- Japan

- /

- Entertainment

- /

- TSE:3672

AltPlus Inc. (TSE:3672) Looks Inexpensive After Falling 35% But Perhaps Not Attractive Enough

AltPlus Inc. (TSE:3672) shareholders that were waiting for something to happen have been dealt a blow with a 35% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

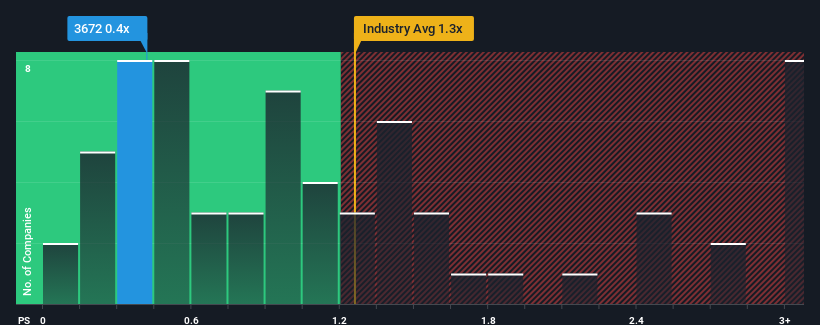

Following the heavy fall in price, when close to half the companies operating in Japan's Entertainment industry have price-to-sales ratios (or "P/S") above 1.3x, you may consider AltPlus as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for AltPlus

How AltPlus Has Been Performing

For instance, AltPlus' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for AltPlus, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AltPlus' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 46% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 2.2% over the next year, or less than the company's recent medium-term annualised revenue decline.

In light of this, it's understandable that AltPlus' P/S sits below the majority of other companies. However, when revenue shrink rapidly P/S often shrinks too, which could set up shareholders for future disappointment regardless. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

The Final Word

The southerly movements of AltPlus' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear that AltPlus trades at a low P/S relative to the wider industry on the weakness of its recent three-year revenue being even worse than the forecasts for a struggling industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for AltPlus (1 is a bit unpleasant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3672

AltPlus

Engages in the planning, development, and operation of social games.

Flawless balance sheet slight.

Market Insights

Community Narratives