Branding Technology Inc.'s (TSE:7067) 29% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Branding Technology Inc. (TSE:7067) shares have been powering on, with a gain of 29% in the last thirty days. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

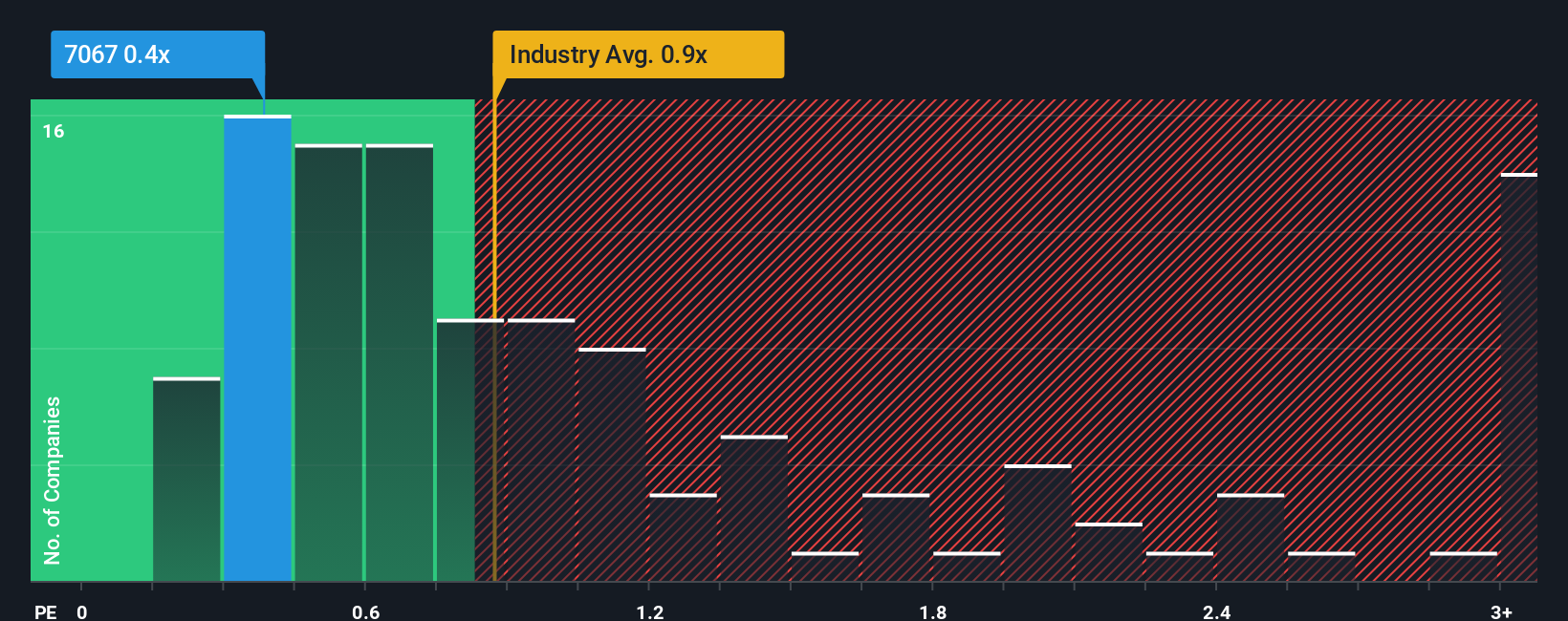

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Branding Technology's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Media industry in Japan is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Branding Technology

What Does Branding Technology's P/S Mean For Shareholders?

Revenue has risen firmly for Branding Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on Branding Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Branding Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Branding Technology would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 9.2% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Branding Technology's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Branding Technology's P/S Mean For Investors?

Its shares have lifted substantially and now Branding Technology's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Branding Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You should always think about risks. Case in point, we've spotted 2 warning signs for Branding Technology you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Branding Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7067

Branding Technology

Engages in the brand, digital marketing, and offshore related businesses in Japan.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives