SKY Perfect JSAT Holdings (TSE:9412): Fresh Analyst Coverage Sparks Valuation Debate on Space Defense Growth Prospects

Reviewed by Kshitija Bhandaru

Goldman Sachs just initiated coverage of SKY Perfect JSAT Holdings (TSE:9412), pointing to Japan’s ramped-up defense spending in the space sector as a potential catalyst for growth. The firm expects that expanding government budgets could reshape the company’s revenue mix.

See our latest analysis for SKY Perfect JSAT Holdings.

SKY Perfect JSAT Holdings has seen a steady build in momentum, with its total shareholder return climbing nearly 0.7% over the past year. Investors are tuning in to its potential role in Japan’s rapidly expanding space and defense ecosystem. Ongoing signals of robust government support and sector demand seem to be attracting new interest, which hints at a more optimistic outlook beyond day-to-day price noise.

If government-driven space growth stories appeal to you, now is a great moment to explore other exciting opportunities in the sector with our See the full list for free.

With upbeat analyst coverage and a surge in government-driven demand, investors may wonder if SKY Perfect JSAT Holdings is trading at an attractive bargain or if the anticipation of growth has already been fully factored into its current share price.

Price-to-Earnings of 22x: Is it justified?

SKY Perfect JSAT Holdings is trading at a price-to-earnings (P/E) ratio of 22x, putting its valuation above the Japanese media industry average of 17.6x. This signals that investors are willing to pay a premium for the company’s earnings relative to most domestic peers.

The price-to-earnings ratio reflects how much investors are prepared to pay for one yen of current earnings, and is often used to compare companies within the same sector. For media companies, a higher P/E can imply expectations for stable growth or unique competitive advantages.

Although SKY Perfect JSAT’s earnings have grown by 8% per year over the past five years, which is a credible pace for the industry, its P/E suggests the market is pricing in continued strength or perhaps a positive shift in its future revenue mix related to government contracts.

Compared to the industry’s 17.6x, SKY Perfect JSAT’s 22x multiple is on the expensive side. However, versus a peer average of 64.3x and an estimated fair P/E of 26.1x, the current valuation sits between sector norms and what regression analysis would suggest as a justifiable benchmark.

Explore the SWS fair ratio for SKY Perfect JSAT Holdings

Result: Price-to-Earnings of 22x (OVERVALUED)

However, slower-than-expected government spending or delays in key contracts could limit revenue growth and put pressure on near-term earnings momentum for SKY Perfect JSAT Holdings.

Find out about the key risks to this SKY Perfect JSAT Holdings narrative.

Another View: The SWS DCF Model Perspective

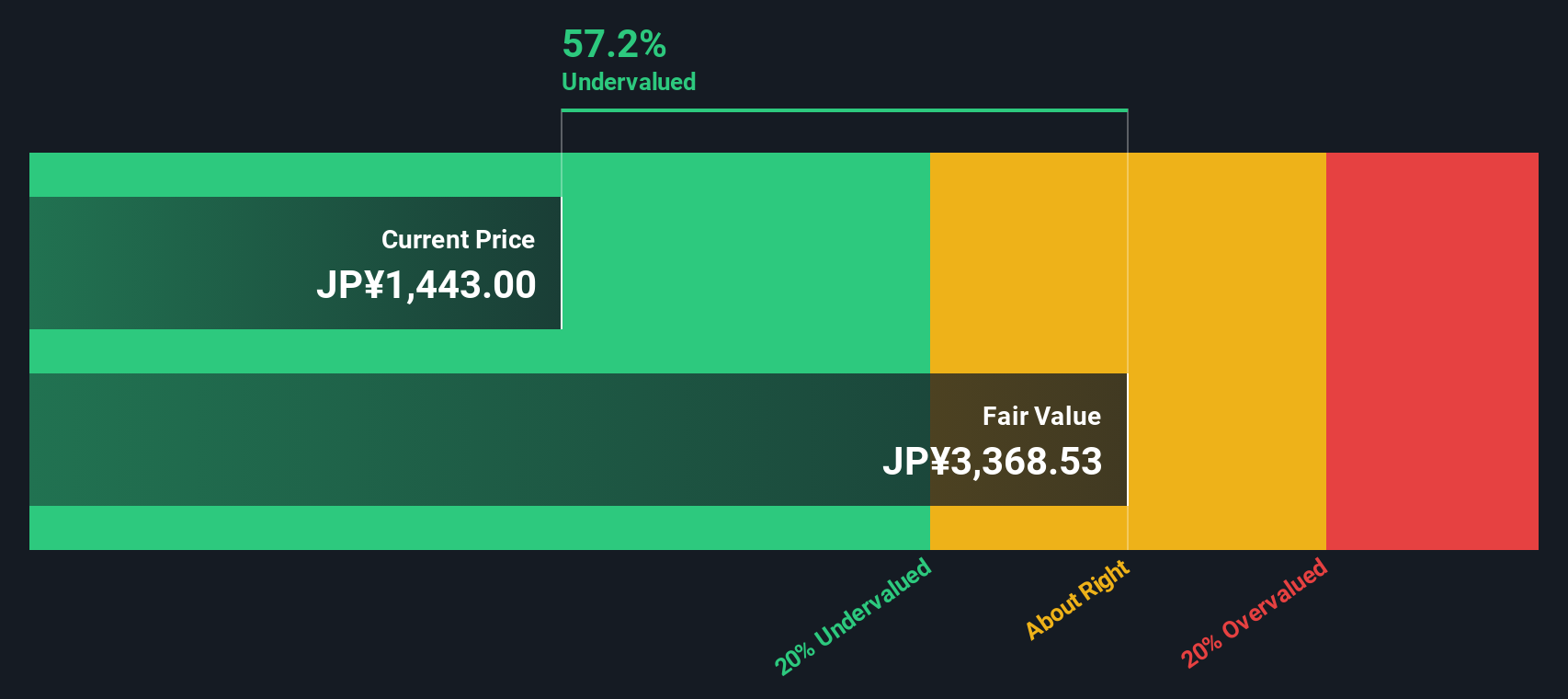

While the price-to-earnings ratio paints SKY Perfect JSAT Holdings as somewhat overvalued, our DCF model suggests the opposite. According to the SWS DCF model, shares are trading at a significant 54.6% discount to fair value. Could this signal a deeper long-term opportunity that the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SKY Perfect JSAT Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SKY Perfect JSAT Holdings Narrative

If you’re the type who trusts your own research or wants to dig deeper into the numbers, you can build your own view on SKY Perfect JSAT Holdings in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SKY Perfect JSAT Holdings.

Looking for more investment ideas?

Smart investors never settle for one opportunity. Don't let your next big winner pass you by. See what else could strengthen your portfolio using these hand-picked screens:

- Add steady income potential and tap into market resilience by checking out these 19 dividend stocks with yields > 3% offering yields above 3%.

- Capture emerging trends and seize the chance to back future-leading companies through these 25 AI penny stocks as artificial intelligence transforms the investment landscape.

- Spot undervalued gems primed for growth. Start by researching these 894 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9412

SKY Perfect JSAT Holdings

Provides satellite-based multichannel pay TV and satellite communications services primarily in Asia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives