Exploring High Growth Tech Stocks in Japan This September 2024

Reviewed by Simply Wall St

Japan’s stock markets have experienced significant declines recently, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss, driven by a U.S.-led sell-off in semiconductor stocks and yen strength impacting export-oriented companies. Despite these challenges, investors continue to seek high-growth opportunities within Japan's tech sector, focusing on companies that demonstrate strong innovation capabilities and resilience in volatile market conditions.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. engages in the planning, development, and selling of cloud-based solutions in Japan and has a market cap of ¥288.72 billion.

Operations: Sansan focuses on developing and selling cloud-based solutions in Japan. The company generates revenue primarily through its subscription services for business card management and contact sharing platforms.

Sansan's recent buyback of 141,700 shares for ¥299.95 million underscores its commitment to shareholder returns. Notably, the company's earnings are projected to grow at 35.6% annually, significantly outpacing the Japanese market's 8.6%. With revenue expected to increase by 16.2% per year, Sansan is capitalizing on its innovative software solutions and extensive client base. The company has also invested substantially in R&D, with ¥1 billion allocated last year alone, driving advancements in AI and SaaS models that ensure recurring revenue streams.

- Unlock comprehensive insights into our analysis of Sansan stock in this health report.

Review our historical performance report to gain insights into Sansan's's past performance.

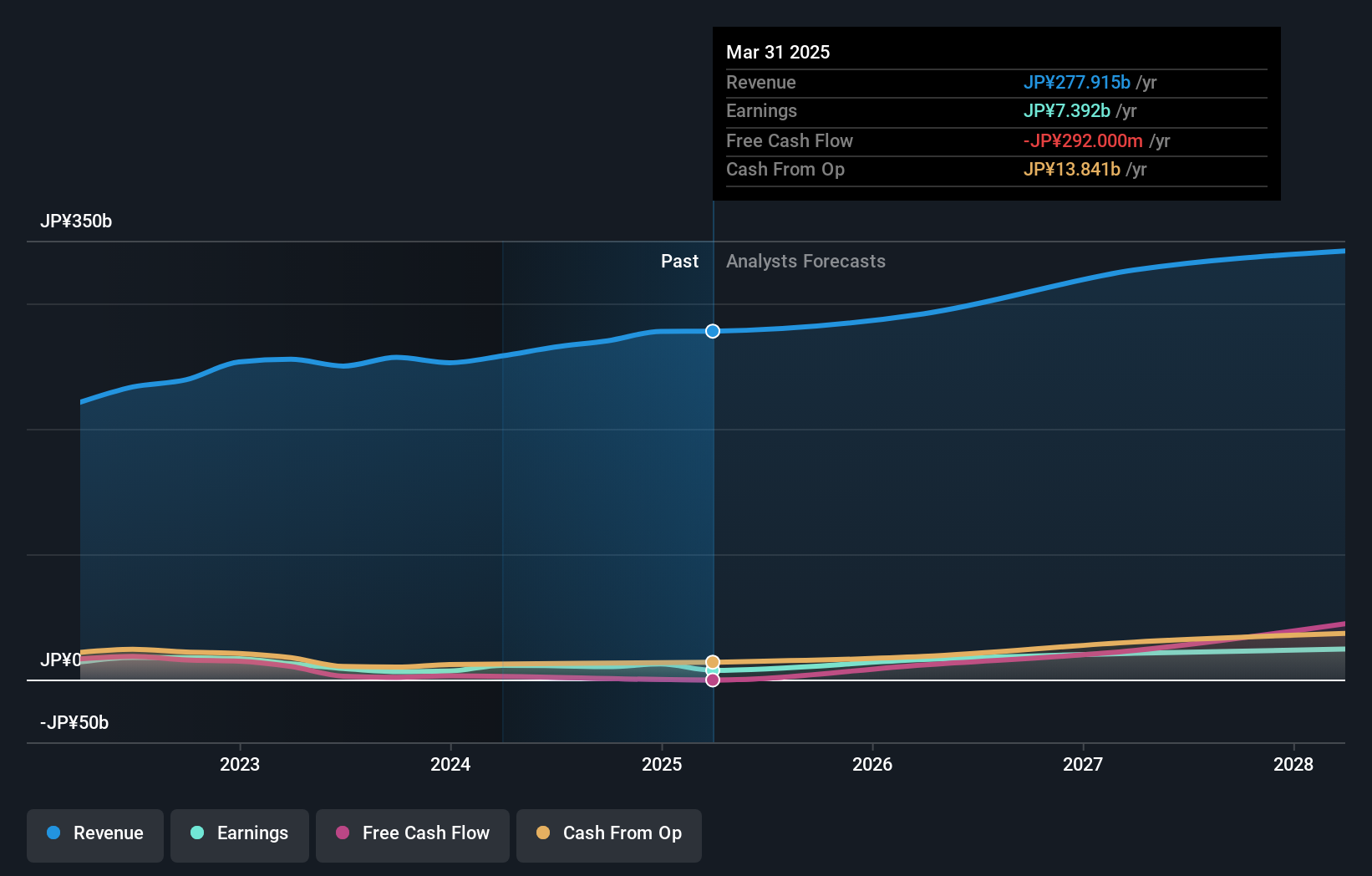

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan, with a market cap of ¥406.08 billion.

Operations: Kadokawa Corporation generates revenue primarily from its Publication segment (¥143.28 billion) and Animation/Film segment (¥46.36 billion), supplemented by Game, Web Service, and Education/Edtech segments. The company's diverse entertainment portfolio spans multiple media formats and educational technologies in Japan.

Kadokawa's earnings have grown by 23.8% over the past year, significantly outpacing the Media industry's 1.6%. With a forecasted annual profit growth of 21.7%, Kadokawa is expected to continue its upward trajectory, surpassing Japan's market average of 8.6%. The company's revenue growth is projected at 6.5% annually, supported by substantial R&D investments, which reached ¥1 billion last year. This focus on innovation in AI and software segments positions Kadokawa for sustained success in the tech landscape.

- Take a closer look at Kadokawa's potential here in our health report.

Evaluate Kadokawa's historical performance by accessing our past performance report.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. engages in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of ¥1.36 trillion.

Operations: Capcom generates revenue primarily from Digital Content, Amusement Equipment, and Amusement Facilities segments, with Digital Content contributing ¥103.38 billion. The company is involved in the entire lifecycle of its gaming products, from planning to distribution.

Capcom's revenue is forecast to grow at 9.5% per year, outpacing Japan's market average of 4.2%. Despite a negative earnings growth of -23.3% last year, future earnings are projected to rise by 14.5% annually, surpassing the market's expected growth of 8.6%. The company has invested significantly in R&D, with expenses reaching ¥1 billion last year, focusing on AI and software innovations that could drive future success in the tech landscape.

- Click here to discover the nuances of Capcom with our detailed analytical health report.

Explore historical data to track Capcom's performance over time in our Past section.

Turning Ideas Into Actions

- Access the full spectrum of 126 Japanese High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Fair value with concerning outlook.