- Japan

- /

- Real Estate

- /

- TSE:3299

3 Top Japanese Dividend Stocks Yielding Up To 4.5%

Reviewed by Simply Wall St

Amid recent market volatility, Japan's stock markets have experienced notable declines, with the Nikkei 225 Index dropping 5.8% and the broader TOPIX Index losing 4.2%. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income and potential resilience during uncertain times. In this environment, a good dividend stock is typically characterized by a strong balance sheet, consistent earnings growth, and a commitment to returning capital to shareholders through dividends.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Globeride (TSE:7990) | 4.38% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.26% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.93% | ★★★★★★ |

| Innotech (TSE:9880) | 4.87% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

Click here to see the full list of 467 stocks from our Top Japanese Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sumiseki HoldingsInc (TSE:1514)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumiseki Holdings, Inc. imports, purchases, and sells coal in Japan with a market cap of ¥51.23 billion.

Operations: Sumiseki Holdings, Inc. generates revenue from three primary segments: Coal Business (¥16.94 billion), Quarrying Business (¥546 million), and New Material Business (¥269 million).

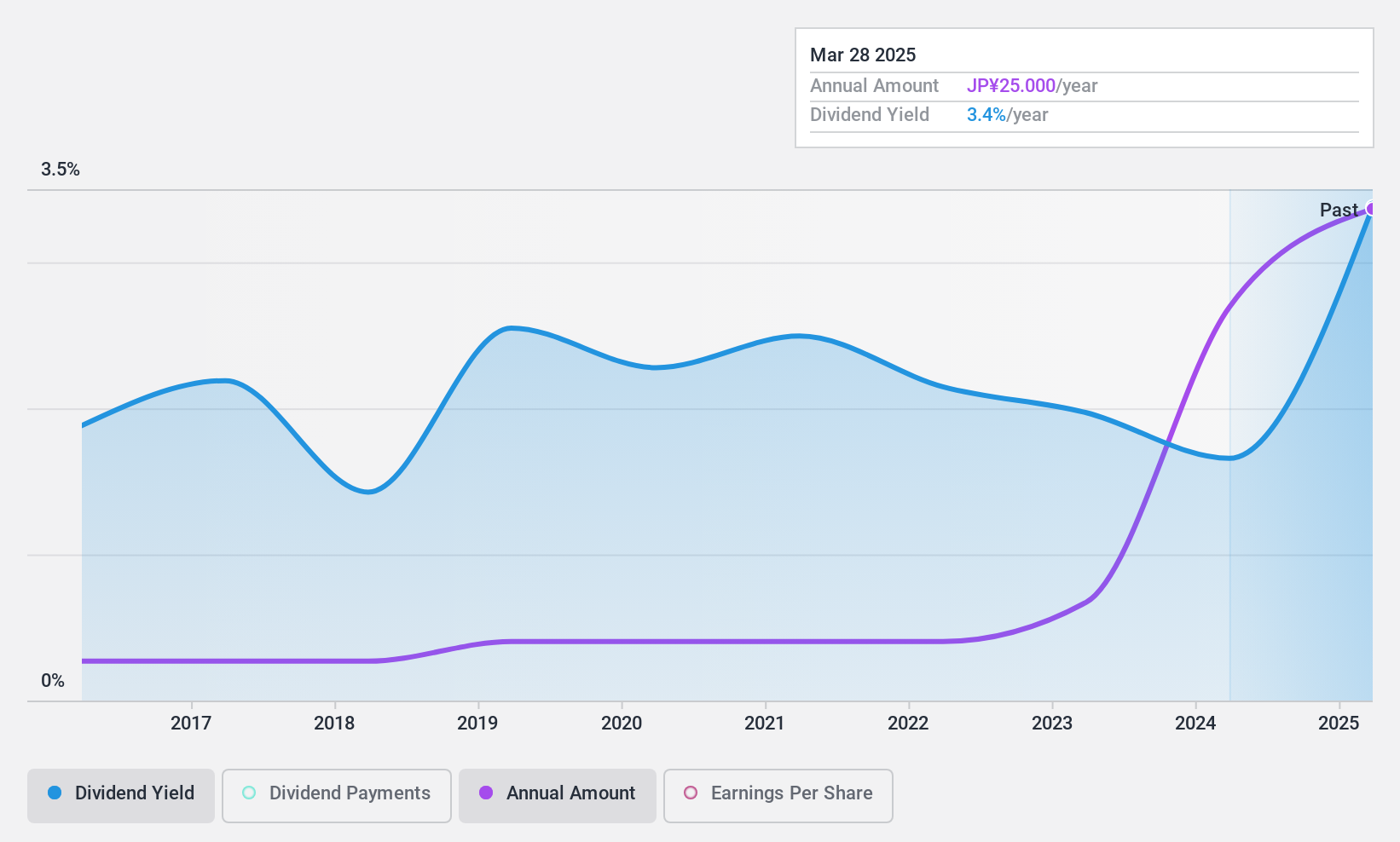

Dividend Yield: 4.2%

Sumiseki Holdings Inc. has shown strong earnings growth of 105.2% over the past year, supporting its dividend payments with a low payout ratio of 41.6% and a cash payout ratio of 11.5%. Its dividend yield of 4.22% places it in the top quartile among Japanese stocks, although it has been paying dividends for less than ten years and exhibits high share price volatility recently. The company will report Q1, 2025 results on July 31, 2024.

- Click to explore a detailed breakdown of our findings in Sumiseki HoldingsInc's dividend report.

- In light of our recent valuation report, it seems possible that Sumiseki HoldingsInc is trading behind its estimated value.

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. purchases and resells used real estate properties in Japan and has a market cap of ¥35.09 billion.

Operations: MUGEN ESTATE Ltd. generates revenue primarily through its Real Estate Buying and Selling Business, which accounts for ¥54.55 billion, and its Rental and Other Businesses, which contribute ¥2.38 billion.

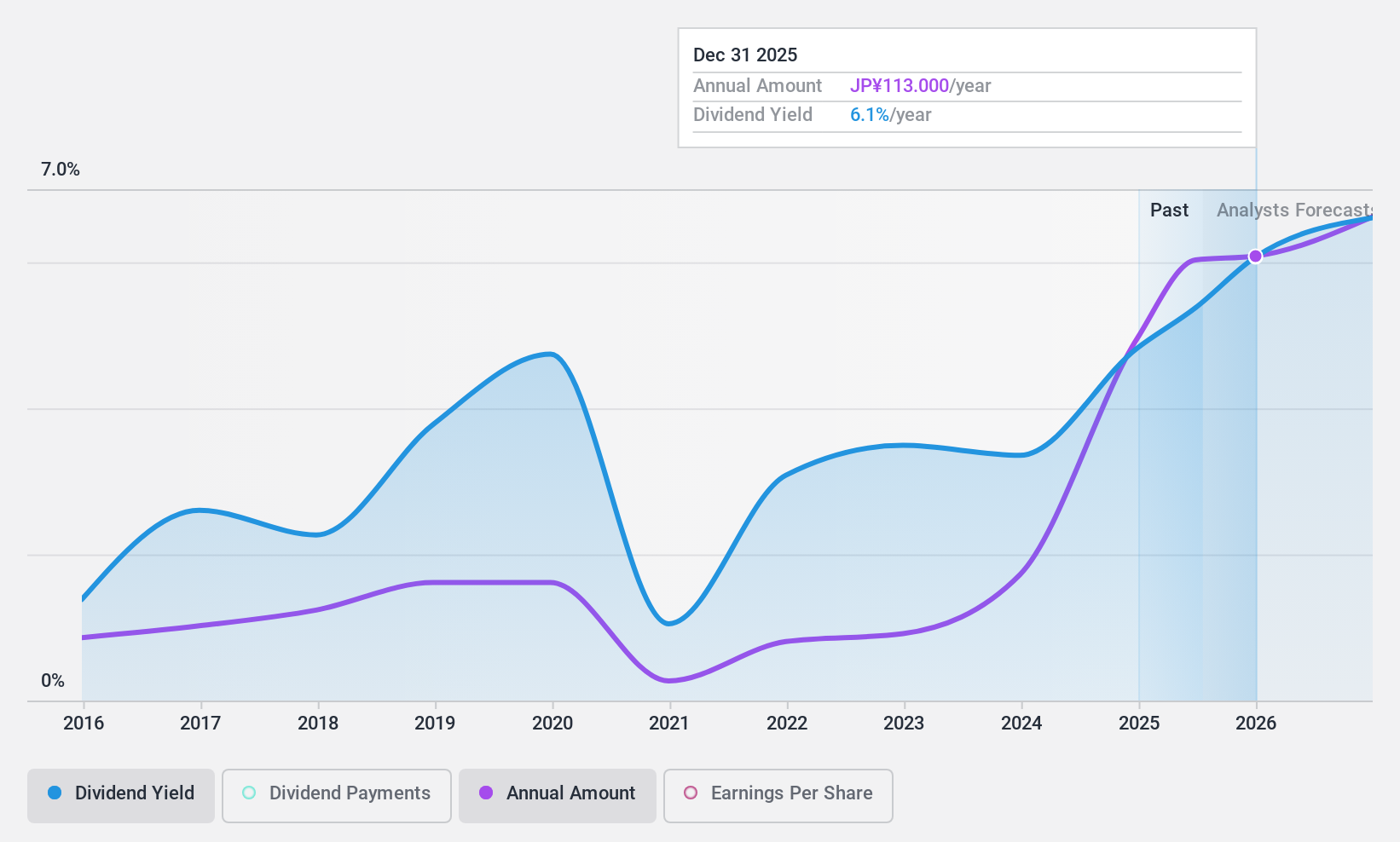

Dividend Yield: 4.5%

MUGEN ESTATE Ltd.'s dividend yield of 4.55% places it in the top quartile among Japanese stocks, but its sustainability is questionable due to a high cash payout ratio of 306.2%. Despite earnings covering dividends with a low payout ratio of 31%, free cash flows fall short, and past dividend payments have been volatile. Recent strategic moves include opening new sales offices in regional areas and completing a share buyback program worth ¥499.93 million to enhance shareholder returns.

- Dive into the specifics of MUGEN ESTATELtd here with our thorough dividend report.

- According our valuation report, there's an indication that MUGEN ESTATELtd's share price might be on the cheaper side.

Daiichikosho (TSE:7458)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daiichikosho Co., Ltd. operates in Japan, focusing on the sale and rental of commercial karaoke systems, with a market cap of ¥183.46 billion.

Operations: Daiichikosho Co., Ltd.'s revenue segments include ¥61.10 billion from Commercial Karaoke, ¥65.50 billion from the Karaoke and Restaurant Business, and ¥6.50 billion from Music Soft.

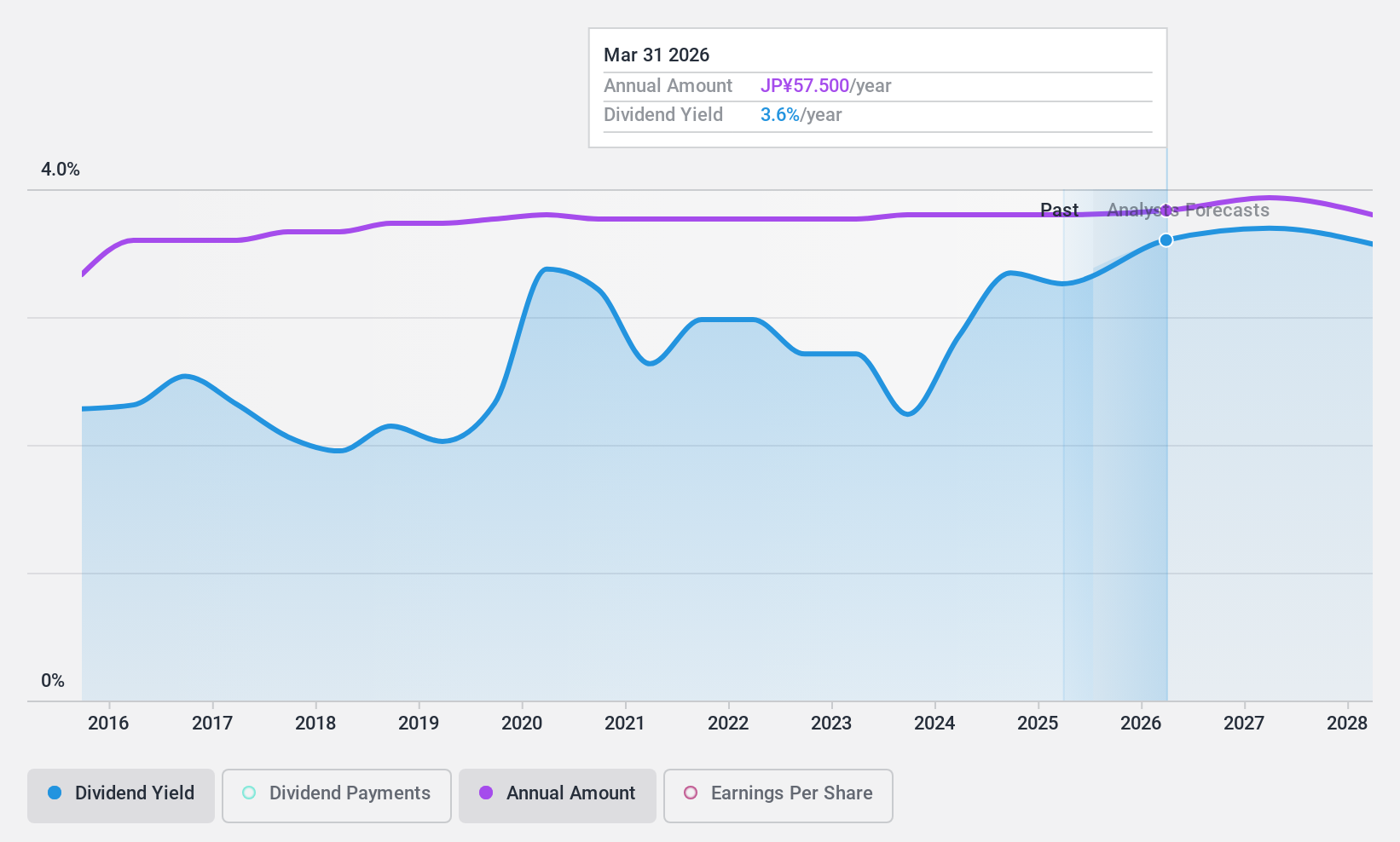

Dividend Yield: 3.3%

Daiichikosho Co., Ltd. offers a stable dividend, with recent affirmations of ¥28.00 per share for the second quarter and ¥29.00 for the year ending March 31, 2025. However, its dividends are not covered by free cash flows and have a relatively low yield of 3.27%. Despite this, the company has a low payout ratio of 48.6%, indicating earnings cover dividends well. Recent buyback plans increase shareholder value but highlight cash flow constraints.

- Unlock comprehensive insights into our analysis of Daiichikosho stock in this dividend report.

- Our expertly prepared valuation report Daiichikosho implies its share price may be lower than expected.

Seize The Opportunity

- Unlock more gems! Our Top Japanese Dividend Stocks screener has unearthed 464 more companies for you to explore.Click here to unveil our expertly curated list of 467 Top Japanese Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3299

MUGEN ESTATELtd

MUGEN ESTATE Co.,Ltd. purchases and resells used real estate properties in Japan.

Solid track record with adequate balance sheet and pays a dividend.