TBS Holdings (TSE:9401): Evaluating Valuation After Recent Steady Share Price Gains

Reviewed by Simply Wall St

There is no major event shaking things up for TBS HoldingsInc (TSE:9401) right now, but the recent moves in its share price could still make some investors pause and reconsider where the stock is headed. Sometimes, shifts without big news can be even more revealing about how the market is thinking about a company’s prospects. Whether you are already holding shares or just keeping an eye from the sidelines, the question becomes whether these quiet periods are signals of opportunity or just the market taking a breather.

Over the past year, TBS HoldingsInc’s performance has quietly stacked up, with the stock returning 41% year-to-date and 41% over the last year. Momentum has especially picked up in the past 3 months, delivering a 22% gain to investors, while the past month alone shows a nearly 3% uptick. Even without a headline-grabbing catalyst, this consistent upward trajectory raises eyebrows and naturally leads to questions about what the market is forecasting or possibly missing about TBS HoldingsInc’s future.

With all this in mind, is the market underestimating the stock’s value, or has it already priced in the steady climb ahead?

Price-to-Earnings of 18.2x: Is it justified?

According to the most relevant valuation metric, TBS HoldingsInc is currently trading at a price-to-earnings (P/E) ratio of 18.2x. When compared to the JP Media industry average P/E of 17.7x, the stock appears slightly more expensive than its peers.

The P/E ratio compares a company's share price to its per-share earnings. This gives investors a sense of whether a stock is overvalued or undervalued relative to its profit generation. In the media sector, where stable profits and moderate growth are typical, the P/E ratio is a widely used tool to benchmark valuation and assess whether current prices reflect underlying performance.

While TBS HoldingsInc trades at a premium to the industry average, this could suggest the market is anticipating stronger future earnings or growth drivers that justify the higher ratio. However, investors should consider whether recent profit growth and future expectations are enough to support this multiple.

Result: Fair Value of ¥5,521 (OVERVALUED)

See our latest analysis for TBS HoldingsInc.However, slower revenue and net income growth, or a shift in investor sentiment, could quickly disrupt the stock's recent momentum and valuation premium.

Find out about the key risks to this TBS HoldingsInc narrative.Another View: What Does Our DCF Model Indicate?

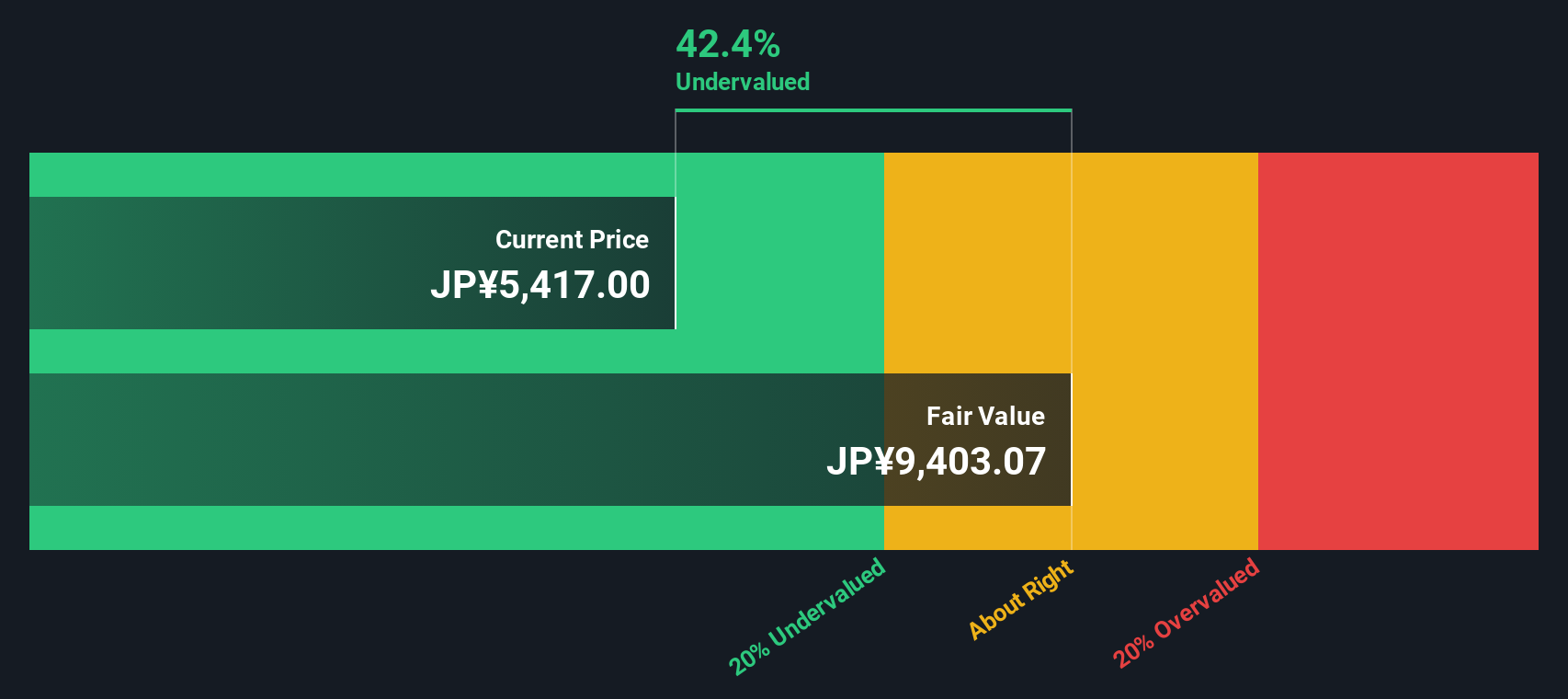

Taking a different approach, our SWS DCF model suggests a much more optimistic valuation. This points to possible undervaluation in the current share price and raises a key question: could the market be missing something fundamental?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TBS HoldingsInc Narrative

If you see things differently, or want to dig into the numbers and come to your own conclusion, you can do so in just a few minutes. Do it your way.

A great starting point for your TBS HoldingsInc research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Unlock more potential and keep your portfolio ahead of the curve by tapping into other standout markets today.

- Benefit from strong ongoing income, and tap into potential winners among dividend stocks with yields > 3% that offer yields above 3%.

- Spot tomorrow’s technology leaders early by targeting AI penny stocks that are poised for growth in artificial intelligence.

- Maximize value by finding hidden gems through undervalued stocks based on cash flows trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TBS HoldingsInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9401

TBS HoldingsInc

Engages in the broadcasting and real estate businesses primarily in Japan.

Excellent balance sheet and good value.

Market Insights

Community Narratives