- Japan

- /

- Healthtech

- /

- TSE:4480

Exploring 3 High Growth Tech Stocks in Japan

Reviewed by Simply Wall St

Japan’s stock markets have seen significant gains recently, with the Nikkei 225 Index rising 5.6% and the broader TOPIX Index up 3.7%, driven by optimism surrounding China's stimulus measures and dovish commentary from the Bank of Japan. In this favorable market environment, identifying high-growth tech stocks can be particularly rewarding, as these companies often benefit from increased investor sentiment and economic support measures.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

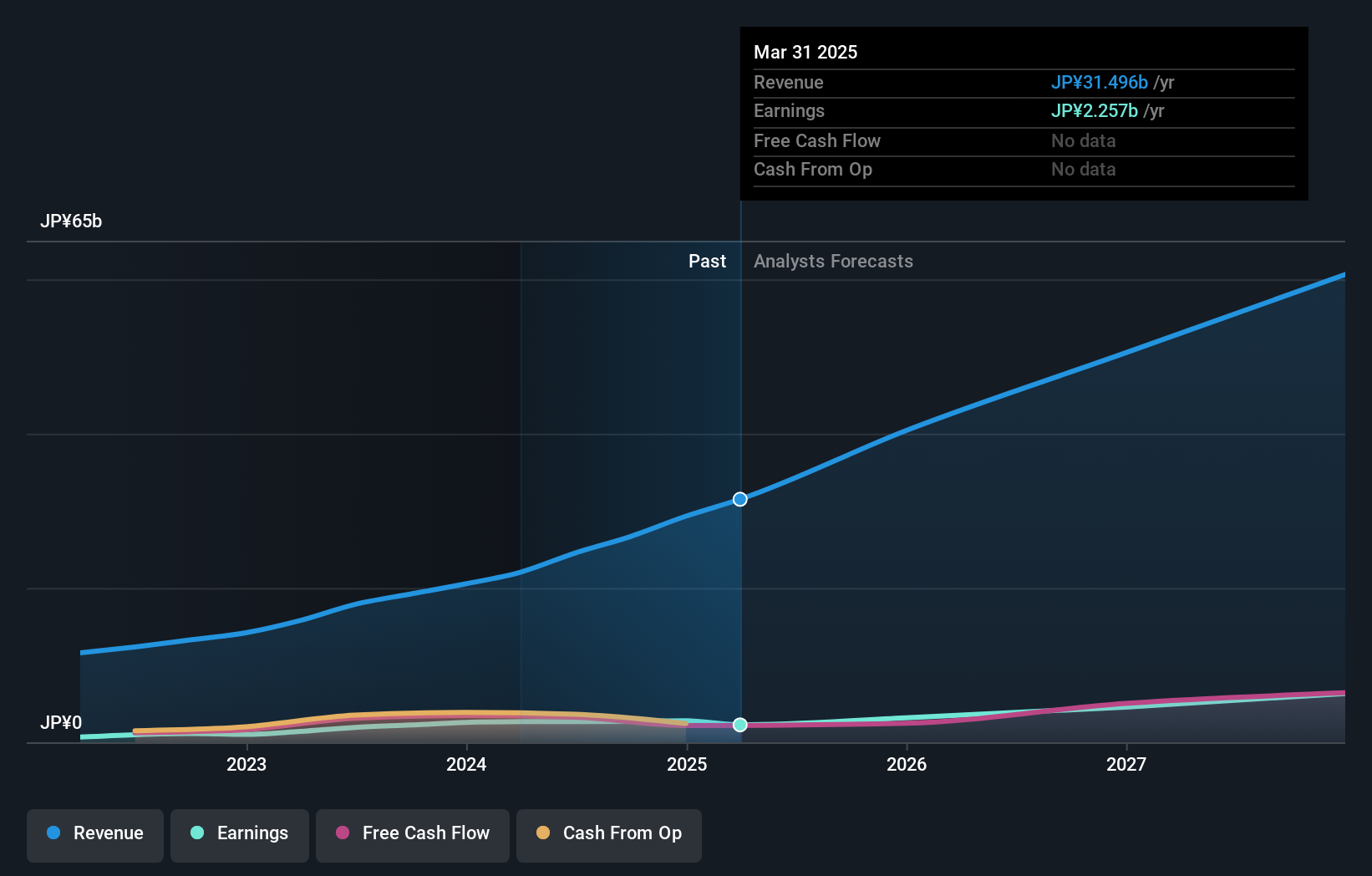

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States with a market capitalization of ¥125.07 billion.

Operations: Medley generates revenue primarily from its Human Resource Platform Business (¥17.87 billion) and Medical Platform Business (¥6.09 billion), with additional income from New Services (¥573 million). The company focuses on recruitment and medical platforms across Japan and the United States, contributing to its market presence.

Medley's strategic decision to potentially acquire Offshore Inc. highlights its ambition to expand and diversify, aligning with the broader trend in Japan's tech sector towards consolidation for competitive advantage. This move comes at a time when Medley is experiencing robust growth, with revenue projections soaring at 25% annually, outpacing the Japanese market average of 4.2%. Furthermore, its earnings are expected to surge by 30.4% per year, significantly above the market forecast of 8.7%. This financial vitality is underpinned by a recent surge in earnings growth by 39.2% over the past year, eclipsing the Healthcare Services industry’s growth rate of 11.9%. Such dynamic financial performance coupled with aggressive expansion strategies like Jobley’s rollout across the U.S., positions Medley well within a highly competitive landscape while addressing critical workforce challenges in healthcare through innovative hiring solutions. The company's focus on R&D investment is crucial for sustaining long-term innovation and maintaining a competitive edge in high-tech industries where rapid advancements are commonplace. By strategically allocating resources towards research and development, companies like Medley not only enhance their product offerings but also significantly contribute to industry-wide progress and standards-setting—essential for staying relevant in an ever-evolving technological landscape.

- Delve into the full analysis health report here for a deeper understanding of Medley.

Evaluate Medley's historical performance by accessing our past performance report.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

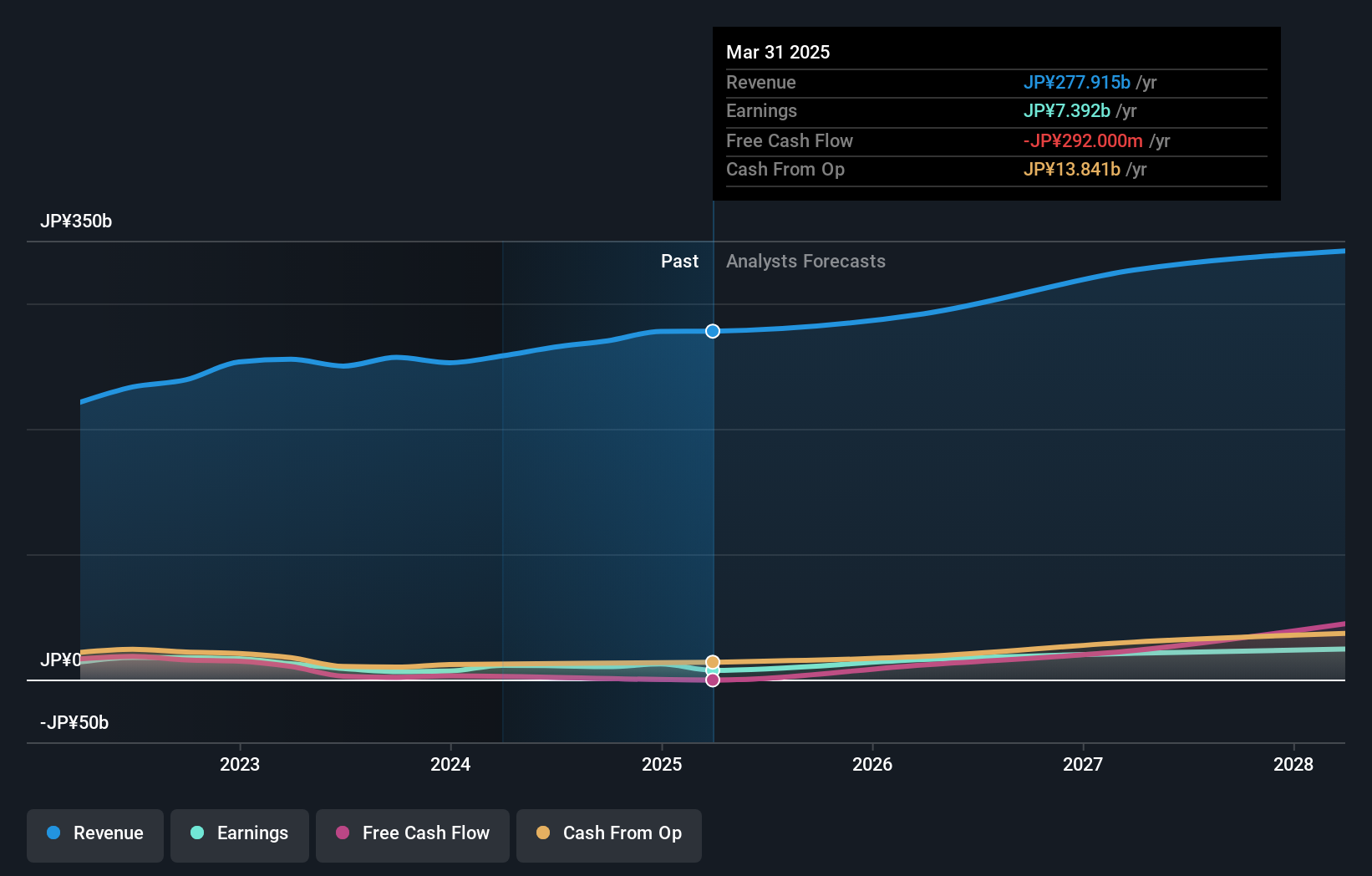

Overview: OMRON Corporation engages in industrial automation, device and module solutions, social systems, and healthcare businesses worldwide with a market cap of ¥1.28 trillion.

Operations: OMRON generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Social Systems, Solutions and Service Business (¥156.85 billion), Healthcare Business (¥150.40 billion), and Devices & Module Solutions Business (¥143.69 billion). The company's diverse operations span multiple sectors, contributing significantly to its overall financial performance.

OMRON is navigating the competitive landscape of Japan's tech sector with a clear focus on innovation, as evidenced by its R&D spending which forms a significant part of its strategic expenditures. In the fiscal year 2024, OMRON allocated 5.6% of its revenue to R&D activities, aiming to bolster its technological capabilities and market position. This investment is critical in light of their revenue growth projections at 5.6% annually, outstripping the broader Japanese market's average growth rate. Moreover, earnings are expected to surge by an impressive 46.2% per year thanks to these innovations and operational efficiencies which might set new industry standards. Recent financial events underscore OMRON's proactive approach in shareholder value creation through dividends and forward-looking earnings strategies highlighted in their Q1 2025 Earnings Call on August 2nd, where they discussed future prospects amidst current financial trends. The commitment to returning value was evident with a substantial dividend payout announced for September at ¥52 per share, reflecting confidence in sustained profitability despite challenging economic conditions globally. This strategy not only enhances shareholder returns but also stabilizes investor confidence during volatile market phases.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation is an entertainment company in Japan with a market cap of ¥433.51 billion, engaging in various sectors including gaming, publishing, web services, animation/film production, and education/Edtech.

Operations: The company generates revenue primarily from its publication segment (¥143.28 billion), followed by animation/film production (¥46.36 billion) and gaming (¥28.63 billion).

Kadokawa stands out in Japan's tech landscape, not just for its content but for its strategic R&D investments, which have been pivotal. In FY 2024, the company dedicated a substantial 6.7% of its revenue to R&D to enhance technological and creative capabilities—a move reflecting in their earnings growth forecast of 21.5% annually. This focus is vital as it significantly outpaces the broader market's growth expectations and positions Kadokawa well amidst industry shifts towards digital and multimedia integration. Their recent strategy also includes repurchasing shares this year, signifying strong confidence in their financial health and future prospects.

- Dive into the specifics of Kadokawa here with our thorough health report.

Review our historical performance report to gain insights into Kadokawa's's past performance.

Next Steps

- Navigate through the entire inventory of 121 Japanese High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4480

Medley

Operates platforms for recruitment and medical businesses in Japan and the United States.

Exceptional growth potential with excellent balance sheet.