- Japan

- /

- Entertainment

- /

- TSE:7359

Potential Upside For Tokyo Communications Group,Inc. (TSE:7359) Not Without Risk

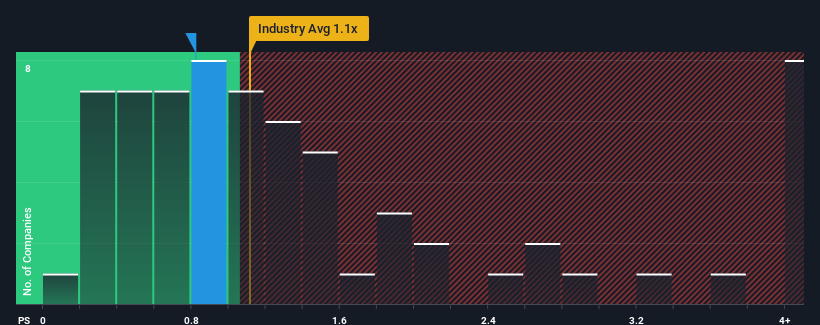

It's not a stretch to say that Tokyo Communications Group,Inc.'s (TSE:7359) price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" for companies in the Entertainment industry in Japan, where the median P/S ratio is around 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Tokyo Communications GroupInc

What Does Tokyo Communications GroupInc's P/S Mean For Shareholders?

Revenue has risen firmly for Tokyo Communications GroupInc recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Tokyo Communications GroupInc will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tokyo Communications GroupInc will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Tokyo Communications GroupInc would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow revenue by 154% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 0.4% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that Tokyo Communications GroupInc's P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Tokyo Communications GroupInc's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Tokyo Communications GroupInc revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

You need to take note of risks, for example - Tokyo Communications GroupInc has 3 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tokyo Communications GroupInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7359

Tokyo Communications GroupInc

Engages in media, platform, and other businesses.

Adequate balance sheet low.

Market Insights

Community Narratives