- Japan

- /

- Entertainment

- /

- TSE:9601

High Growth Tech And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

Amidst a backdrop of a resilient U.S. labor market and persistent inflation concerns, global markets have experienced volatility, with small-cap stocks underperforming their larger counterparts. In this environment, identifying high growth tech stocks and other promising investments requires careful consideration of factors such as innovation potential, market positioning, and adaptability to economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Modern Times Group MTG (OM:MTG B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Modern Times Group MTG AB is a company that offers game franchise services across various regions including Sweden, the United Kingdom, Germany, and several other countries, with a market capitalization of approximately SEK11.68 billion.

Operations: The company generates revenue primarily through its broadcasting segment, which accounts for SEK5.89 billion. Its operations span multiple regions, including Europe, Asia, and North America.

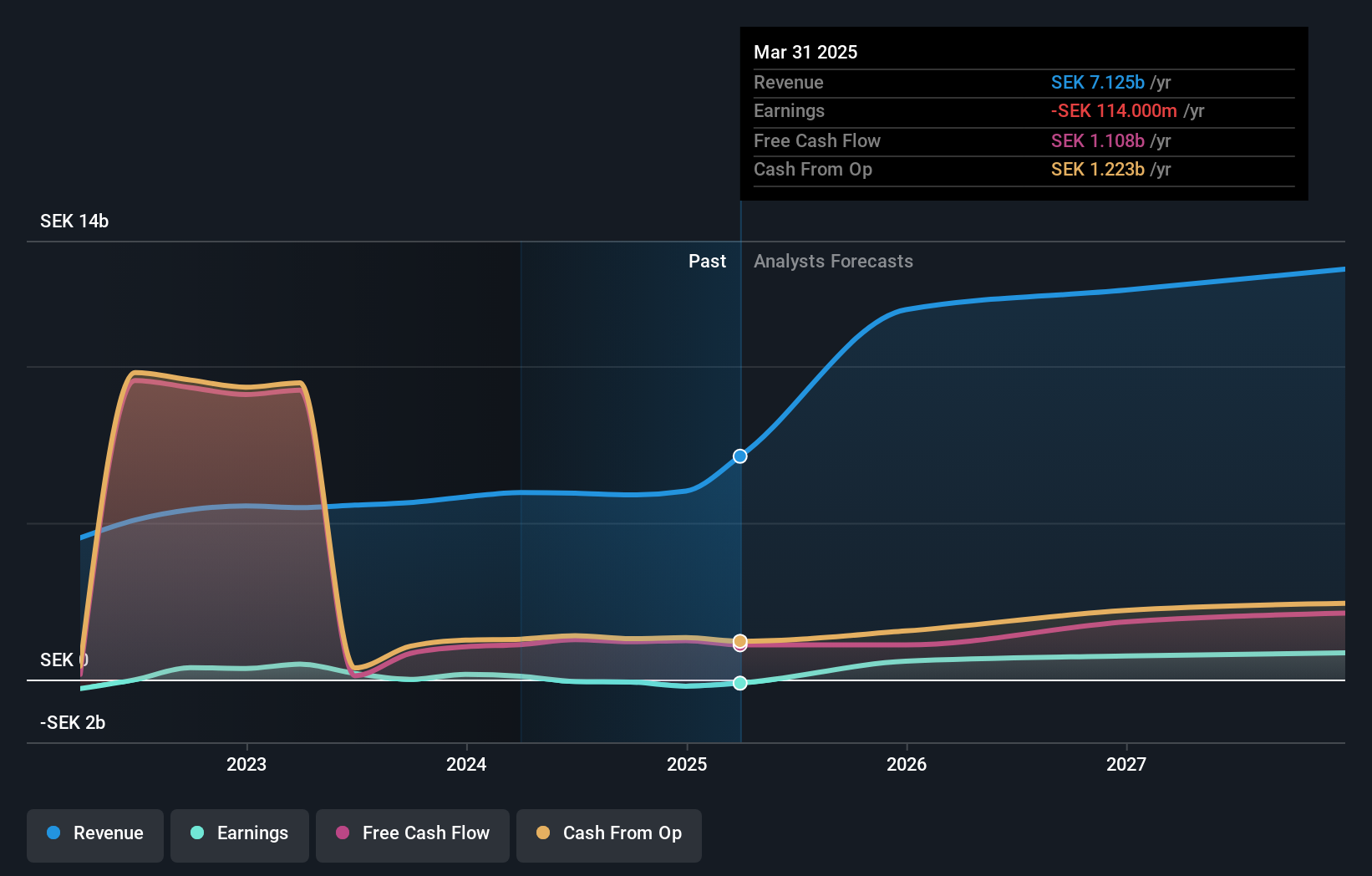

Modern Times Group MTG AB, navigating through a challenging landscape, has shown resilience with a projected annual revenue growth of 4.1%, outpacing the Swedish market's 1.1%. Despite current unprofitability, MTG B is poised for a turnaround with expected earnings growth soaring at 87.16% annually. This optimistic outlook is bolstered by strategic acquisitions like Plarium Global Ltd, aiming to enhance its gaming segment and drive future profitability. The firm's commitment to organic growth and synergistic M&A positions it well amidst industry shifts towards digital and interactive entertainment solutions.

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Perfect World Co., Ltd. operates in the online games and movies and television sectors in China, with a market cap of CN¥19.63 billion.

Operations: The company generates revenue primarily from its online games and movies and television segments. The online games segment is the major contributor, while the movies and television segment adds diversity to its income streams.

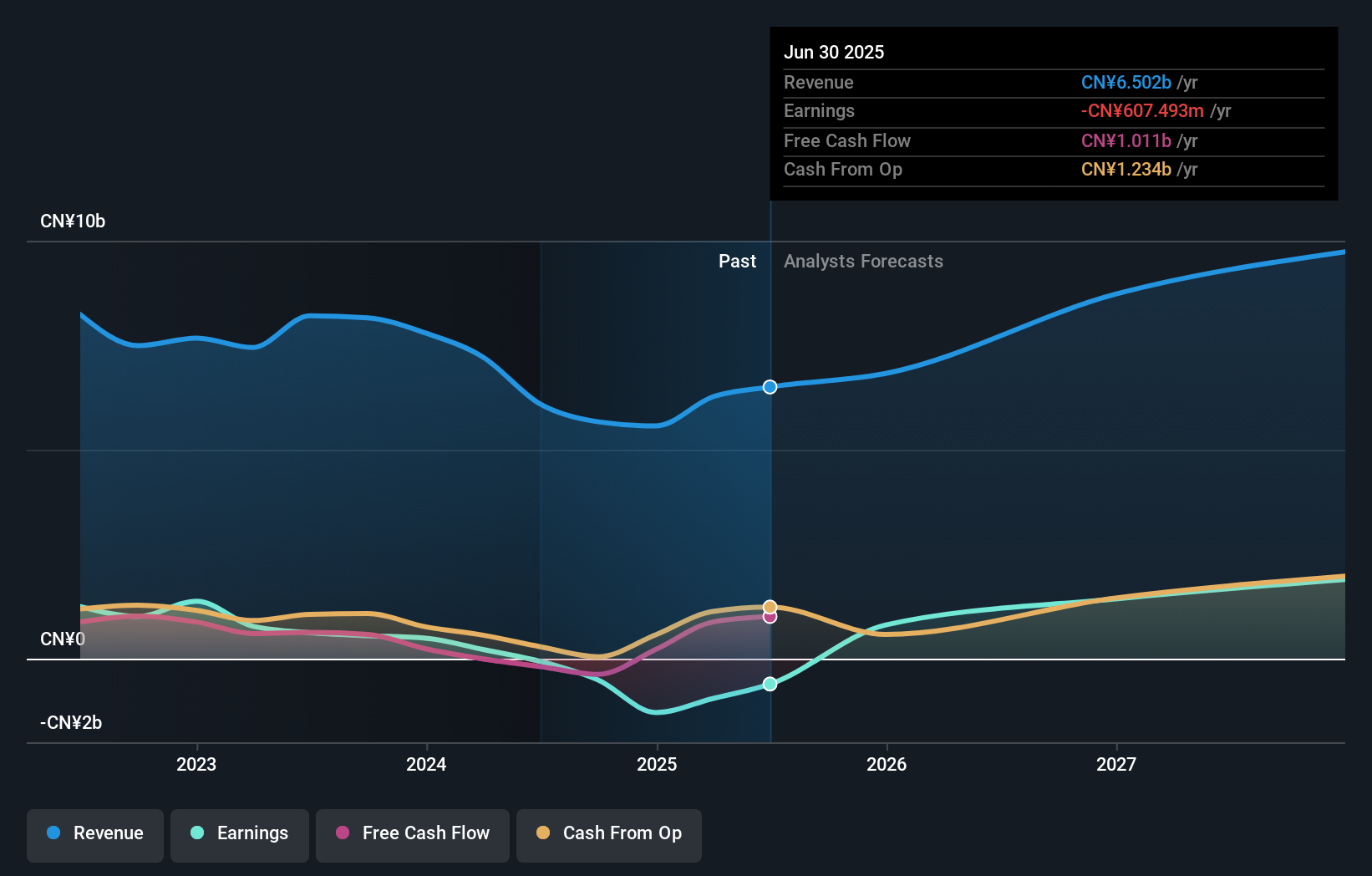

Perfect World has faced challenges, evidenced by a significant revenue drop to CNY 4.07 billion from CNY 6.20 billion year-over-year and transitioning from a net income of CNY 614.71 million to a net loss of CNY 388.81 million. Despite this downturn, the company's strategic buyback activities, repurchasing shares worth CNY 110 million, signal confidence in its recovery potential. Looking forward, Perfect World is expected to reverse its fortunes with an impressive forecasted annual earnings growth rate of 109.54%, significantly outpacing the industry's contraction of -16.1%. This anticipated rebound is underpinned by robust projected revenue growth at an annual rate of 19.7%, which surpasses the Chinese market average growth forecast of 13.4%.

Shochiku (TSE:9601)

Simply Wall St Growth Rating: ★★★★☆☆

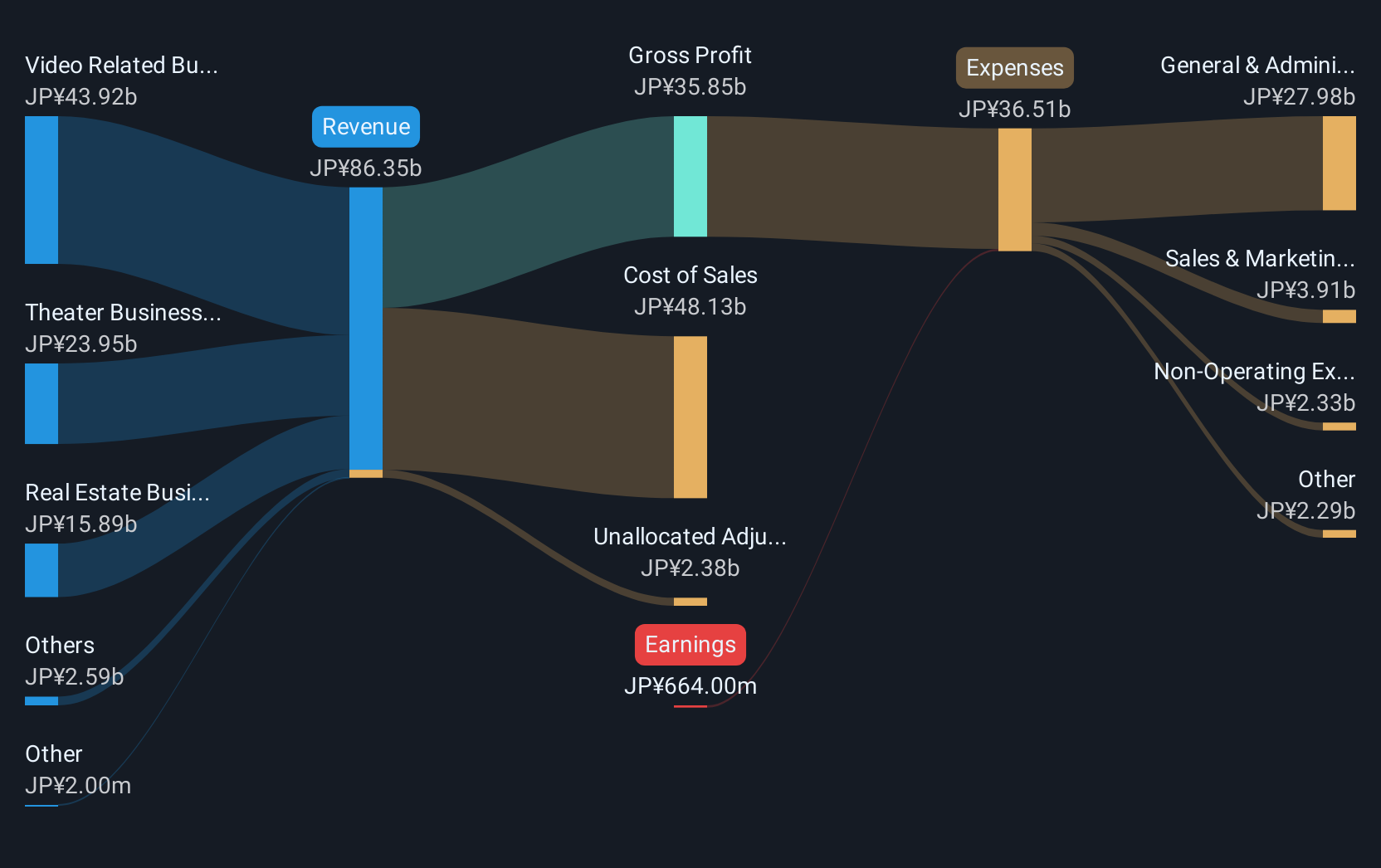

Overview: Shochiku Co., Ltd. operates in audio and video, theatre, real estate, and other sectors both in Japan and internationally, with a market cap of ¥156.11 billion.

Operations: Shochiku Co., Ltd. generates revenue through its diverse operations in audio and video production, theatre, and real estate sectors across Japan and internationally. The company's business model is supported by its engagement in both domestic and international markets, leveraging cultural content creation and property management as key income streams.

Shochiku Co., Ltd., despite its current unprofitability, is poised for a significant turnaround with earnings forecasted to surge by 120.98% annually. This growth trajectory starkly contrasts with the broader Entertainment industry, which has seen a decline of 6.5% over the past year. The company's revenue growth at 4.4% per annum is slightly ahead of Japan's market average of 4.2%, suggesting a competitive edge in its sector. However, challenges remain as Shochiku's debt is not well covered by operating cash flow, highlighting potential financial strain despite positive forecasts in profitability and revenue growth trends observed recently on January 14, 2025 earnings release event.

- Unlock comprehensive insights into our analysis of Shochiku stock in this health report.

Understand Shochiku's track record by examining our Past report.

Summing It All Up

- Explore the 1234 names from our High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9601

Shochiku

Engages in audio and video, theatre, real estate, and other businesses in Japan and internationally.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives