Wall St

Japan's stock markets have recently experienced a downturn, with the Nikkei 225 Index dropping 5.8% and the broader TOPIX Index losing 4.2%, influenced by a U.S.-led sell-off in semiconductor stocks and yen strength impacting export-oriented companies. Despite these challenges, high-growth tech stocks in Japan remain an area of interest for investors seeking opportunities amidst market volatility. In this environment, identifying strong tech stocks involves looking for companies with robust growth potential, solid financial health, and innovative business models that can withstand economic fluctuations.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

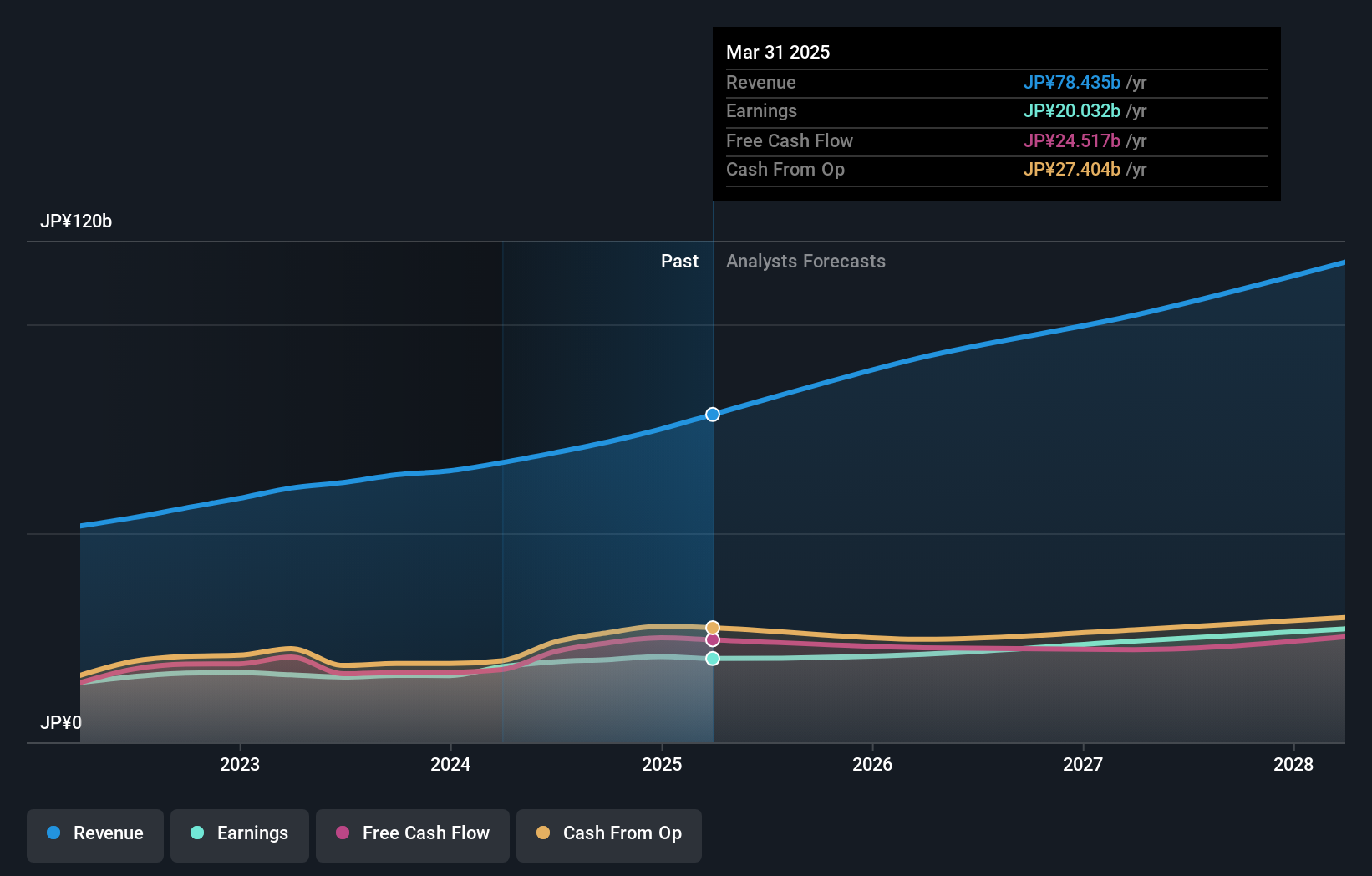

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan and has a market cap of approximately ¥512.20 billion.

Operations: Kakaku.com, Inc. operates in Japan, providing purchase support and restaurant review services. The company generates revenue primarily through advertising and affiliate fees from its online platforms.

Kakaku.com, a notable player in Japan's tech landscape, has demonstrated robust earnings growth of 23.4% over the past year, outpacing the Interactive Media and Services industry average of 14.5%. With an expected annual profit growth rate of 9%, it is set to grow faster than the JP market's forecasted 8.6%. The company’s revenue is projected to increase by 8.8% annually, surpassing the broader market's anticipated 4.2% growth rate. Recent board decisions include disposing of treasury shares as restricted share remuneration, indicating strategic financial maneuvers aimed at enhancing shareholder value. Investments in R&D have been significant; Kakaku.com allocated ¥1 billion ($9 million) towards innovation last year, reflecting its commitment to staying ahead in a competitive sector. This focus on research and development underpins their ability to offer cutting-edge solutions and maintain high-quality earnings moving forward. As software firms increasingly adopt SaaS models for recurring revenue streams, Kakaku.com's strategic positioning could potentially yield sustainable long-term benefits within Japan’s high-growth tech environment.

- Click to explore a detailed breakdown of our findings in Kakaku.com's health report.

Gain insights into Kakaku.com's historical performance by reviewing our past performance report.

TechMatrix (TSE:3762)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TechMatrix Corporation operates in Japan's information infrastructure and application service sector with a market cap of ¥93.02 billion.

Operations: TechMatrix Corporation focuses on providing information infrastructure and application services within Japan. The company generates revenue through various segments, though specific figures are not disclosed.

TechMatrix has shown impressive earnings growth of 23.2% over the past year, outpacing the IT industry average of 10.1%. The company's revenue is forecast to grow by 12.3% annually, significantly higher than Japan's market average of 4.2%. With a projected annual profit growth rate of 15.5%, it demonstrates robust potential for future expansion. Notably, TechMatrix invested ¥1 billion ($9 million) in R&D last year, underscoring its commitment to innovation and maintaining high-quality earnings within Japan’s dynamic tech landscape.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

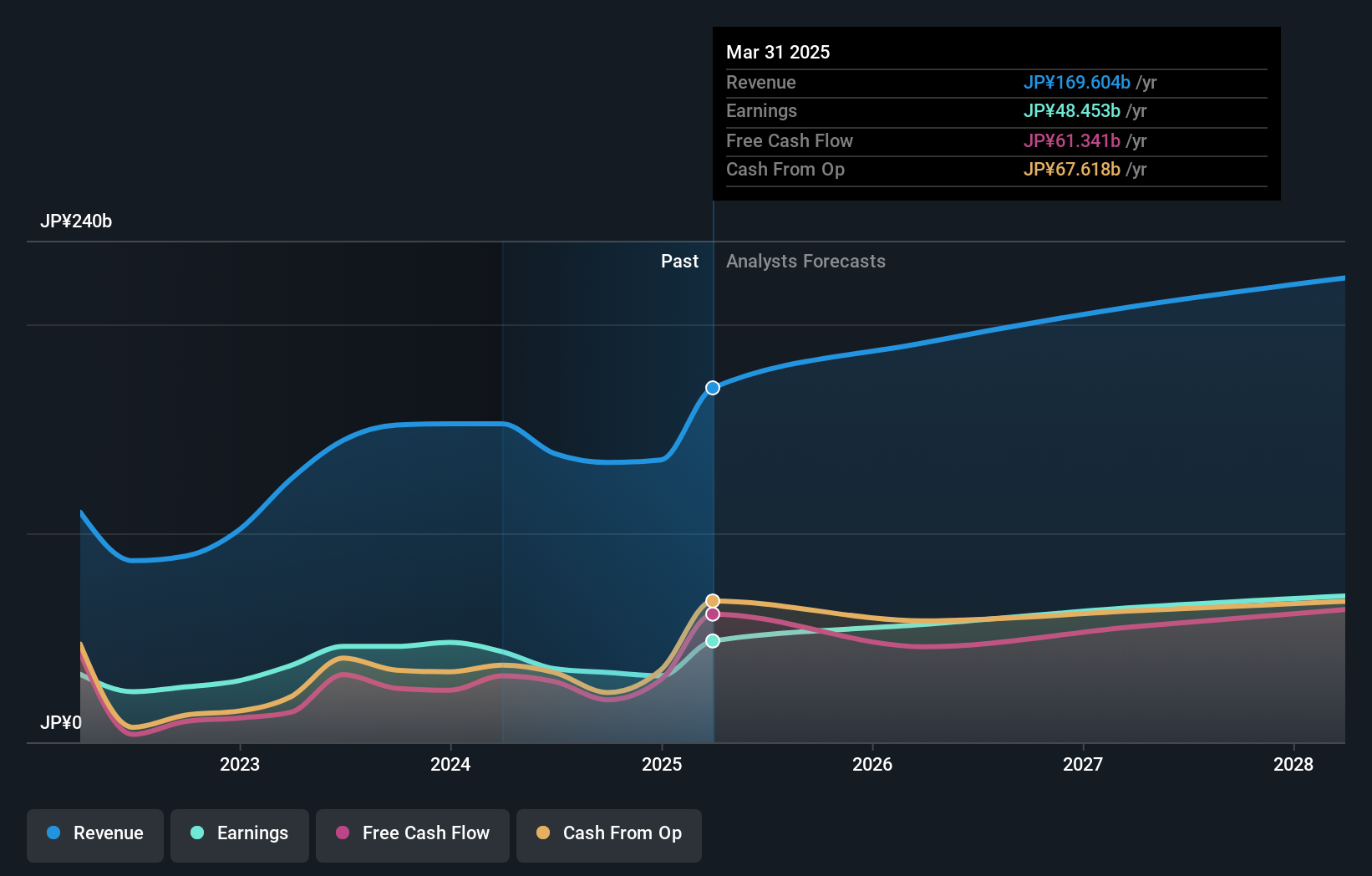

Overview: Capcom Co., Ltd. is a global company involved in planning, developing, manufacturing, selling, and distributing home video games, online games, mobile games, and arcade games with a market cap of ¥1.40 trillion.

Operations: Capcom generates revenue primarily through its Digital Content segment, which accounted for ¥103.38 billion. Additional revenue streams include Amusement Facilities and Amusement Equipment, contributing ¥20.09 billion and ¥10.34 billion respectively.

Capcom's earnings are forecast to grow at 14.5% annually, outpacing Japan's market average of 8.6%. Despite a challenging past year with a -23.3% earnings decline, the company is investing heavily in R&D, allocating ¥1 billion ($9 million) last year to drive innovation and future growth. Revenue is expected to increase by 9.5% per year, driven by strong performance in its digital content segment which remains crucial for sustained profitability and industry leadership.

- Get an in-depth perspective on Capcom's performance by reading our health report here.

Explore historical data to track Capcom's performance over time in our Past section.

Make It Happen

- Access the full spectrum of 126 Japanese High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakaku.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2371

Kakaku.com

Engages in the provision of purchase support, restaurant review, and other services in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.