There's Reason For Concern Over Fuji Media Holdings, Inc.'s (TSE:4676) Massive 26% Price Jump

The Fuji Media Holdings, Inc. (TSE:4676) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 100%.

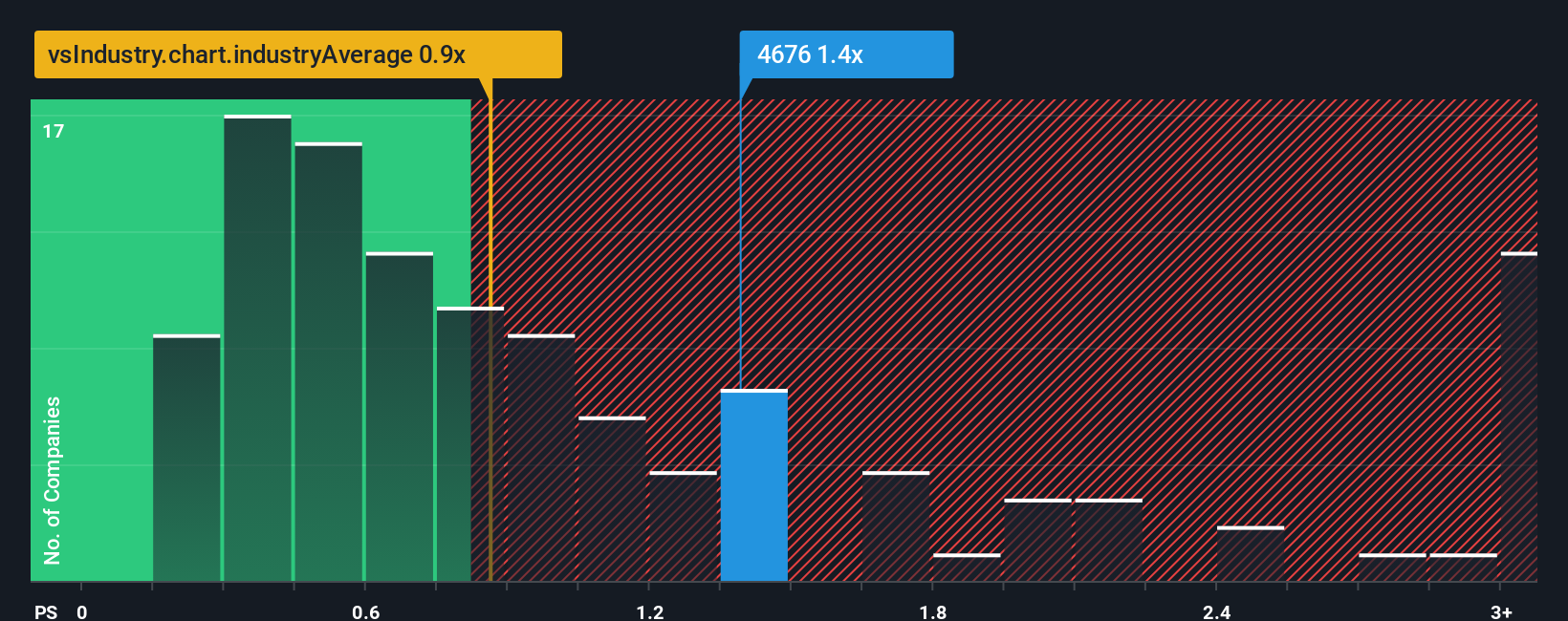

After such a large jump in price, when almost half of the companies in Japan's Media industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Fuji Media Holdings as a stock probably not worth researching with its 1.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Fuji Media Holdings

What Does Fuji Media Holdings' Recent Performance Look Like?

Fuji Media Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fuji Media Holdings.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Fuji Media Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.6% each year over the next three years. That's shaping up to be similar to the 4.5% per annum growth forecast for the broader industry.

With this information, we find it interesting that Fuji Media Holdings is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

The large bounce in Fuji Media Holdings' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Fuji Media Holdings currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for Fuji Media Holdings you should be aware of.

If these risks are making you reconsider your opinion on Fuji Media Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4676

Fuji Media Holdings

Through its subsidiaries, engages in the broadcasting activities in Japan.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives