As global markets experience a divergence in major indexes, with growth stocks rallying and small-cap indices like the Russell 2000 facing declines, investors are focusing on sectors such as consumer discretionary and information technology that have shown significant gains. In this environment of mixed economic signals and potential interest rate adjustments by the Federal Reserve, identifying high-growth tech stocks involves looking for companies with strong innovation capabilities and robust market demand that can thrive despite broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

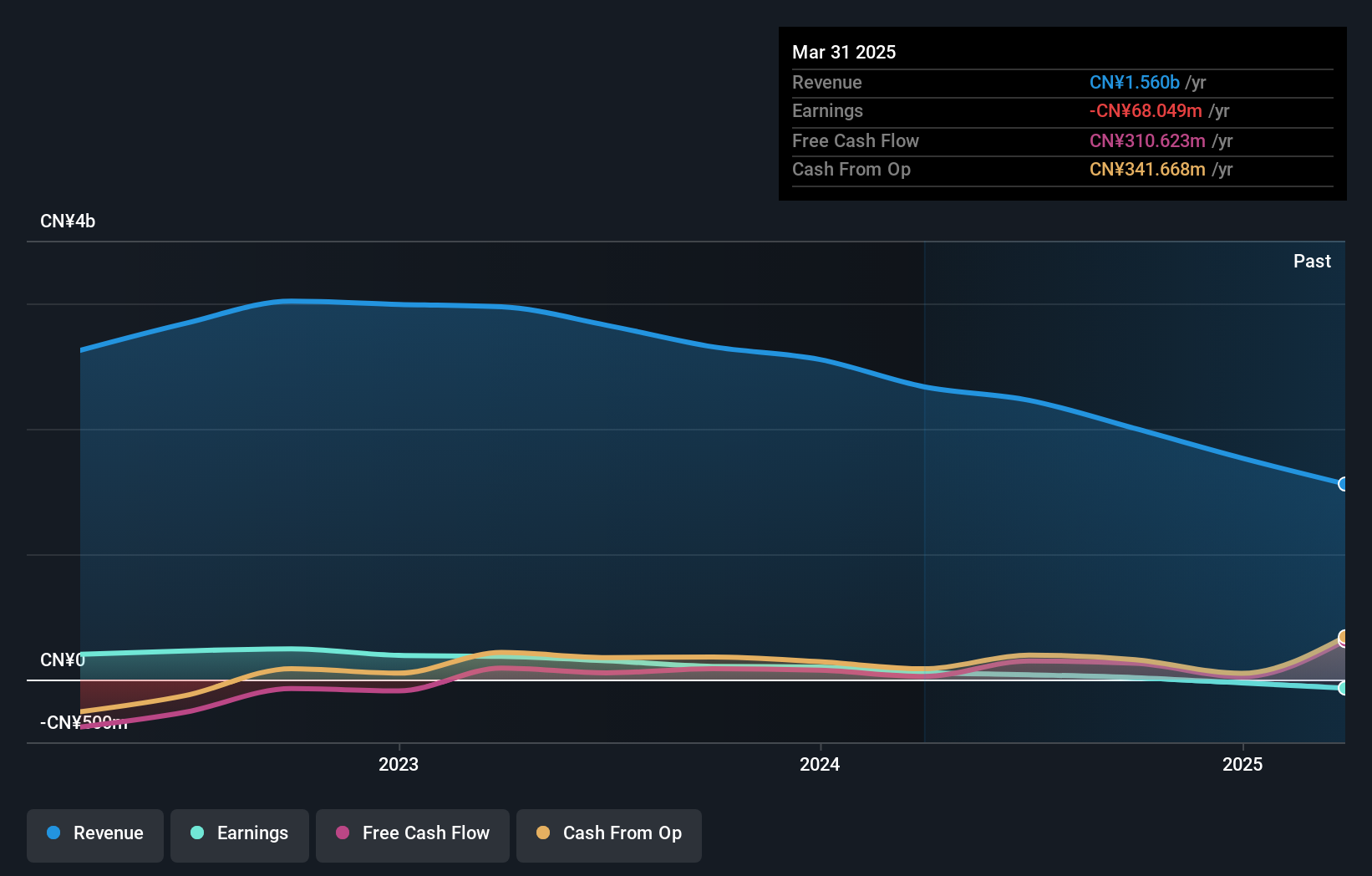

Sichuan Tianyi Comheart Telecom (SZSE:300504)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Tianyi Comheart Telecom Co., Ltd. is a company with a market cap of CN¥5.08 billion, engaged in the telecommunications industry.

Operations: Sichuan Tianyi Comheart Telecom operates in the telecommunications sector with a focus on providing various communication services.

Sichuan Tianyi Comheart Telecom has demonstrated a robust revenue growth trajectory, with forecasts indicating an annual increase of 17.7%, outpacing the Chinese market average of 13.8%. Despite facing challenges such as a significant one-off loss of CN¥3.7M and a sharp earnings decline by 85.3% over the past year, the company's future prospects appear promising with an expected earnings surge of 64.1% annually, significantly above the market forecast of 25.9%. This growth is underpinned by substantial investments in R&D, aligning with its strategic focus on enhancing technological capabilities to sustain long-term competitiveness in the communications sector. Recent financial disclosures reveal that for the nine months ending September 30, 2024, Sichuan Tianyi reported revenues and net income significantly lower than the previous year, at CNY 1,449.7 million and CNY 38.47 million respectively; however, these figures are set against a backdrop of strategic index inclusion and promising revenue growth forecasts. The company's commitment to innovation through R&D spending is poised to catalyze further advancements in its offerings and market position despite current financial volatilities and competitive pressures within China’s tech landscape.

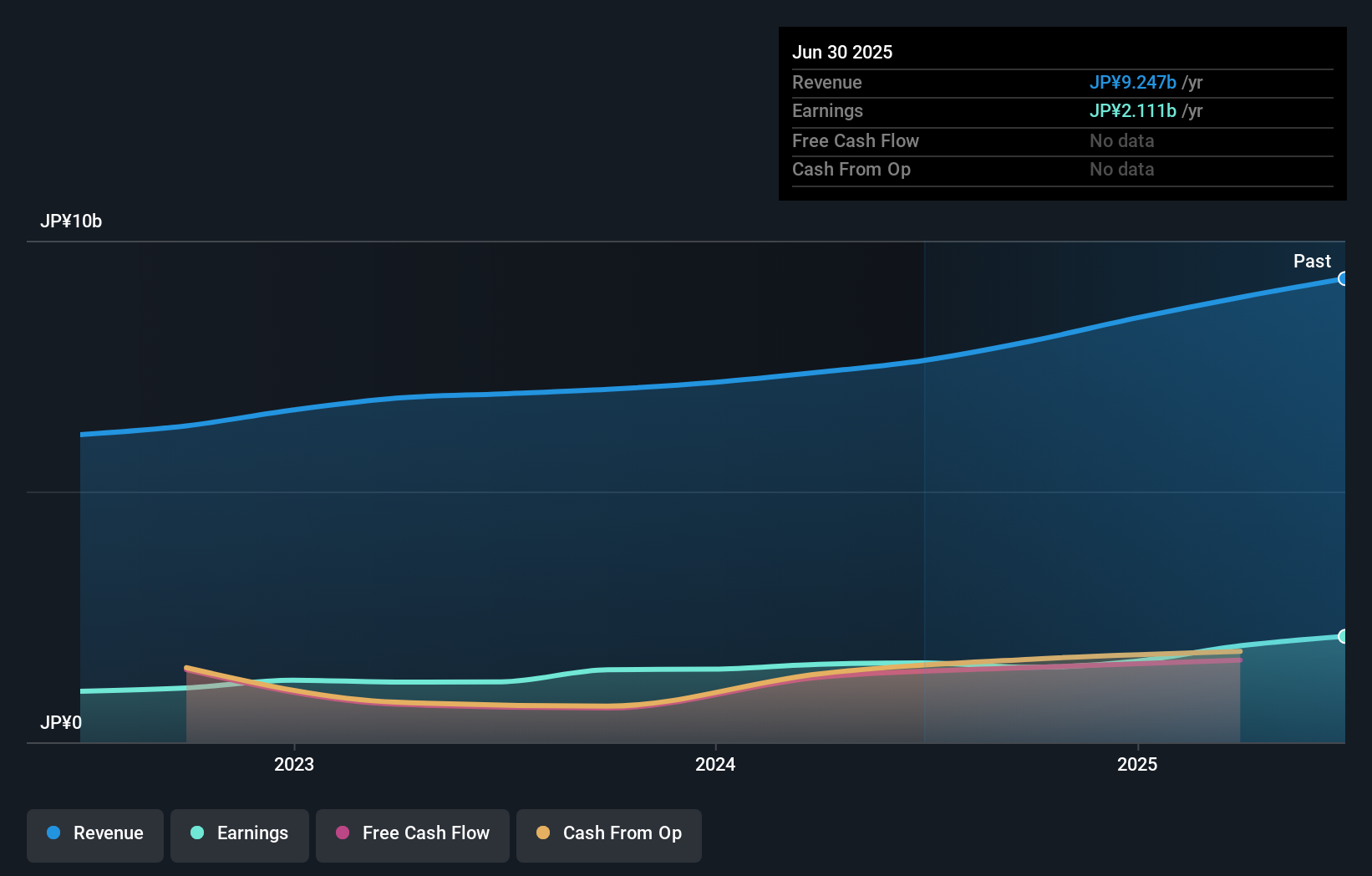

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fixstars Corporation is a software company that operates both in Japan and internationally, with a market capitalization of approximately ¥59.60 billion.

Operations: The company generates revenue primarily through its Solution Business, which accounts for ¥7.70 billion, and its SaaS business contributing ¥487.52 million.

Fixstars has been navigating the competitive tech landscape with notable agility, evidenced by its robust revenue growth rate of 14.7% annually, outstripping Japan's market average of 4.1%. This growth is complemented by an impressive forecast for earnings expansion at a rate of 20.5% per year, positioning it well above the broader market's expectation of 7.9%. The firm’s commitment to innovation is underscored by its strategic R&D investments which have not only fueled advancements in their offerings but also enhanced their market stance amidst a volatile share price environment over the past three months. With recent announcements including a special cash dividend and upcoming fiscal results, Fixstars continues to demonstrate its potential within the high-stakes realm of software and technology development.

- Get an in-depth perspective on Fixstars' performance by reading our health report here.

Review our historical performance report to gain insights into Fixstars''s past performance.

Akatsuki (TSE:3932)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Akatsuki Inc. operates in the gaming, comic, and other sectors mainly within Japan, with a market capitalization of ¥38.23 billion.

Operations: The company generates revenue primarily from its gaming segment, contributing ¥23.07 billion, followed by comics at ¥1.03 billion. The net profit margin exhibits notable variability over recent periods, reflecting changes in operational efficiency and cost management strategies within these sectors.

Akatsuki's dynamic growth trajectory is evident with its revenue forecast to expand by 14.4% annually, outpacing the broader Japanese market's average of 4.1%. This robust expansion is propelled by a significant earnings surge, having increased by an impressive 172.3% over the past year alone. The firm has strategically channeled funds into R&D, which constitutes a substantial portion of their expenses, reflecting their commitment to innovation and securing competitive advantages in the tech sector. With earnings expected to grow at an annual rate of 42.4%, Akatsuki is not just keeping pace but setting benchmarks within its industry sphere, highlighting both potential and challenges in maintaining such high growth rates moving forward.

- Click to explore a detailed breakdown of our findings in Akatsuki's health report.

Gain insights into Akatsuki's past trends and performance with our Past report.

Where To Now?

- Click through to start exploring the rest of the 1286 High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3687

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives