- Japan

- /

- Interactive Media and Services

- /

- TSE:6054

Some May Be Optimistic About Livesense's (TSE:6054) Earnings

Soft earnings didn't appear to concern Livesense Inc.'s (TSE:6054) shareholders over the last week. We did some digging, and we believe the earnings are stronger than they seem.

See our latest analysis for Livesense

Examining Cashflow Against Livesense's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

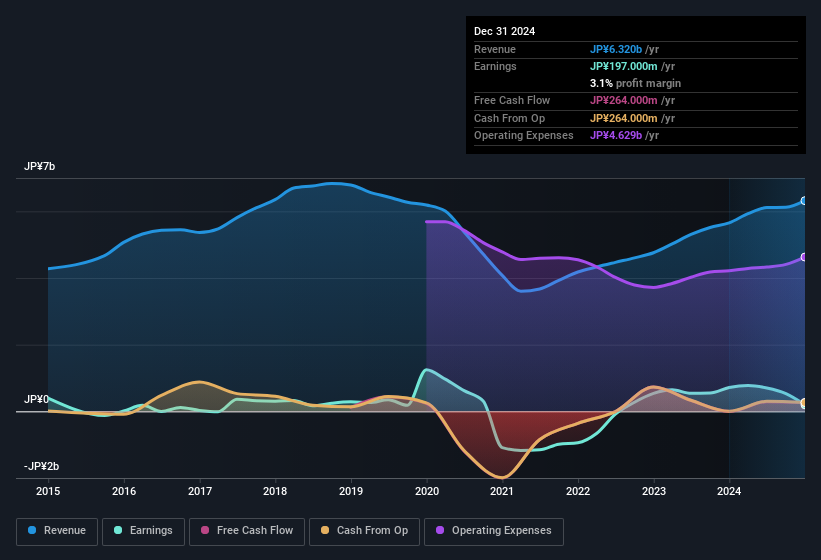

For the year to December 2024, Livesense had an accrual ratio of -0.21. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of JP¥264m in the last year, which was a lot more than its statutory profit of JP¥197.0m. Given that Livesense had negative free cash flow in the prior corresponding period, the trailing twelve month resul of JP¥264m would seem to be a step in the right direction. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Livesense.

The Impact Of Unusual Items On Profit

While the accrual ratio might bode well, we also note that Livesense's profit was boosted by unusual items worth JP¥23m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. If Livesense doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Livesense's Profit Performance

In conclusion, Livesense's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Considering all the aforementioned, we'd venture that Livesense's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. In terms of investment risks, we've identified 2 warning signs with Livesense, and understanding these should be part of your investment process.

Our examination of Livesense has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6054

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives