- Hong Kong

- /

- Consumer Services

- /

- SEHK:2373

3 Growth Stocks With High Insider Ownership And 25% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and growing enthusiasm for artificial intelligence, major indices like the S&P 500 have reached new record highs. In this environment, growth stocks with high insider ownership and impressive earnings growth stand out as potentially strong performers, offering a unique combination of internal confidence and financial momentum.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Beauty Farm Medical and Health Industry (SEHK:2373)

Simply Wall St Growth Rating: ★★★★★☆

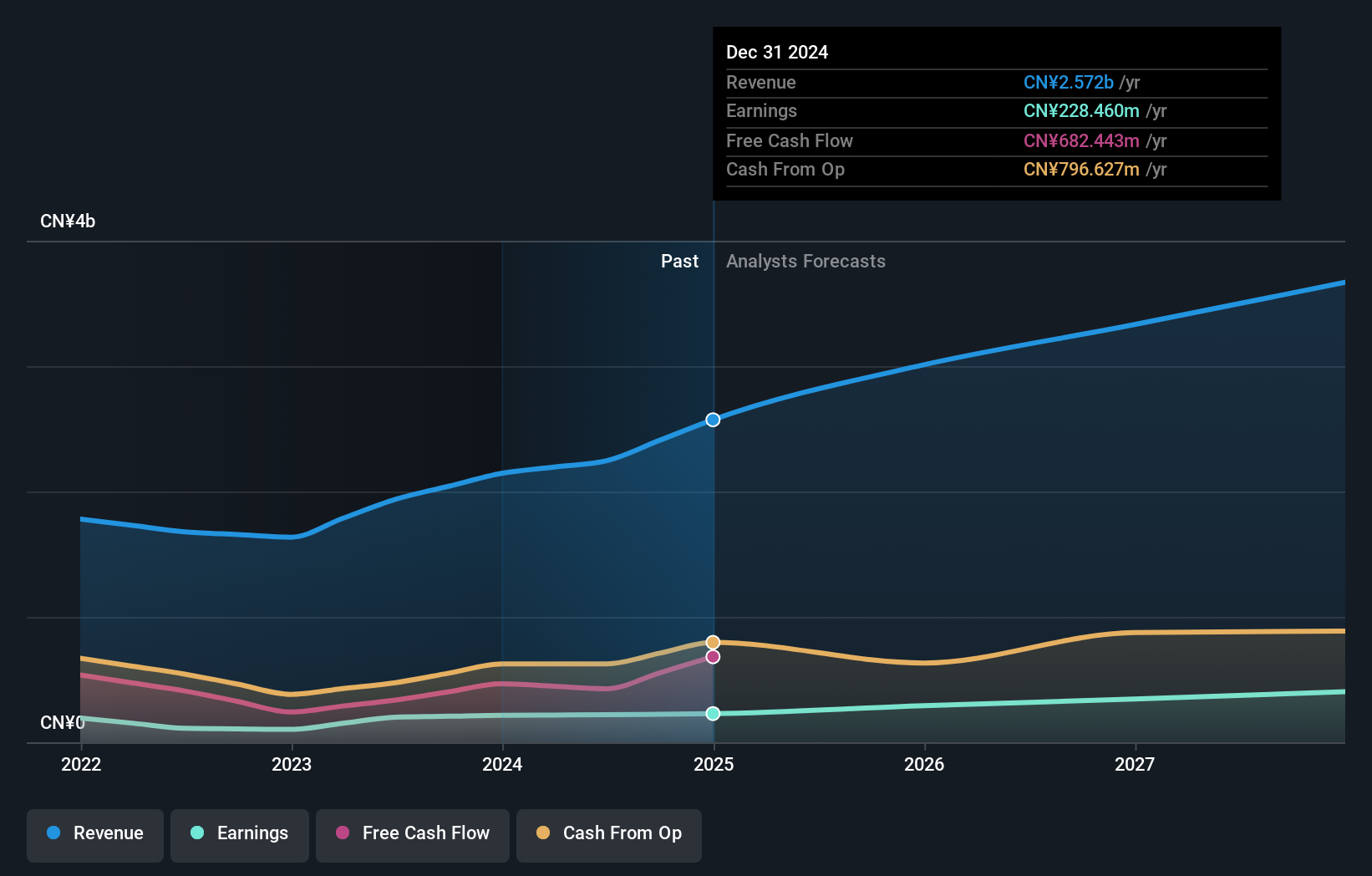

Overview: Beauty Farm Medical and Health Industry Inc. operates in the medical and health sector, focusing on beauty and wellness services, with a market cap of HK$4.45 billion.

Operations: The company's revenue segments include CN¥851.81 million from Aesthetic Medical Services, CN¥125.69 million from Subhealth Medical Services, CN¥1.14 billion from Beauty and Wellness Services - Direct Stores, and CN¥131.48 million from Beauty and Wellness Services - Franchisee and Others.

Insider Ownership: 33.9%

Earnings Growth Forecast: 20.2% p.a.

Beauty Farm Medical and Health Industry is trading at 58.7% below its estimated fair value, presenting a potential opportunity for investors. The company has shown earnings growth of 9.7% over the past year, with forecasts predicting significant annual earnings growth of 20.2% over the next three years, outpacing the Hong Kong market average of 11.2%. Revenue is also expected to grow at an impressive rate of 18.7% per year, exceeding market expectations.

- Unlock comprehensive insights into our analysis of Beauty Farm Medical and Health Industry stock in this growth report.

- Upon reviewing our latest valuation report, Beauty Farm Medical and Health Industry's share price might be too optimistic.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

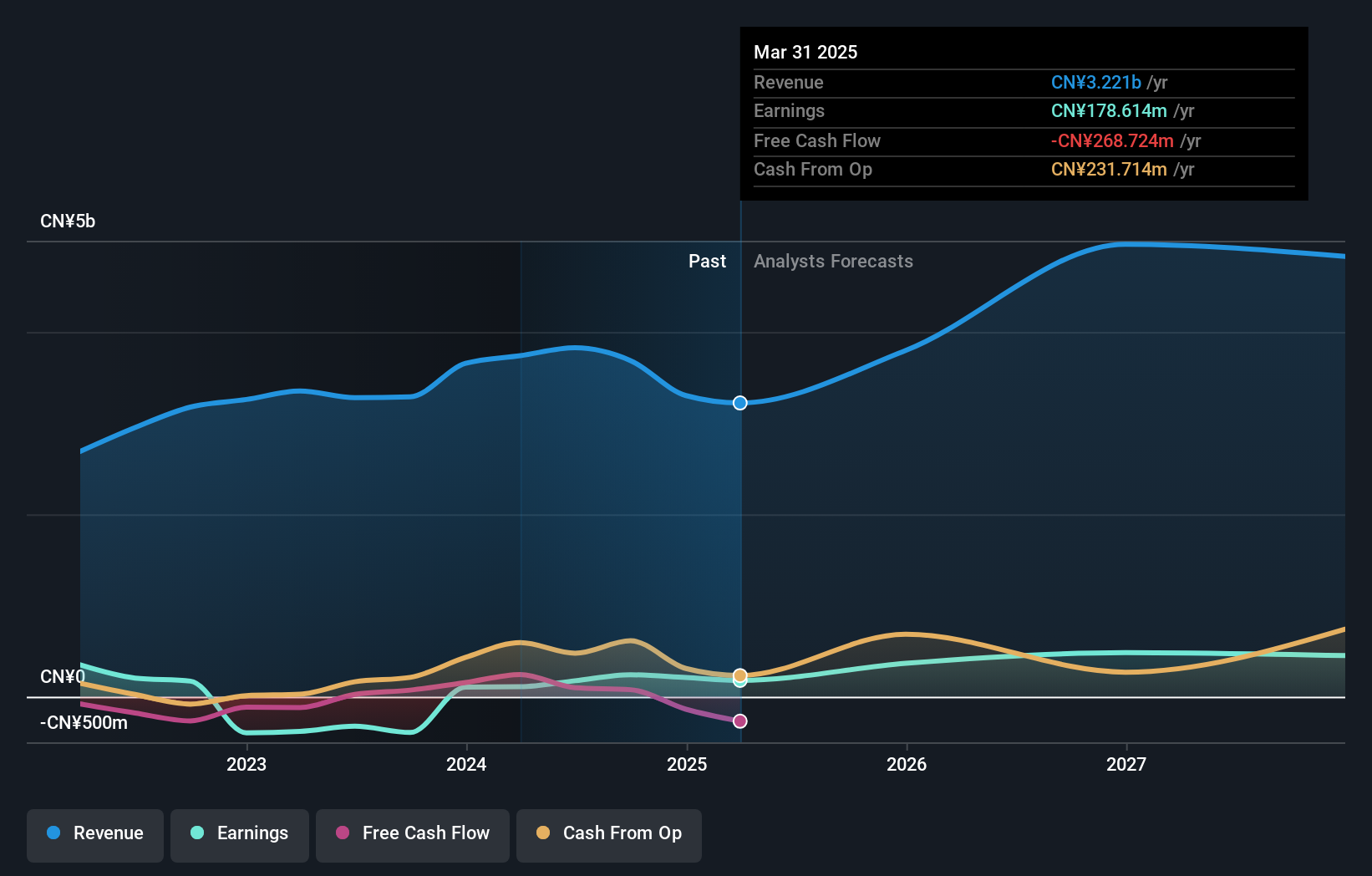

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both in China and internationally, with a market cap of CN¥7.65 billion.

Operations: Wuxi Boton Technology Co., Ltd. generates revenue from its operations in the industrial bulk material handling and mobile Internet sectors across domestic and international markets.

Insider Ownership: 21.9%

Earnings Growth Forecast: 25.1% p.a.

Wuxi Boton Technology's recent earnings report shows significant improvement, with net income rising to CNY 237.7 million from CNY 103.42 million the previous year. The company's earnings are forecast to grow at 25.1% annually, surpassing the Chinese market average of 25%. Despite trading at a substantial discount to its estimated fair value, concerns include a low projected return on equity and large one-off items affecting financial results.

- Delve into the full analysis future growth report here for a deeper understanding of Wuxi Boton Technology.

- Our valuation report unveils the possibility Wuxi Boton Technology's shares may be trading at a discount.

IG Port (TSE:3791)

Simply Wall St Growth Rating: ★★★★☆☆

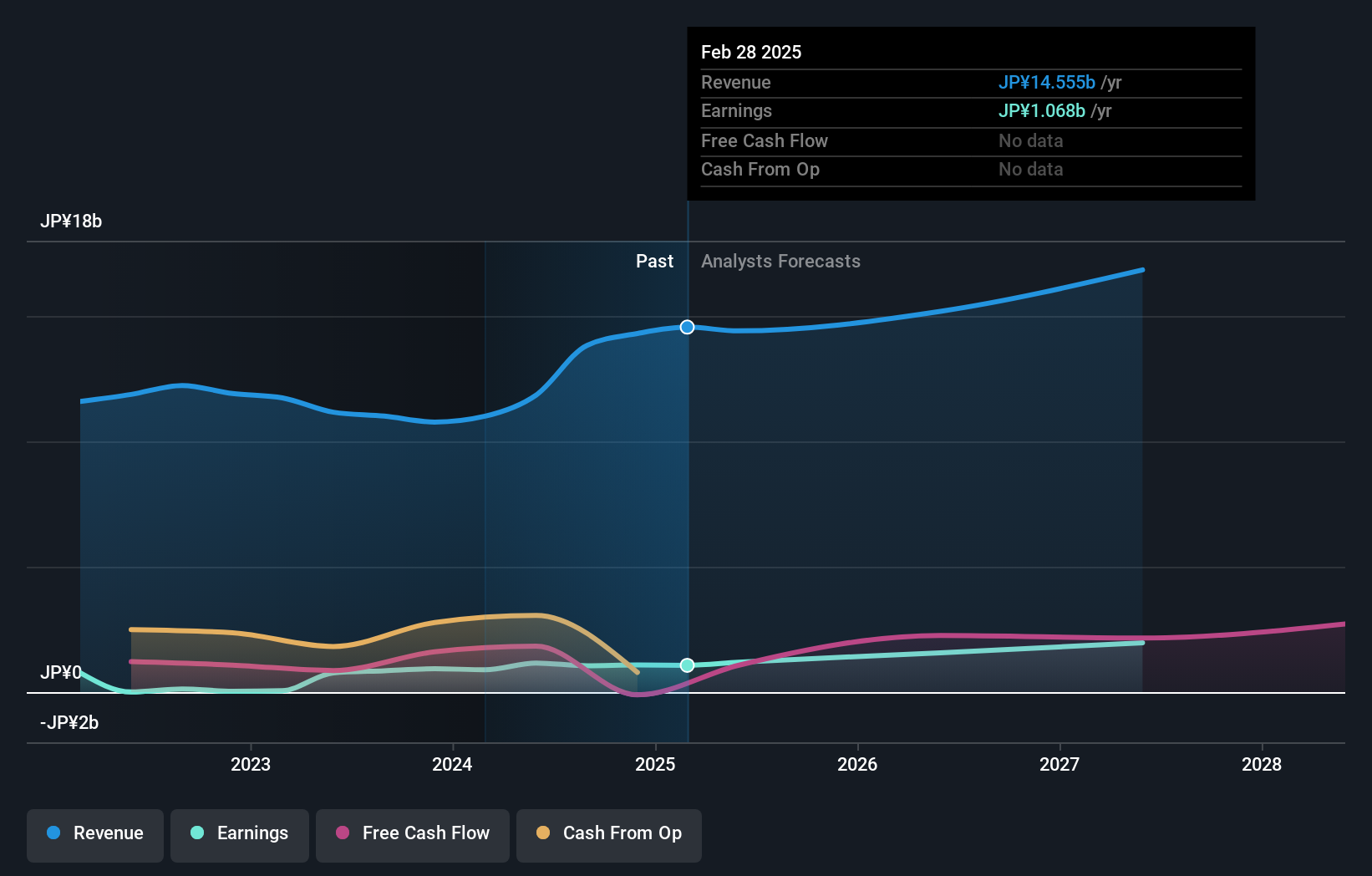

Overview: IG Port, Inc. is an animation production company that operates both in Japan and internationally, with a market capitalization of ¥42.11 billion.

Operations: The company's revenue segments include animation production at ¥3.45 billion, publishing at ¥2.78 billion, and licensing at ¥1.12 billion.

Insider Ownership: 27.8%

Earnings Growth Forecast: 25% p.a.

IG Port's earnings are projected to grow at 25% annually, outpacing the JP market's 8.1% growth rate, while revenue is expected to increase by 7.3%. Despite a highly volatile share price recently and no substantial insider trading activity reported over the past three months, the stock trades at a significant discount to its estimated fair value. However, concerns include a forecasted low return on equity of 18.7% in three years and high non-cash earnings levels.

- Navigate through the intricacies of IG Port with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of IG Port shares in the market.

Summing It All Up

- Click this link to deep-dive into the 1473 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beauty Farm Medical and Health Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2373

Beauty Farm Medical and Health Industry

Beauty Farm Medical and Health Industry Inc.

High growth potential with proven track record.

Market Insights

Community Narratives