Extraordinary Gains From Asset Sale Might Change the Case for Investing in Fuji Media Holdings (TSE:4676)

Reviewed by Simply Wall St

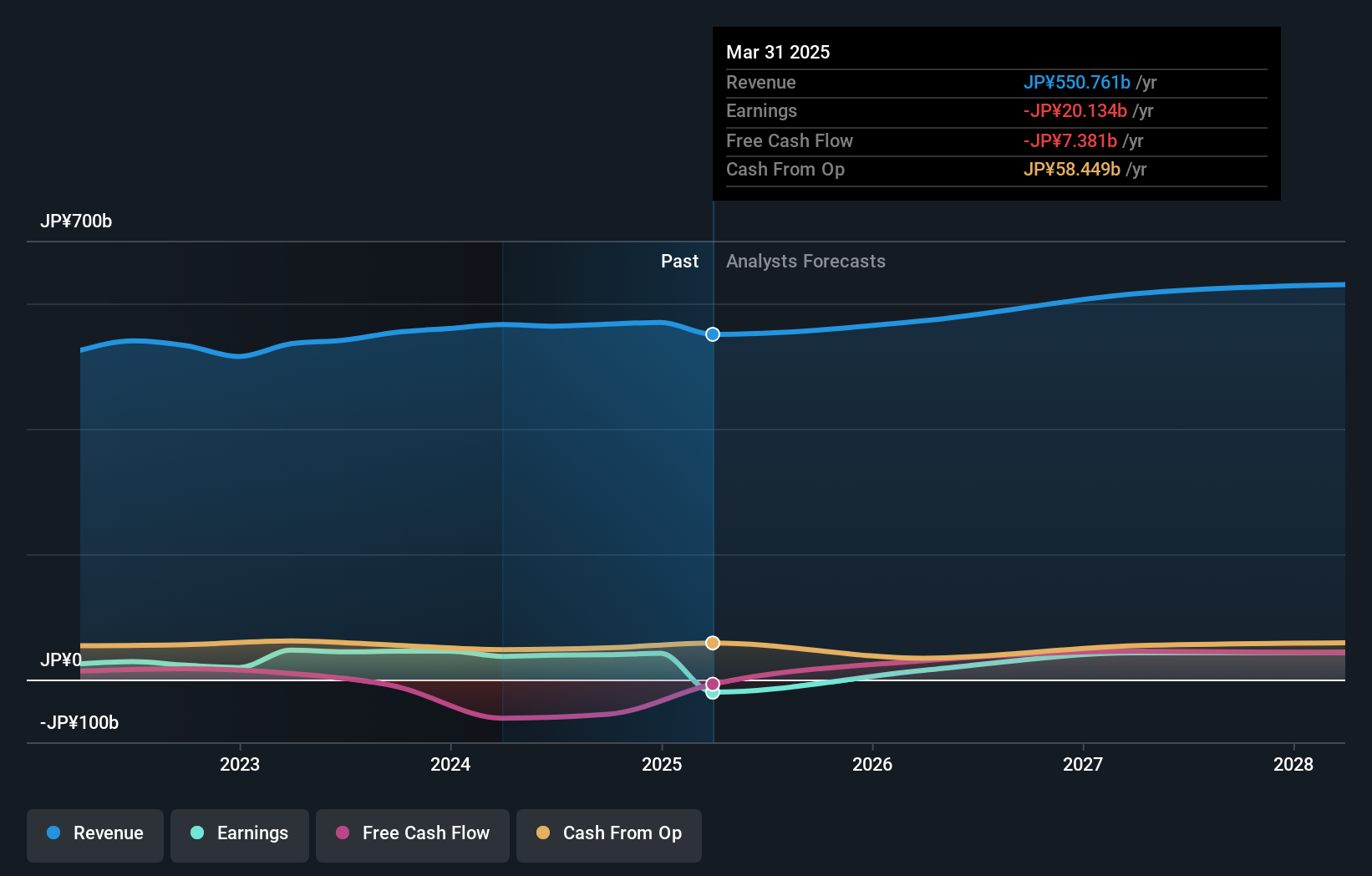

- Fuji Media Holdings recently raised its consolidated earnings guidance for the fiscal year ending March 31, 2026, updating projected profit attributable to owners of the parent to ¥16.5 billion and basic earnings per share to ¥79.52 following a larger-than-anticipated gain on the sale of investment securities.

- This revision resulted from extraordinary gains that surpassed previous estimates, highlighting the material impact of one-off factors on the company's near-term financial outlook.

- We’ll explore how the stronger-than-expected extraordinary gains shape Fuji Media Holdings’ investment narrative moving forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Fuji Media Holdings' Investment Narrative?

For anyone considering Fuji Media Holdings, the key story is whether its core businesses can return to sustainable profitability amid an industry still pressured by shifts in advertising revenues. The company's recent boost in full-year profit guidance, driven by an extraordinary gain from selling investment securities, certainly improves its immediate financial snapshot and temporarily alleviates concerns about ongoing losses. However, this windfall does little to address the more structural, near-term risks around operational performance: specifically, persistent operating losses and unprofitability, a new and relatively untested leadership team, and the ongoing impacts of advertising weakness in Fuji Television. With activist investors calling for bold moves like a real estate unit spin-off and the board undergoing further changes, the catalysts for real value creation may depend on deeper reforms extending beyond one-off accounting gains. The latest news adds short-term optimism, but investors still face important questions about the sustainability of earnings and the direction of long-term strategy.

On the other hand, board inexperience could present challenges as Fuji Media navigates industry change. Fuji Media Holdings' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on Fuji Media Holdings - why the stock might be worth less than half the current price!

Build Your Own Fuji Media Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fuji Media Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Fuji Media Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fuji Media Holdings' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4676

Fuji Media Holdings

Through its subsidiaries, engages in the broadcasting activities in Japan.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives