Exploring SAKURA Internet And Two Other High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

Amidst the backdrop of Japan's stock markets experiencing declines, with the Nikkei 225 Index and TOPIX both losing ground due to election uncertainties and inflationary pressures, investors are keenly observing high-growth sectors like technology for potential opportunities. In such a dynamic environment, identifying stocks that demonstrate strong innovation capabilities and adaptability to market changes can be crucial for navigating the complexities of Japan's evolving tech landscape.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 21.21% | 70.32% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

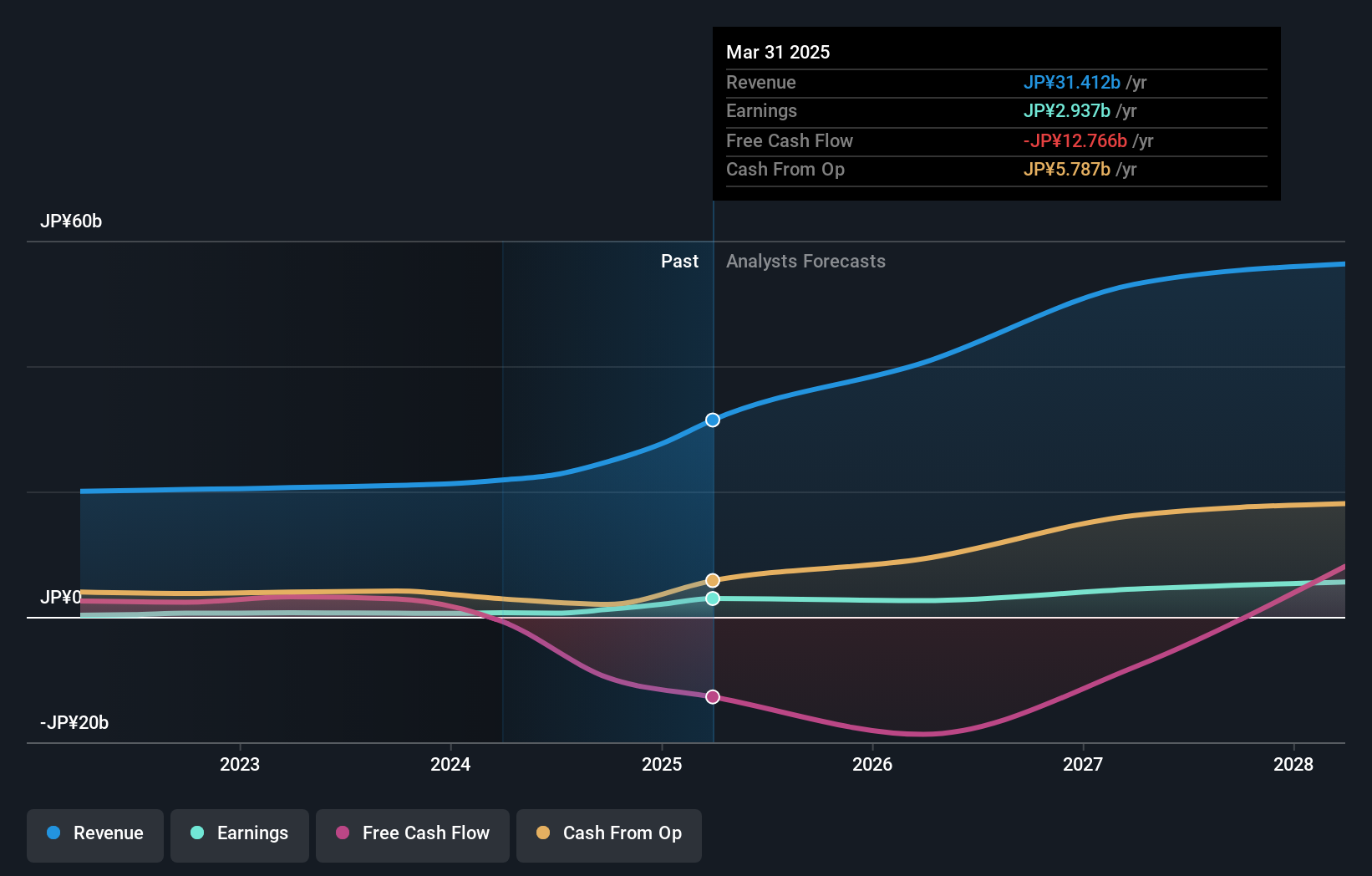

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SAKURA Internet Inc. is a Japanese company specializing in cloud computing services with a market capitalization of ¥162.92 billion.

Operations: The company generates revenue primarily from its Internet Infrastructure Business, which amounts to ¥22.66 billion. This segment focuses on providing cloud computing services in Japan.

SAKURA Internet, amid a volatile market, shows promising growth metrics with expected revenue and earnings surges at 33.9% and 55.6% per year respectively, significantly outpacing the Japanese market averages of 4.2% and 8.7%. Despite past challenges reflected by a -7.6% earnings dip last year, the firm's aggressive R&D investment aligns with its ambitious revenue projections for FY2025 at JPY 28 billion—a potential indicator of its commitment to innovation and market expansion. This strategic focus on development may well position SAKURA as a resilient contender in Japan's tech landscape, leveraging upcoming product launches and enhanced service offerings forecasted in their latest guidance.

- Dive into the specifics of SAKURA Internet here with our thorough health report.

Explore historical data to track SAKURA Internet's performance over time in our Past section.

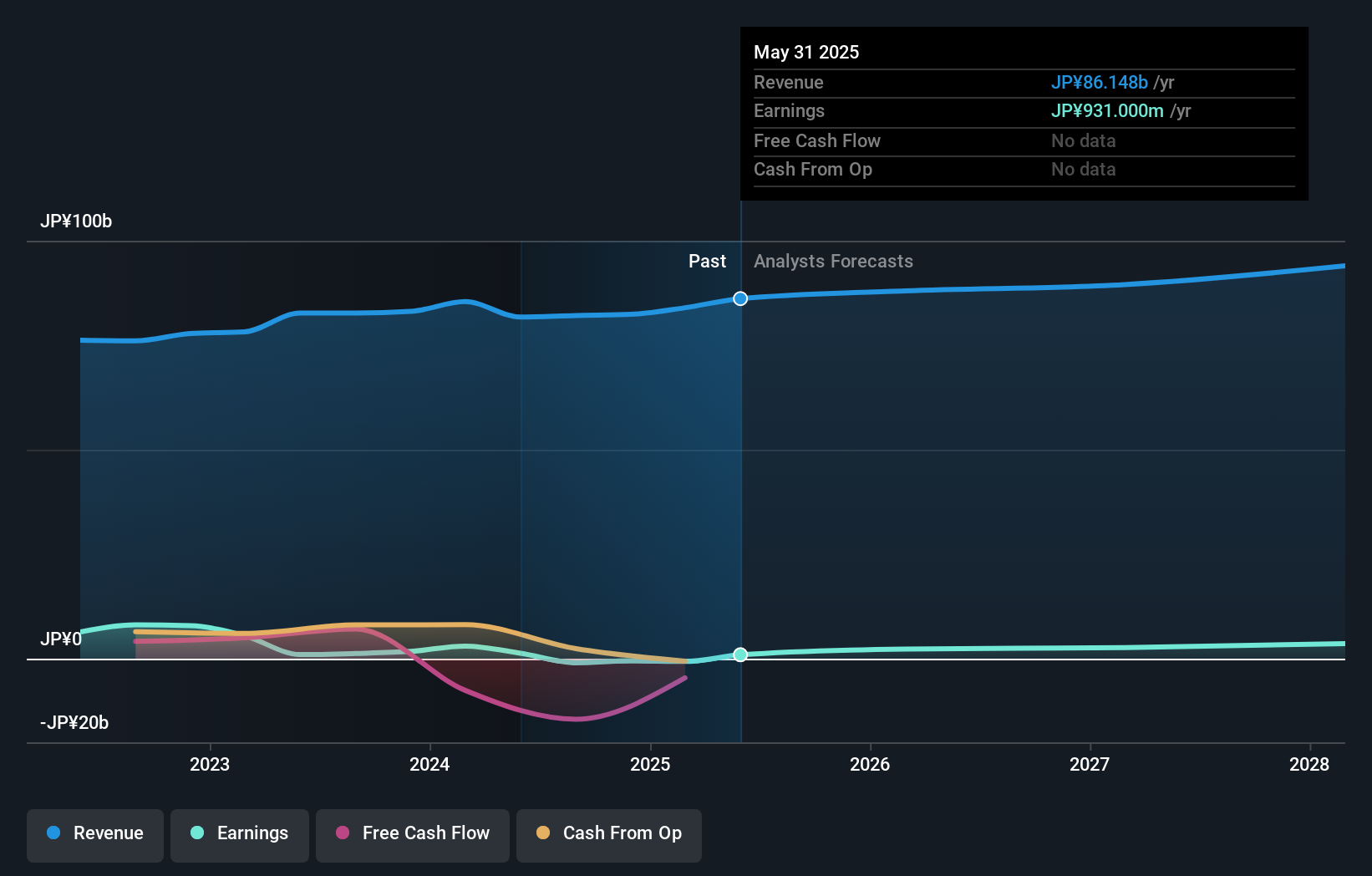

Nissha (TSE:7915)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nissha Co., Ltd. operates in industrial materials, devices, medical technologies, information and communication, and pharmaceutical and cosmetics sectors both in Japan and internationally, with a market cap of ¥87.06 billion.

Operations: Nissha Co., Ltd. generates revenue primarily from industrial materials and devices, with significant contributions from its medical technology segment. The industrial materials segment is the largest revenue driver at ¥72.03 billion, followed by the device segment at ¥63.30 billion.

Nissha's performance in the high-growth tech sector in Japan is underscored by a robust projected annual earnings growth of 30.2%, significantly surpassing the Japanese market average of 8.7%. This growth is supported by an aggressive R&D strategy, with expenses notably constituting a substantial portion of revenue, reflecting the company's commitment to innovation and technological advancement. Despite recent challenges indicated by a one-off loss of ¥3.1 billion affecting past financial results, Nissha has actively engaged in shareholder value enhancement through strategic share repurchases, completing a buyback of 501,900 shares for ¥999.94 million as part of its capital efficiency efforts. These moves highlight Nissha's adaptive strategies and potential resilience in navigating market dynamics while fostering growth and innovation within Japan's competitive tech landscape.

Shochiku (TSE:9601)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shochiku Co., Ltd. operates in the audio and video, theatre, and real estate sectors both in Japan and internationally with a market cap of ¥142.23 billion.

Operations: Shochiku Co., Ltd. generates revenue through its diverse operations in audio and video production, theatre performances, and real estate ventures across Japan and international markets. The company's business model capitalizes on the entertainment industry's demand while leveraging its assets in real estate to support financial stability.

Shochiku, navigating the competitive tech landscape in Japan, is poised for significant growth with a forecasted annual earnings increase of 82.2%. This optimistic projection complements its revenue growth rate of 5.5% per year, outpacing the Japanese market average of 4.2%. The company's commitment to innovation is evident in its substantial R&D expenditures, which are crucial for sustaining long-term competitiveness and addressing unprofitability issues highlighted by recent financial analyses. Despite challenges in covering debt through operating cash flow and current unprofitability, Shochiku's strategic focus on R&D could catalyze its transition into profitability and secure a stronger position within Japan’s high-growth tech sector.

- Delve into the full analysis health report here for a deeper understanding of Shochiku.

Examine Shochiku's past performance report to understand how it has performed in the past.

Next Steps

- Embark on your investment journey to our 120 Japanese High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3778

High growth potential with solid track record.

Market Insights

Community Narratives