- Japan

- /

- Entertainment

- /

- TSE:3791

High Growth Tech Stocks To Explore In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets reflect a mixed sentiment with U.S. stocks closing out a strong year despite some end-of-year profit-taking and economic indicators showing varied signals, such as the Chicago PMI's contraction and the Atlanta Fed's GDP forecast revision. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience amid economic fluctuations and have robust innovation pipelines to capitalize on evolving market opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Digital Value (BIT:DGV)

Simply Wall St Growth Rating: ★★★★★☆

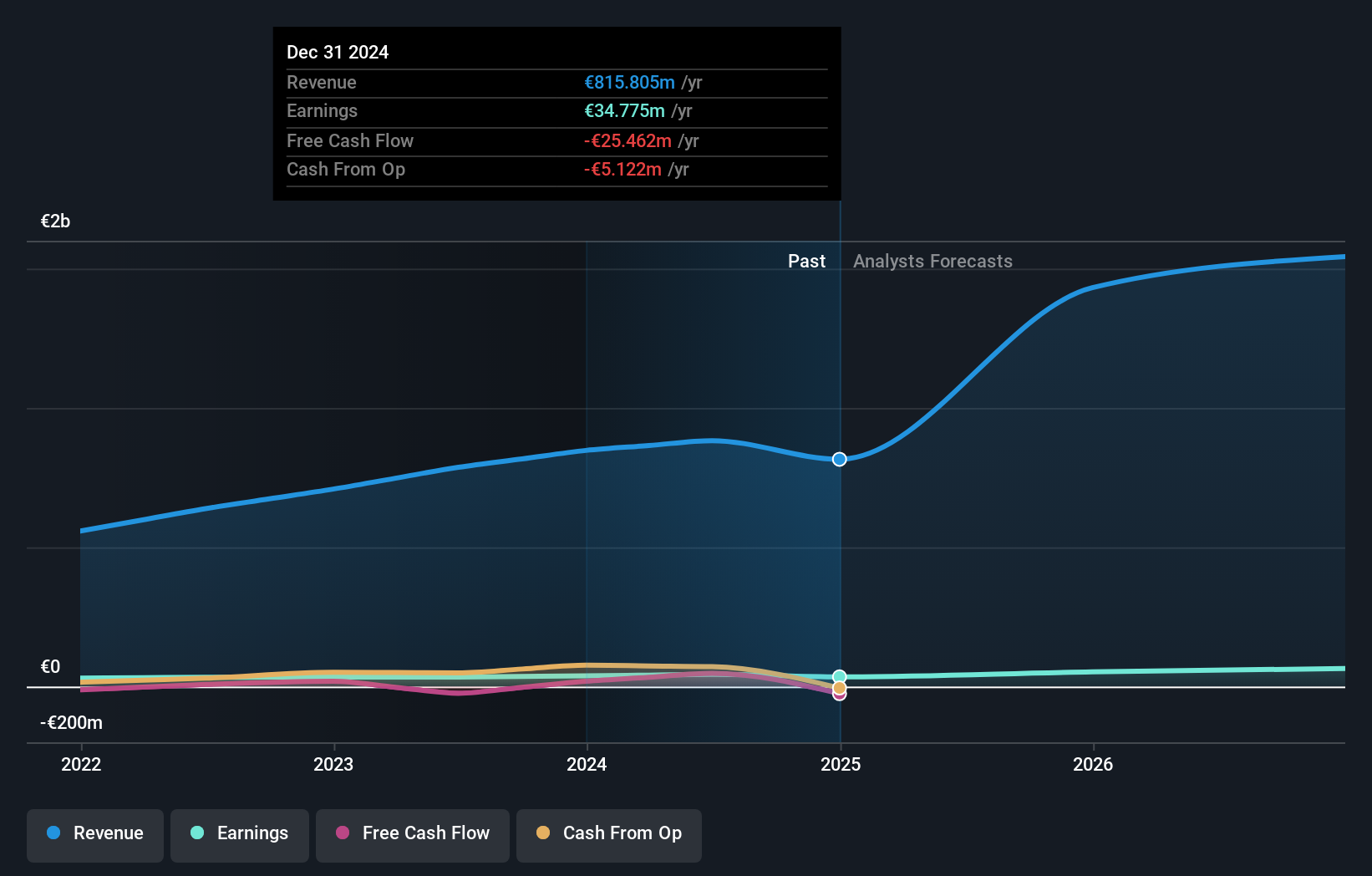

Overview: Digital Value S.p.A. offers IT solutions and services in Italy with a market capitalization of €243.39 million.

Operations: Digital Value S.p.A. specializes in IT solutions and services within Italy, focusing on providing comprehensive technology support to businesses. The company's revenue streams are primarily derived from these services, which cater to various sectors demanding IT infrastructure and digital transformation.

Digital Value stands out in the high-growth tech sector, with its revenue projected to increase by 24.8% annually, surpassing the broader Italian market's growth rate of 4%. This robust expansion is complemented by an earnings surge of 17.8% per year, again outpacing the local market's average of 7%. The company has successfully maintained a positive free cash flow and a forecasted return on equity of 20.4% in three years, indicating strong financial health and effective capital management. Furthermore, Digital Value's commitment to innovation is evident from its R&D expenses which are strategically aligned to fuel future growth, ensuring it remains at the forefront of technological advancements in its sector.

- Navigate through the intricacies of Digital Value with our comprehensive health report here.

Examine Digital Value's past performance report to understand how it has performed in the past.

YD Electronic TechnologyLtd (SZSE:301123)

Simply Wall St Growth Rating: ★★★★★☆

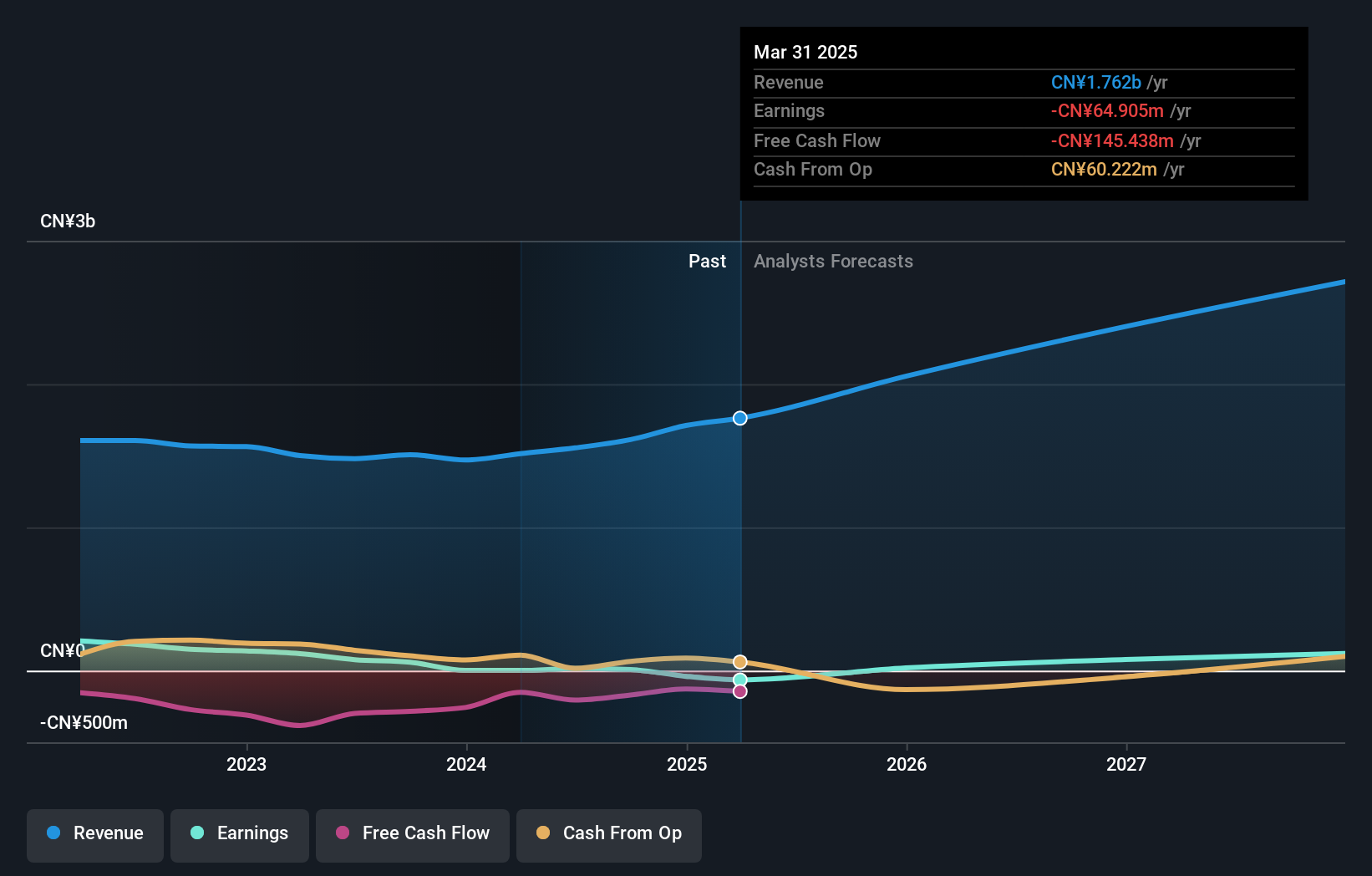

Overview: YD Electronic Technology Co., Ltd. focuses on the research, development, production, and sale of flexible printed circuit (FPC) boards, connector components, LED backlight modules, and other precision electronic components in China with a market capitalization of CN¥5.16 billion.

Operations: YD Electronic Technology Co., Ltd. generates revenue primarily through the production and sale of flexible printed circuit boards, connector components, and LED backlight modules. The company operates within China's electronic components industry with a market capitalization of CN¥5.16 billion.

YD Electronic TechnologyLtd. has demonstrated a notable performance in the tech sector, with its revenue rising to CNY 1.23 billion, up from CNY 1.09 billion year-over-year, reflecting a robust growth rate of 25.5%. This surge is supported by an impressive earnings increase, where net income escalated to CNY 17.03 million from CNY 11.16 million, marking a significant annual growth of 76.3%. The company's strategic focus on R&D is evident as it continues to invest in innovation, aligning with its recent share repurchase initiative where it bought back shares worth CNY 49.99 million, signaling confidence in its future prospects and commitment to shareholder value.

IG Port (TSE:3791)

Simply Wall St Growth Rating: ★★★★☆☆

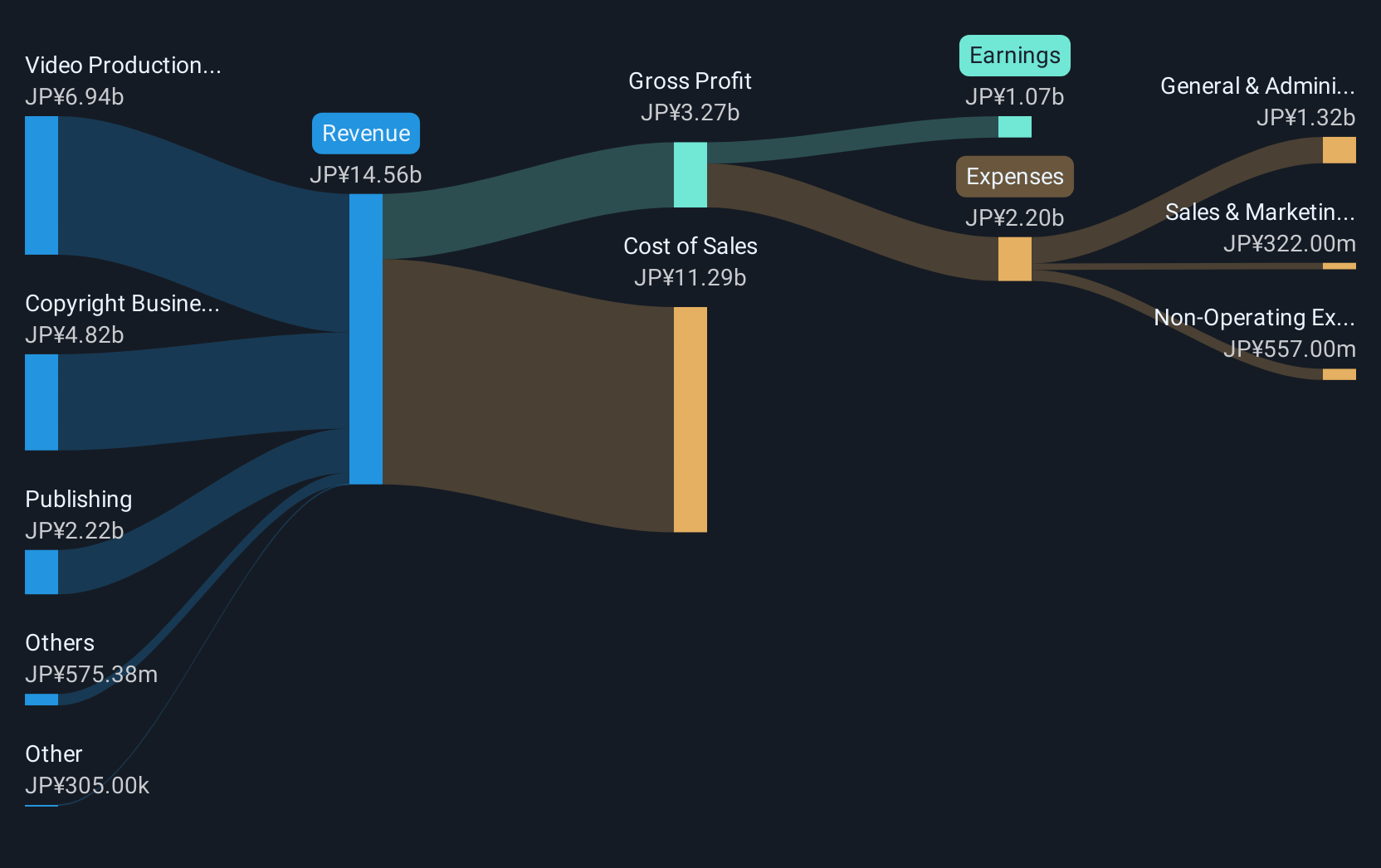

Overview: IG Port, Inc., with a market cap of ¥45.80 billion, operates as an animation production company both in Japan and internationally through its subsidiaries.

Operations: IG Port, Inc. generates revenue primarily through animation production and distribution. The company leverages its subsidiaries to operate both domestically and internationally in the animation industry.

IG Port, with its revenue growth at 7.9% annually, is making strides albeit not at the pace of some high flyers in tech. The company's earnings have surged by 21.1% over the past year, outperforming the broader Entertainment industry's decline of 7%. This growth is underpinned by a robust commitment to R&D, which not only reflects in its financials but also positions IG Port well for future technological advancements. Additionally, the firm has demonstrated confidence in its trajectory with recent share repurchases signaling strong future prospects despite a highly volatile share price recently. With earnings expected to grow significantly over the next three years and revenue forecasts outpacing the Japanese market average, IG Port appears poised to continue its upward trajectory amidst challenging industry dynamics.

- Take a closer look at IG Port's potential here in our health report.

Gain insights into IG Port's past trends and performance with our Past report.

Summing It All Up

- Click here to access our complete index of 1266 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3791

IG Port

Operates as an animation production company in Japan and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives