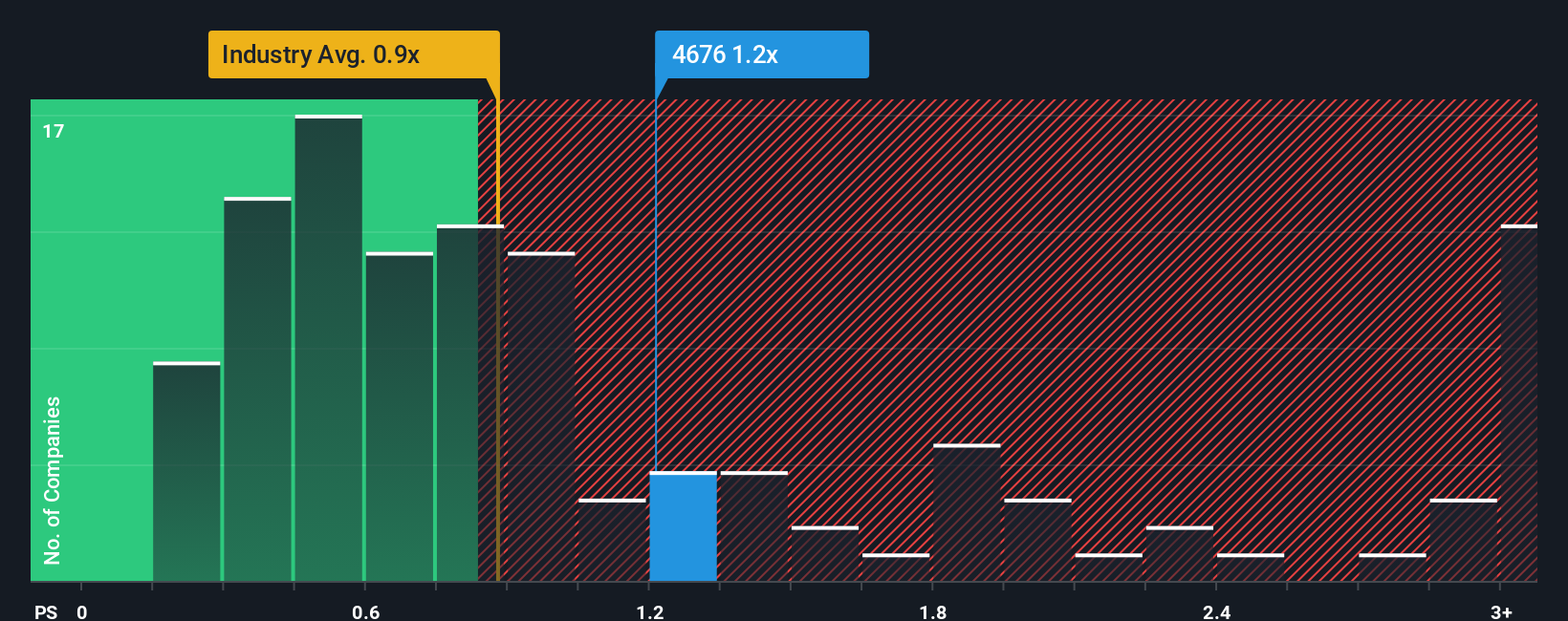

There wouldn't be many who think Fuji Media Holdings, Inc.'s (TSE:4676) price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S for the Media industry in Japan is similar at about 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Fuji Media Holdings

What Does Fuji Media Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Fuji Media Holdings' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fuji Media Holdings.Is There Some Revenue Growth Forecasted For Fuji Media Holdings?

The only time you'd be comfortable seeing a P/S like Fuji Media Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.7%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 5.8% per annum over the next three years. That's shaping up to be similar to the 4.4% per year growth forecast for the broader industry.

With this information, we can see why Fuji Media Holdings is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Fuji Media Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Media industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Fuji Media Holdings with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Fuji Media Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4676

Fuji Media Holdings

Through its subsidiaries, engages in the broadcasting activities in Japan.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives