- Japan

- /

- Entertainment

- /

- TSE:9684

How the Modern Remaster of Final Fantasy Tactics Could Shape Square Enix’s (TSE:9684) Investment Outlook

Reviewed by Sasha Jovanovic

- In late September 2025, Square Enix released FINAL FANTASY TACTICS – The Ivalice Chronicles, a modern remaster of the renowned tactical RPG featuring enhanced graphics, full voice acting, and new features across multiple current gaming platforms.

- This collaboration between original creators and new developers signals an effort to broaden the franchise’s appeal to both legacy fans and new audiences.

- We’ll examine how expanding this classic IP to next-generation consoles and PC platforms could impact Square Enix’s broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Square Enix Holdings' Investment Narrative?

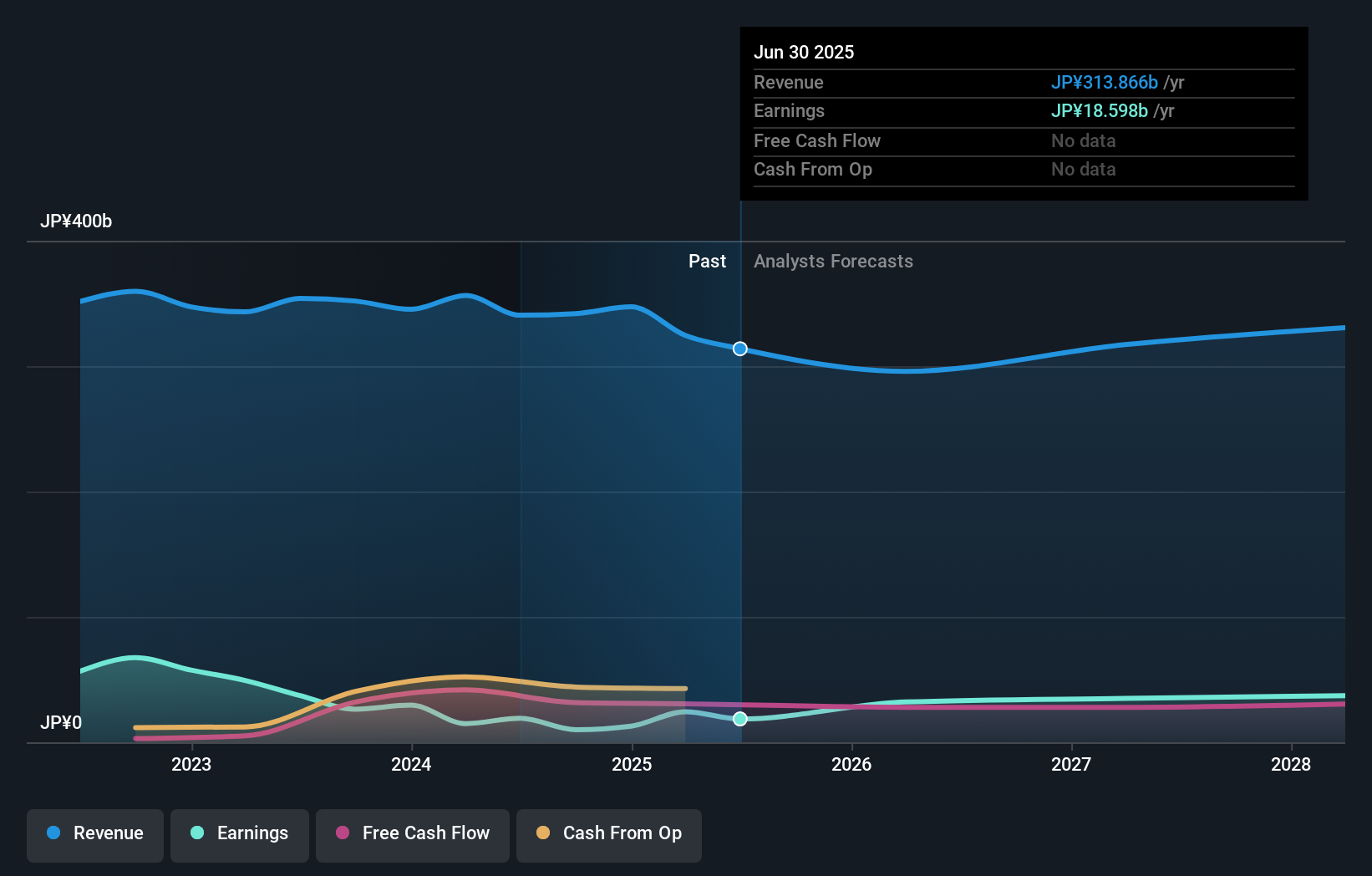

If you’re thinking about what drives conviction in Square Enix Holdings as a shareholder, it always comes back to the strength of its intellectual property, the durability of its global franchises, and its record navigating gaming’s shifting platforms. The release of FINAL FANTASY TACTICS – The Ivalice Chronicles is a clear play to re-energize the pipeline and tap nostalgia, but also opens up new revenue channels at a time when revenue and profit are trending down and the company trades at a high multiple relative to peers. Whether this release alters the recent pattern of softer growth depends on player uptake and the extent to which legacy IP can regain commercial momentum in a crowded marketplace. Risks remain prominent, including ongoing margin pressure and pressure from activist shareholders, but a successful launch could renew optimism around near-term catalysts that were recently lacking.

Yet, ongoing margin pressure and high valuation could weigh on future sentiment, too. Square Enix Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Square Enix Holdings - why the stock might be a potential multi-bagger!

Build Your Own Square Enix Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Square Enix Holdings research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Square Enix Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Square Enix Holdings' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9684

Square Enix Holdings

Operates in the content and service businesses in Japan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives