Japan's stock markets have seen notable gains recently, with the Nikkei 225 Index rising by 3.1% and the broader TOPIX Index up 2.8%, driven in part by a weakening yen following the U.S. Federal Reserve's significant rate cut. This positive momentum provides an opportune backdrop for exploring high-growth tech stocks in Japan, which are poised to benefit from favorable market conditions and robust economic indicators. In this context, identifying promising tech stocks involves looking at companies that demonstrate strong innovation capabilities, solid financial health, and potential for scalability within Japan's dynamic market environment.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

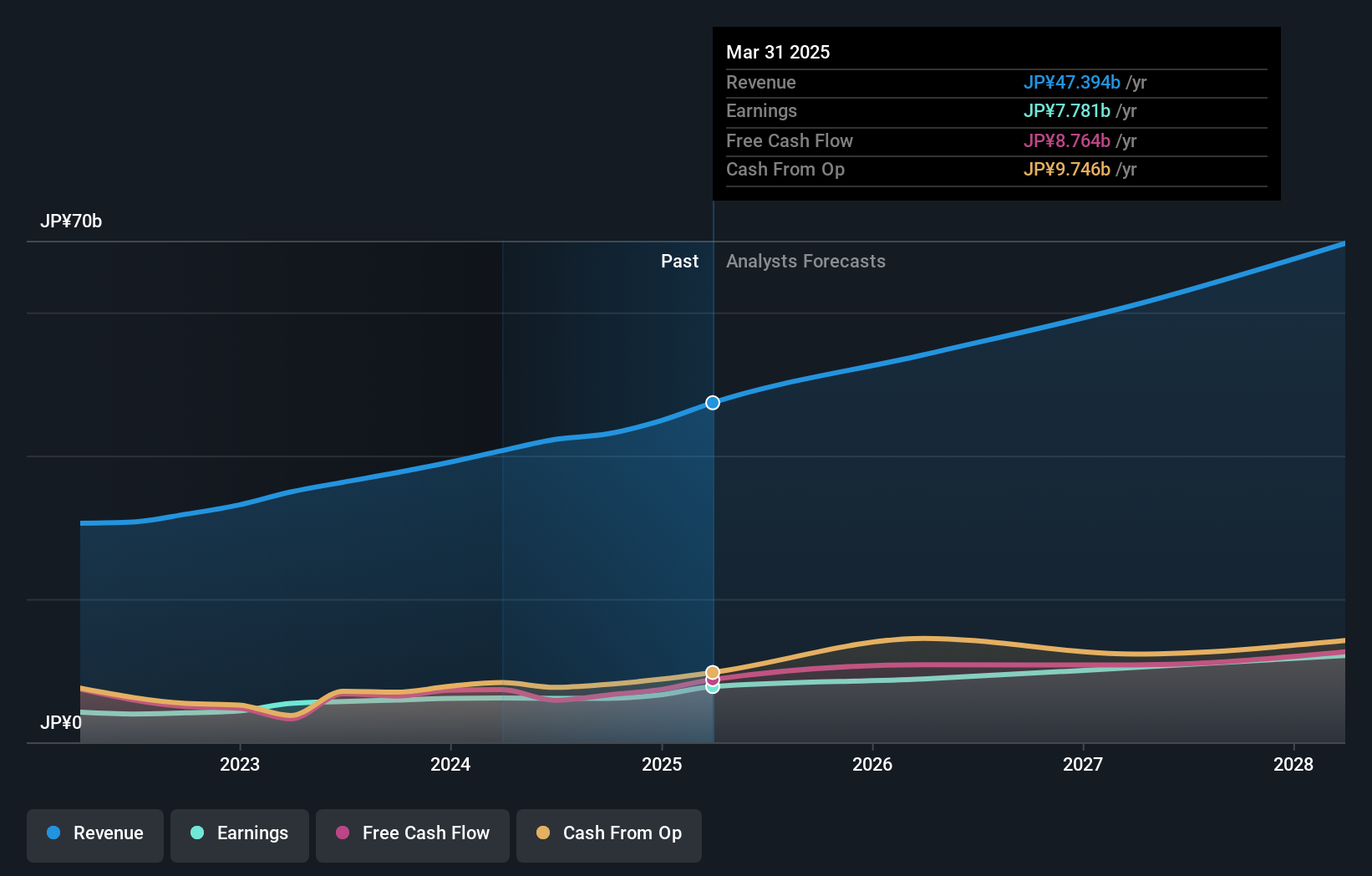

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors worldwide with a market cap of ¥144.69 billion.

Operations: Simplex Holdings, Inc. generates revenue primarily through the provision of IT solutions, amounting to ¥42.26 billion. The company focuses on offering strategic consulting, design and development, as well as operation and maintenance services across various sectors globally.

Simplex Holdings, a player in Japan's tech scene, demonstrates robust potential with its earnings forecast to surge by 20.2% annually, outpacing the broader Japanese market's 8.6%. This growth is underpinned by a significant commitment to R&D, crucial for maintaining competitive advantage in the fast-evolving tech landscape. Notably, Simplex has managed to grow its earnings by an impressive 26.6% annually over the past five years and is projected to continue at about 20.16% yearly. The firm benefits from high-quality past earnings and positive free cash flow, positioning it well amidst industry challenges like revenue growth rates not exceeding the high threshold of 20% per year but still achieving a solid 12.8%, significantly ahead of the market average of 4.3%.

- Dive into the specifics of Simplex Holdings here with our thorough health report.

Examine Simplex Holdings' past performance report to understand how it has performed in the past.

Vector (TSE:6058)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vector Inc. operates in public relations, advertising, press release distribution, video release distribution, direct marketing, media, investment, and human resources sectors across Japan, China, and internationally with a market cap of ¥43.53 billion.

Operations: Vector Inc. generates revenue through its diverse operations in PR and advertising, press release and video distribution, direct marketing, media, investment, and human resources sectors across Japan, China, and internationally. The company has a market cap of ¥43.53 billion.

Vector, amidst a competitive tech landscape in Japan, is navigating with a strategic emphasis on R&D, spending significantly to stay ahead. With an annual revenue growth forecast at 6.9%, it outpaces the broader Japanese market average of 4.3%. The company's earnings are also expected to rise by 10.7% annually, reflecting a robust operational strategy despite not reaching the high-growth threshold of 20% yearly increase. A recent board meeting highlighted structural changes through mergers of subsidiaries, underscoring agility in corporate strategy adjustments without affecting disclosure requirements. This approach could bolster Vector's position by enhancing efficiencies and innovation potential as they continue investing in technological advancements.

- Click to explore a detailed breakdown of our findings in Vector's health report.

Explore historical data to track Vector's performance over time in our Past section.

Nissha (TSE:7915)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nissha Co., Ltd. operates in industrial materials, devices, medical technologies, information and communication, as well as pharmaceutical and cosmetics sectors both in Japan and globally, with a market cap of ¥94.37 billion.

Operations: Nissha generates revenue primarily from industrial materials (¥72.03 billion), devices (¥63.30 billion), and medical technology (¥40.72 billion). The company operates across various sectors including information and communication, as well as pharmaceutical and cosmetics, both in Japan and internationally.

Nissha's strategic maneuvers in the tech sector are underscored by a recent commitment to repurchasing up to 600,000 shares, enhancing shareholder value with a ¥1 billion investment. This move aligns with its robust revenue growth forecast of 4.8% annually, slightly outpacing the Japanese market average of 4.3%. Despite facing challenges like a highly volatile share price and a significant one-off loss of ¥3.1 billion impacting financial results, Nissha projects an impressive earnings growth rate of 31.1% per year. The company's focus on innovative practices and operational efficiencies could potentially strengthen its market position amidst competitive pressures and fluctuating profit margins, currently at a modest 0.3%.

- Navigate through the intricacies of Nissha with our comprehensive health report here.

Assess Nissha's past performance with our detailed historical performance reports.

Summing It All Up

- Reveal the 124 hidden gems among our Japanese High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4373

Flawless balance sheet with solid track record.

Market Insights

Community Narratives