- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A084370

December 2024's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

As global markets navigate a period marked by rate cuts from major central banks and mixed performance across indices, growth stocks continue to outshine their value counterparts, particularly in the technology sector. With the Nasdaq Composite reaching new heights, investors are increasingly focused on companies where insiders hold significant ownership stakes, as this can often signal confidence in a company's long-term potential amidst fluctuating economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

We'll examine a selection from our screener results.

Eugene TechnologyLtd (KOSDAQ:A084370)

Simply Wall St Growth Rating: ★★★★☆☆

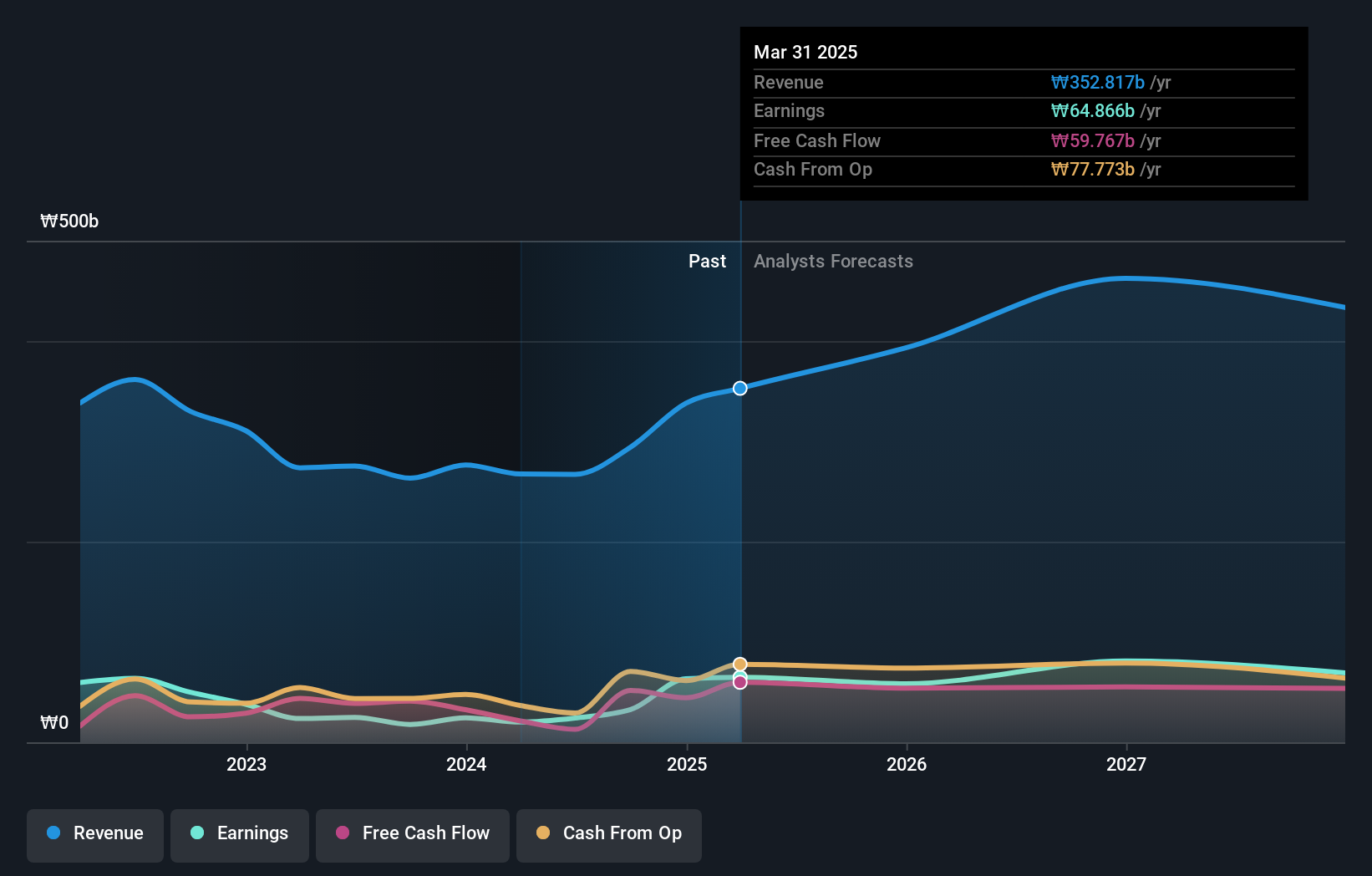

Overview: Eugene Technology Co., Ltd. manufactures and sells semiconductor equipment and parts both in South Korea and internationally, with a market cap of approximately ₩770.73 billion.

Operations: The company's revenue is primarily derived from semiconductor equipment, amounting to ₩282.49 billion, and industrial gases for semiconductors, contributing ₩11.72 billion.

Insider Ownership: 37.5%

Eugene Technology Ltd. exhibits strong growth potential, with earnings expected to grow 32.7% annually, outpacing the Korean market's average. Recent third-quarter results showed a substantial increase in net income to KRW 10,032.2 million from KRW 1,643.25 million year-on-year, reflecting robust performance despite low forecasted return on equity of 15.7%. The company’s revenue is anticipated to rise by 19% annually, surpassing the market's average growth rate.

- Get an in-depth perspective on Eugene TechnologyLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Eugene TechnologyLtd's shares may be trading at a premium.

Nexen Tire (KOSE:A002350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexen Tire Corporation manufactures and sells tires both in South Korea and internationally, with a market cap of ₩639.56 billion.

Operations: The company's revenue segments include Tire at ₩4.38 trillion, Transport and Storage at ₩15.09 billion, and Industrial Machinery Production, Etc. at ₩5.70 billion.

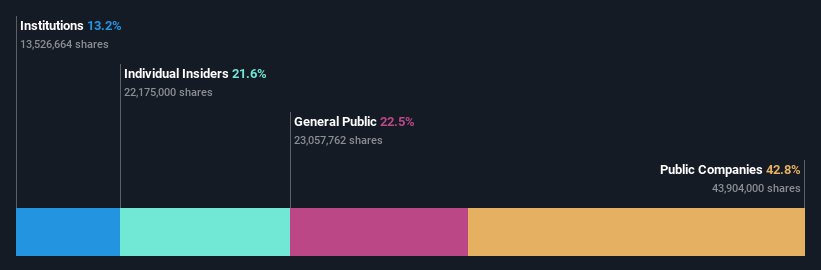

Insider Ownership: 21.6%

Nexen Tire is positioned for growth, with earnings projected to increase significantly at 35.2% annually, outpacing the Korean market's average. While trading at 75% below its estimated fair value suggests potential upside, interest payments are not well covered by earnings, indicating financial constraints. Despite a low forecasted return on equity of 9.5%, analysts agree on a potential stock price rise of 52.9%. Revenue growth is expected to be moderate at 7.1% annually.

- Click here and access our complete growth analysis report to understand the dynamics of Nexen Tire.

- Our comprehensive valuation report raises the possibility that Nexen Tire is priced lower than what may be justified by its financials.

IG Port (TSE:3791)

Simply Wall St Growth Rating: ★★★★☆☆

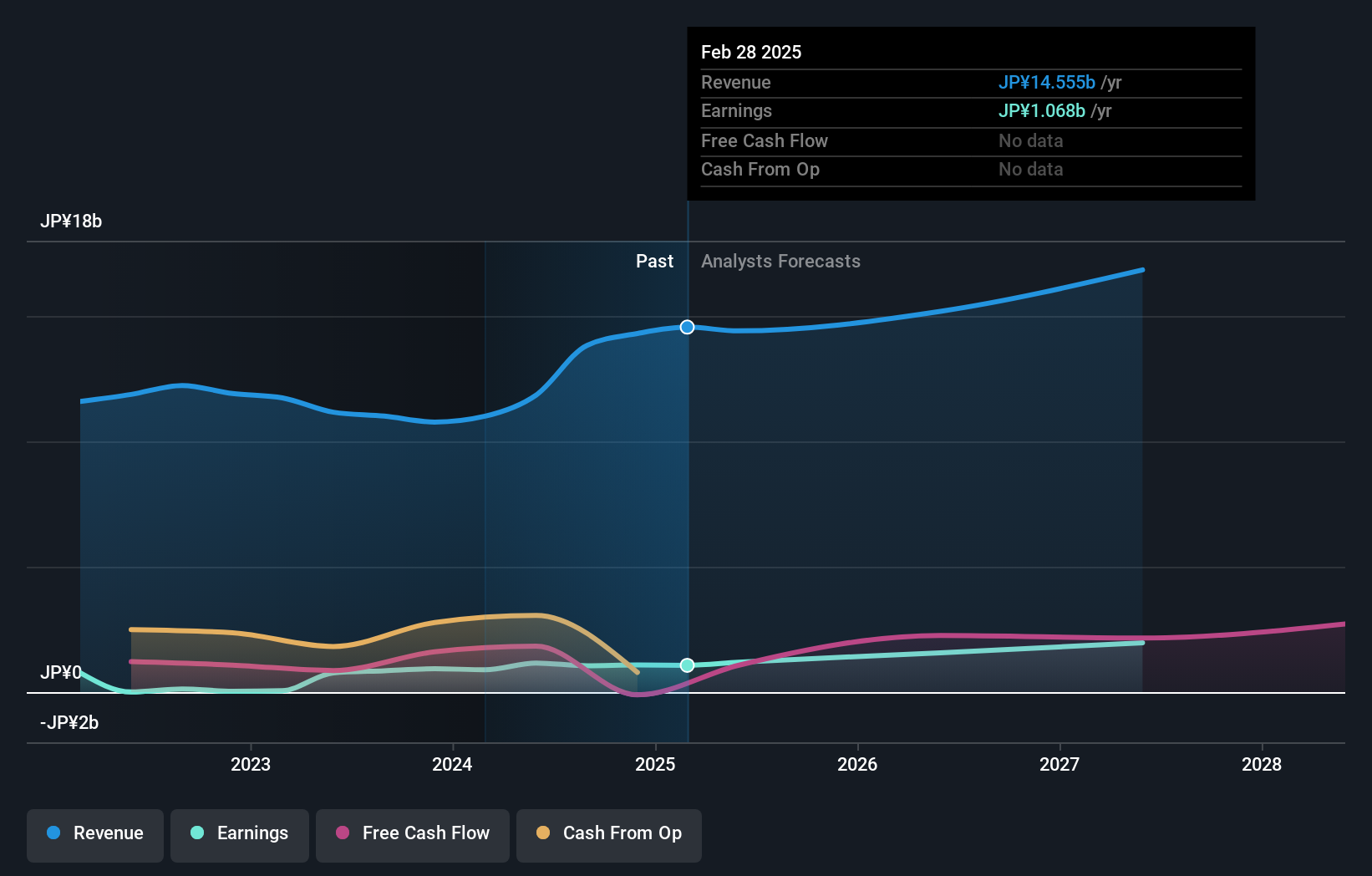

Overview: IG Port, Inc., with a market cap of ¥50.45 billion, is an animation production company that operates both in Japan and internationally through its subsidiaries.

Operations: Revenue Segments (in millions of ¥): Animation Production: ¥5,200; Licensing: ¥1,800; Publishing: ¥2,400.

Insider Ownership: 28.7%

IG Port is poised for growth, with earnings expected to rise significantly at 21.1% annually, surpassing the JP market's average growth rate. Despite a volatile share price recently and a forecasted low return on equity of 17.9%, its inclusion in the S&P Global BMI Index highlights its potential recognition in broader markets. Revenue is projected to grow at 7.9% annually, faster than the market average but below high-growth benchmarks.

- Take a closer look at IG Port's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that IG Port is priced higher than what may be justified by its financials.

Make It Happen

- Discover the full array of 1528 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eugene TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A084370

Eugene TechnologyLtd

Engages in the manufacture and sale of semiconductor equipment and parts in South Korea and internationally.

Flawless balance sheet with solid track record.