- Taiwan

- /

- Tech Hardware

- /

- TWSE:2395

High Growth Tech Stocks to Watch in March 2025

Reviewed by Simply Wall St

As global markets grapple with the impact of U.S. tariff announcements and recession fears, indices such as the S&P 500 and Russell 2000 have experienced consecutive weeks of losses, reflecting broader economic uncertainties. In this challenging environment, a good high-growth tech stock is often characterized by its ability to innovate and adapt quickly to changing market conditions, offering potential resilience amid volatility.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| CD Projekt | 30.55% | 39.06% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

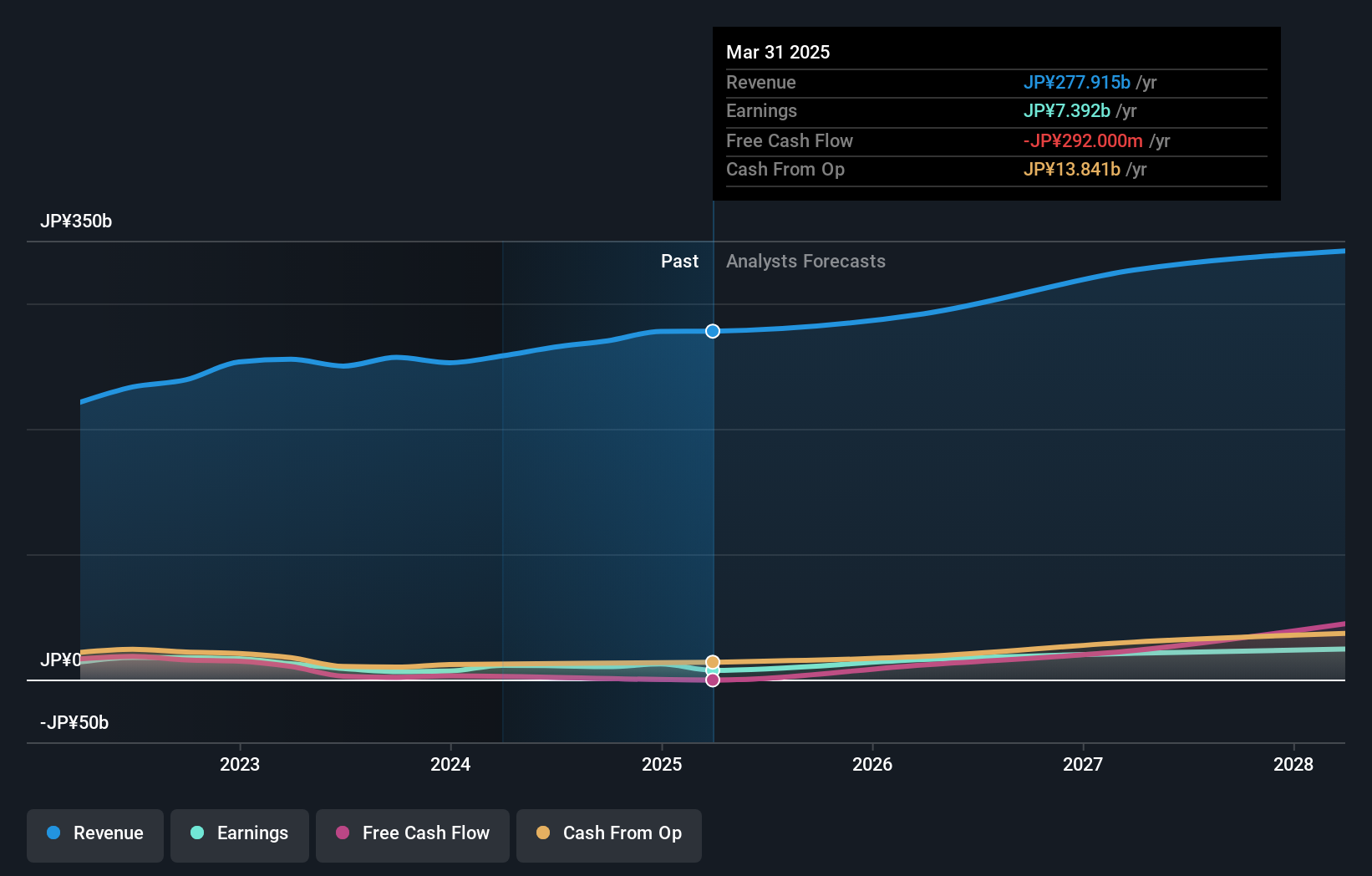

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market capitalization of ¥510.18 billion.

Operations: Kadokawa Corporation generates revenue primarily from its Publishing and IP Creation segment, which contributes ¥149.50 billion, followed by Animation and Live-Action Footage at ¥50.10 billion. The Game segment adds another significant portion with ¥32.55 billion in revenue.

Kadokawa Corporation, a player in the media industry, has demonstrated robust earnings growth of 82% over the past year, significantly outpacing its industry's growth of 0.3%. This performance is underpinned by a strategic emphasis on R&D, with expenses tailored to foster innovation and maintain competitive advantage. Looking ahead, Kadokawa's earnings are expected to grow by 25.5% annually over the next three years, surpassing Japan's market average of 8%. Despite a forecasted revenue growth rate (7.8% per year) that lags behind some high-growth benchmarks, the company benefits from superior quality earnings and a strong return on equity projection of 9.8%. These financial indicators suggest Kadokawa is well-positioned to leverage its R&D investments for sustained future growth within its sector.

- Navigate through the intricacies of Kadokawa with our comprehensive health report here.

Understand Kadokawa's track record by examining our Past report.

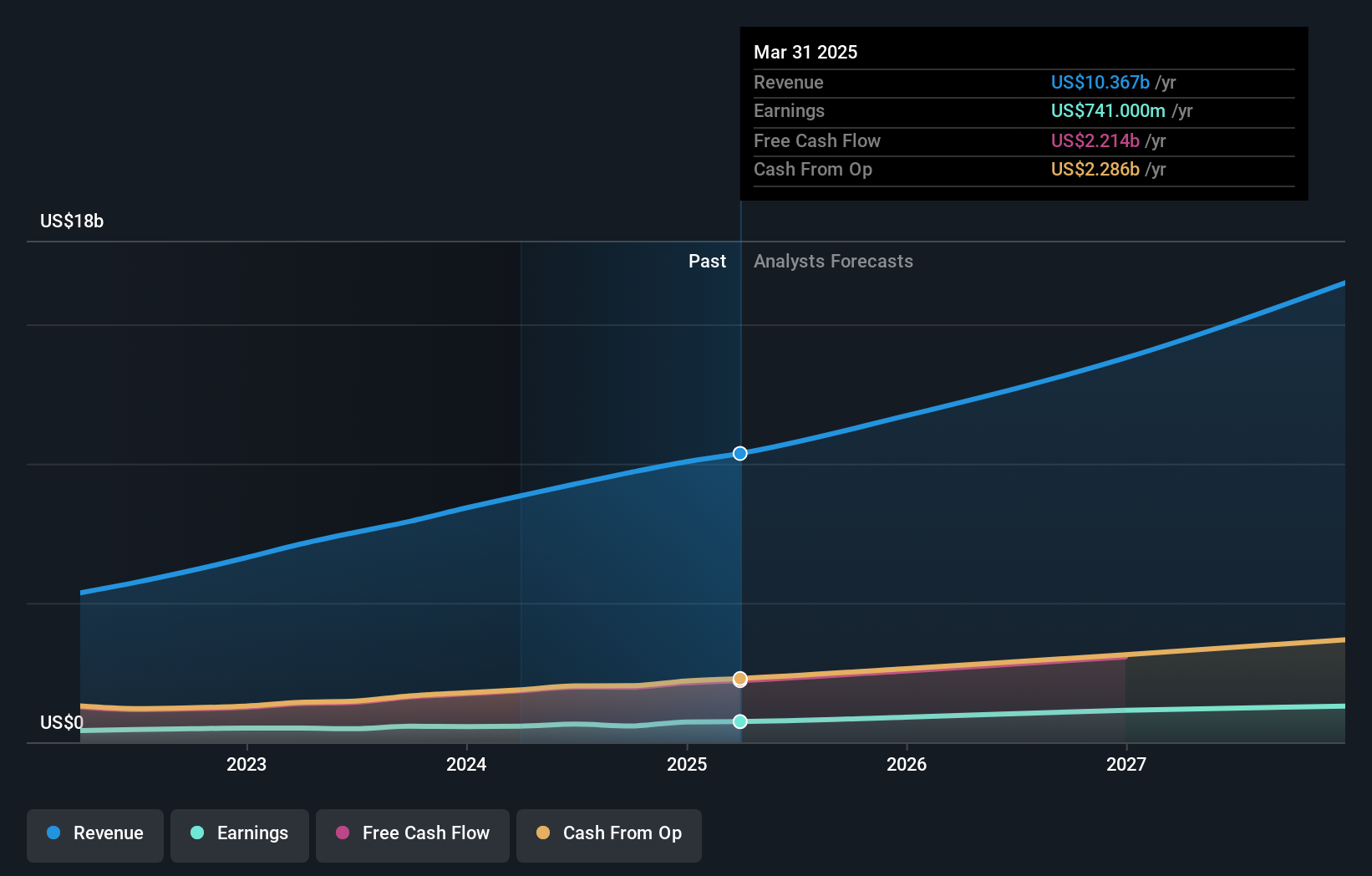

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. is a company that acquires, builds, and manages vertical market software businesses to create mission-critical software solutions for both public and private sector markets, with a market capitalization of CA$98.66 billion.

Operations: CSU generates revenue primarily from its Software & Programming segment, amounting to $10.07 billion. The company focuses on acquiring and managing vertical market software businesses to deliver essential software solutions across various sectors.

Constellation Software, with its recent announcement of a robust annual revenue increase to USD 10.07 billion from USD 8.41 billion, underscores its strong market position and operational effectiveness. This 19.7% growth in revenue is complemented by a significant rise in net income to USD 731 million, up from USD 565 million the previous year, reflecting a solid earnings growth of approximately 29.4%. The firm's commitment to innovation is evident from its strategic R&D investments which are pivotal in driving these financial achievements and maintaining competitive advantage within the tech landscape. Looking forward, Constellation Software's projected earnings growth rate of 20.9% annually over the next three years suggests promising prospects for sustained financial performance and industry leadership.

- Unlock comprehensive insights into our analysis of Constellation Software stock in this health report.

Learn about Constellation Software's historical performance.

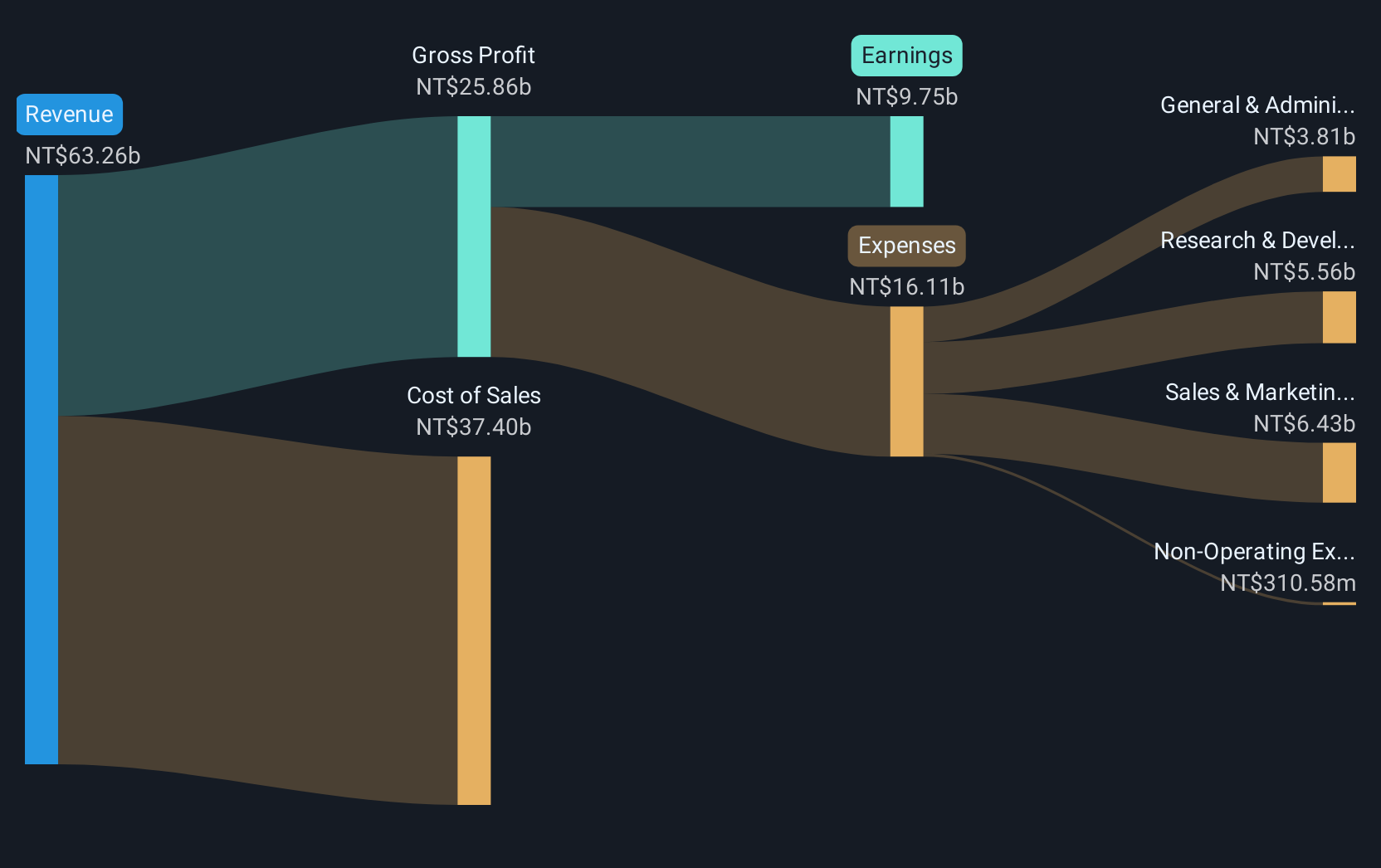

Advantech (TWSE:2395)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advantech Co., Ltd. specializes in manufacturing and selling embedded computing boards, industrial automation products, and applied and industrial computers with a market capitalization of NT$340.25 billion.

Operations: Advantech generates revenue primarily through the sale of embedded computing boards, industrial automation products, and applied and industrial computers. The company focuses on providing technology solutions across various sectors, leveraging its expertise in these specialized areas.

Advantech's recent performance and strategic initiatives reflect its adaptability in the tech sector, despite a revenue dip to TWD 59.79 billion from TWD 64.57 billion year-over-year. The company's net income also saw a reduction, settling at TWD 9.01 billion compared to the previous TWD 10.84 billion, indicating challenges yet resilience in maintaining profitability amidst market fluctuations. Notably, Advantech is enhancing its competitive edge through innovations like the launch of validated edge appliances for industrial private 5G deployments—a move that underscores its commitment to evolving network security solutions and could catalyze future growth avenues in emerging tech landscapes.

- Dive into the specifics of Advantech here with our thorough health report.

Explore historical data to track Advantech's performance over time in our Past section.

Key Takeaways

- Explore the 780 names from our Global High Growth Tech and AI Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Advantech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2395

Advantech

Manufactures and sells embedded computing boards, industrial automation products, and applied and industrial computers.

Flawless balance sheet established dividend payer.