- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

Exploring High Growth Tech Stocks This December 2024

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by the Federal Reserve's cautious stance on interest rates and political tensions in the U.S., small-cap stocks have experienced notable volatility, with indices like the S&P 600 feeling the pressure. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through strong fundamentals and innovative potential, positioning them to capitalize on emerging opportunities despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.09% | 42.97% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

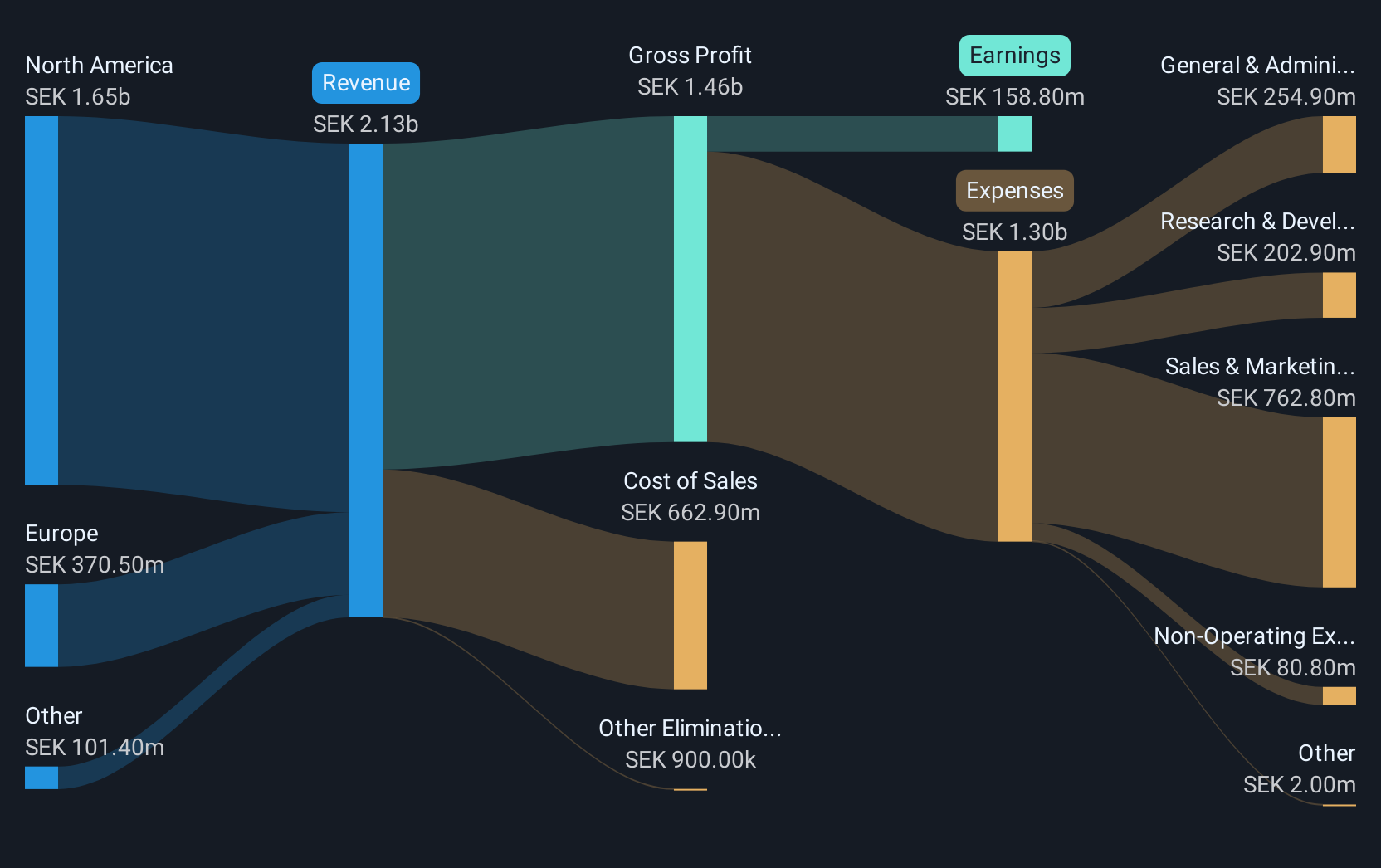

Overview: Dynavox Group AB (publ) is a company that develops and sells assistive technology products for communication both in Sweden and internationally, with a market capitalization of approximately SEK5.92 billion.

Operations: The company generates revenue primarily from its computer hardware segment, amounting to SEK1.86 billion.

Dynavox Group, with its robust 79% earnings growth over the past year, significantly outperforms the tech industry average of 54%, underscoring its competitive edge in innovation and market adaptation. This growth trajectory is supported by a strong forecast that expects Dynavox's revenue to climb at an annual rate of 13.9%, surpassing Sweden's market growth of just 1.3%. Despite facing challenges like high debt levels, the company continues to invest heavily in R&D, which is pivotal for sustaining its technological leadership and supporting expected earnings growth of 34.4% annually. Recent financial results show a solid increase in sales from SEK 424 million to SEK 483 million in Q3 and net income rising from SEK 35 million to SEK 45 million, reflecting both operational efficiency and effective market strategies.

- Click here to discover the nuances of Dynavox Group with our detailed analytical health report.

Explore historical data to track Dynavox Group's performance over time in our Past section.

Probi (OM:PROB)

Simply Wall St Growth Rating: ★★★★☆☆

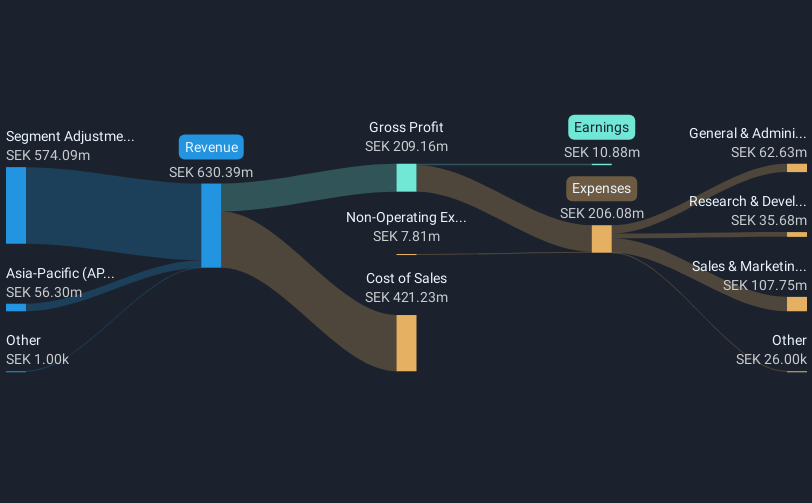

Overview: Probi AB (publ) is engaged in the research, manufacturing, and sale of probiotics for dietary supplements and food companies across various global markets, with a market cap of SEK3.97 billion.

Operations: The company focuses on producing and distributing probiotics for dietary supplements and food industries worldwide. Its operations span multiple regions, including North America, South America, Europe, the Middle East, Africa, and Asia Pacific.

Probi, amidst a transformative acquisition by Symrise AG, is poised for significant shifts in its market dynamics and operational scale. This strategic move, valued at SEK 1.2 billion, not only enhances Probi's financial muscle but also consolidates its market position by potentially delisting from Nasdaq Stockholm. Financially, Probi navigated a challenging Q3 with sales dipping to SEK 143.71 million from SEK 156.03 million year-over-year and net income falling to SEK 3.58 million from SEK 6.4 million; however, this backdrop sets the stage for potential revitalization post-acquisition. The firm's commitment to innovation is evident in its latest product launches aimed at addressing metabolic health—a growing concern globally—signifying Probi’s responsiveness to market needs and consumer health trends.

- Take a closer look at Probi's potential here in our health report.

Gain insights into Probi's past trends and performance with our Past report.

Vector (TSE:6058)

Simply Wall St Growth Rating: ★★★★☆☆

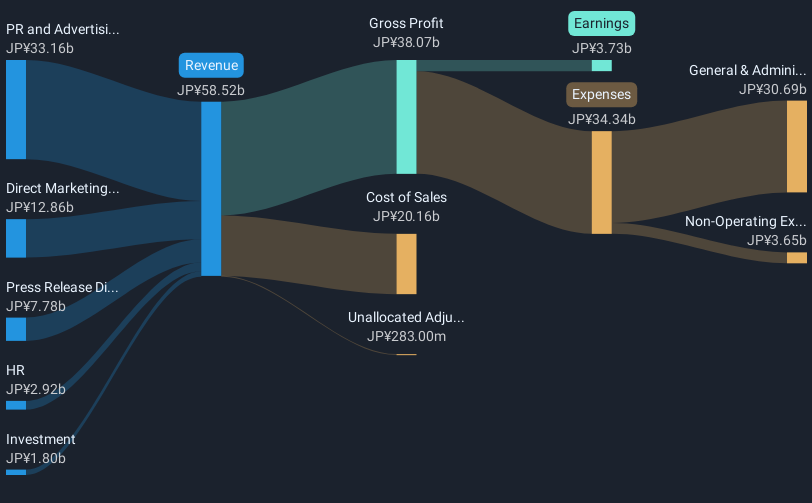

Overview: Vector Inc. operates in public relations, advertising, press release and video distribution, direct marketing, media, investment, and human resources across Japan, China, and internationally with a market cap of ¥48.50 billion.

Operations: Vector Inc. generates revenue through its diverse operations in public relations, advertising, press release and video distribution, direct marketing, media services, investments, and human resources across multiple regions including Japan and China. The company has a market capitalization of approximately ¥48.50 billion.

Vector Inc. has demonstrated a robust trajectory in its financial and strategic endeavors, notably with a 135% earnings growth over the past year, outpacing the media industry's average of 8.3%. This growth is underpinned by significant R&D investments, which have amounted to ¥1.4 billion in non-recurring gains impacting the last fiscal year's results. The recent decision to form a joint venture in Taiwan with Mars Holdings Co., Ltd., aimed at expanding their taxi advertisement business, reflects Vector's agile approach to capturing new market opportunities abroad. Additionally, an updated dividend policy indicates a forward-looking stance on shareholder returns, enhancing its appeal amid evolving market dynamics.

- Unlock comprehensive insights into our analysis of Vector stock in this health report.

Assess Vector's past performance with our detailed historical performance reports.

Next Steps

- Unlock our comprehensive list of 1279 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for communication in Sweden and internationally.

High growth potential with proven track record.