- Japan

- /

- Entertainment

- /

- TSE:3659

Does NEXON’s 43% Rally Reflect True Value After Global Partnerships News?

Reviewed by Bailey Pemberton

- Wondering if NEXON is a hidden bargain or already priced for perfection? You're not alone, especially with so much buzz around uncovering value in today's market.

- After climbing 8.4% in the last week and delivering a strong 43.1% year-to-date return, NEXON's share price has certainly grabbed attention. This performance has also shifted the conversation on growth expectations and risk.

- Recent headlines highlight NEXON's bold steps into new game launches and strategic global partnerships. These moves are widely seen as fueling optimism among investors and amplifying market excitement. This news helps put the latest stock price momentum in context, suggesting the company is actively shaping its future rather than sitting on its hands.

- Currently, NEXON scores 2 out of 6 on our value checks, which means only some valuation marks are in its favor. We'll break down those numbers next, share how traditional valuation tools stack up, and reveal a fresh perspective on finding true value by the end of the article.

NEXON scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NEXON Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is designed to estimate a company’s value by projecting future cash flows and discounting them back to today. This gives investors an idea of the business’s intrinsic worth based on expected cash generation.

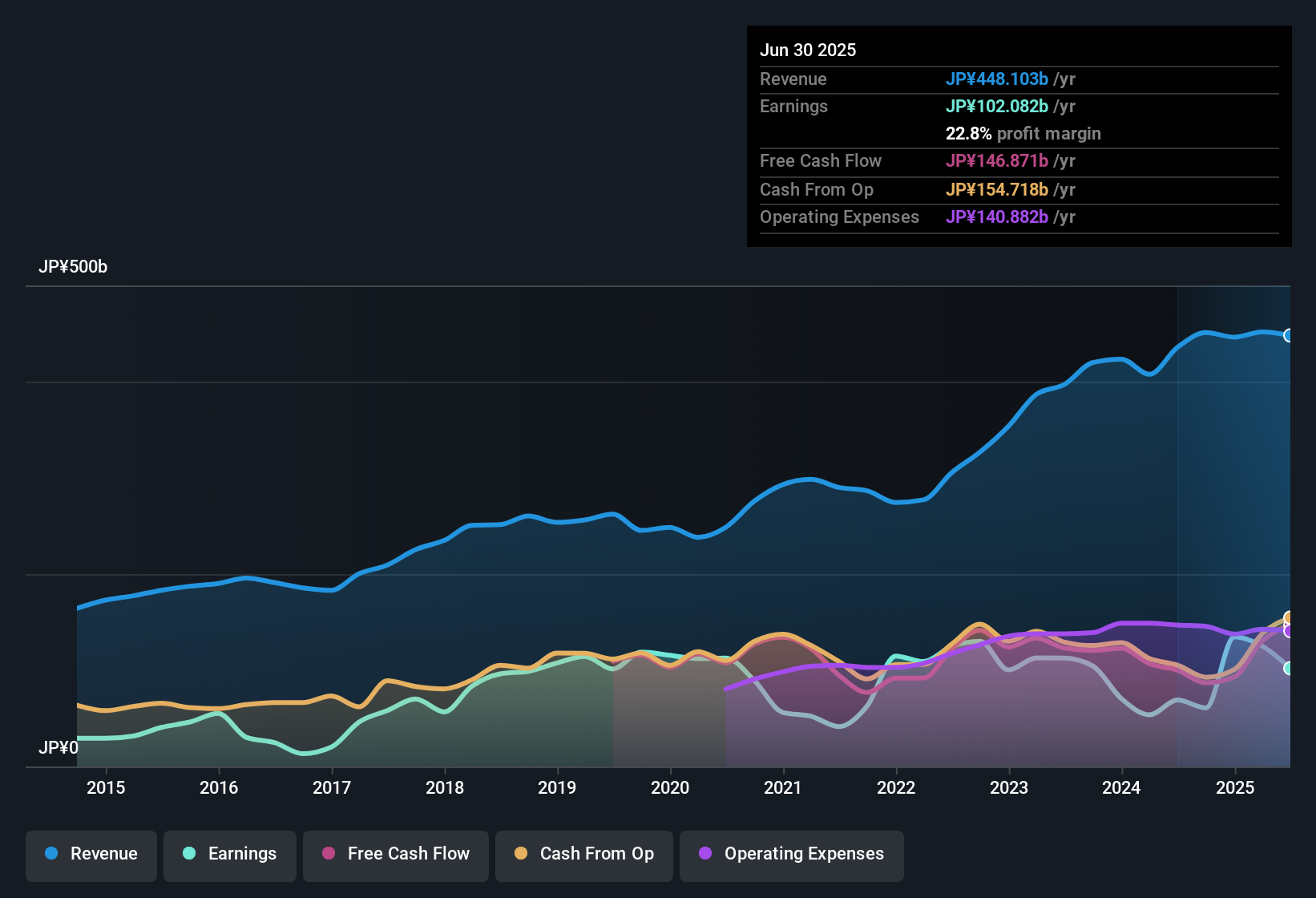

For NEXON, the DCF model used is a 2 Stage Free Cash Flow to Equity approach. The company’s latest reported Free Cash Flow stands at ¥147,918 million. Analysts have forecasted that free cash flows will average around ¥117,279 million by 2027. After this analyst window, projections are derived by extrapolating from existing trends, with ten-year forecasts suggesting free cash flows gently decreasing year by year. For example, by 2035, projected FCF is about ¥95,918 million.

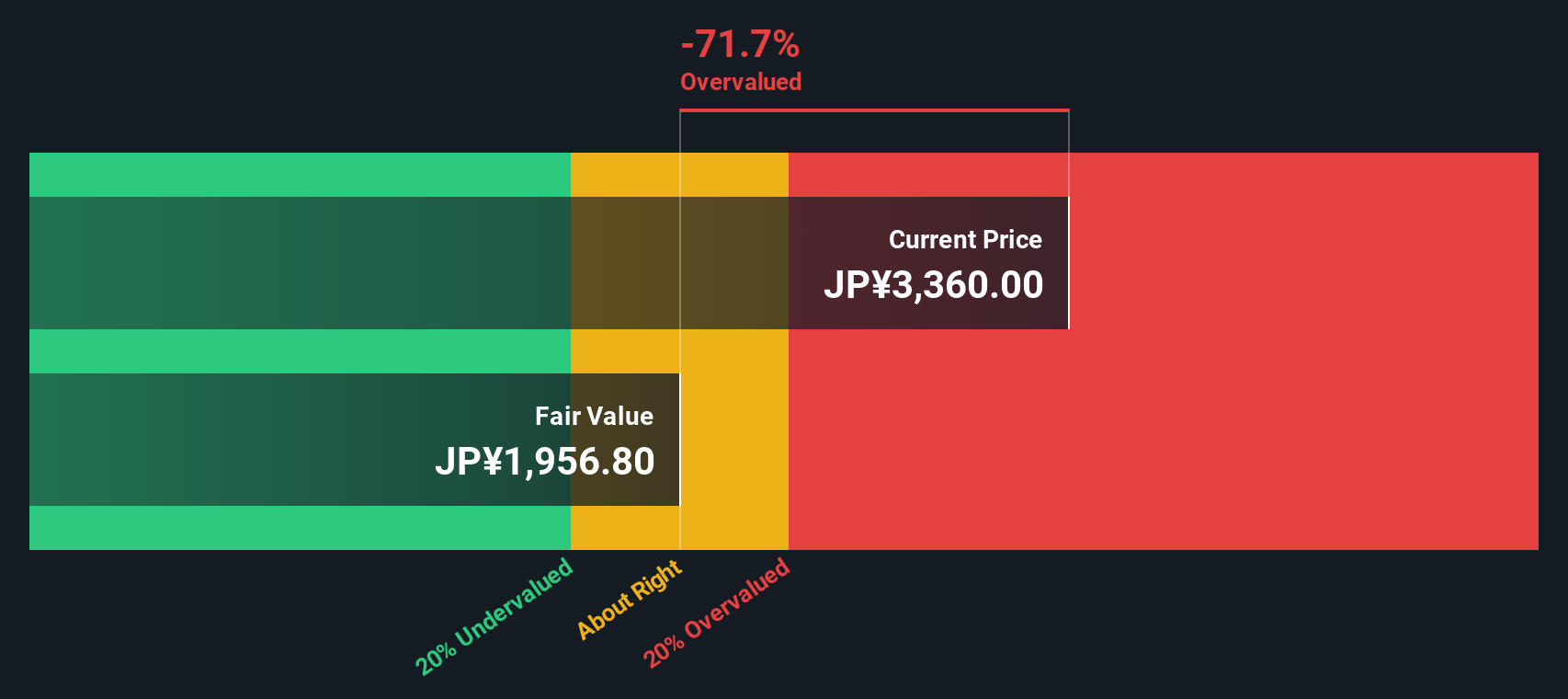

Considering these future cash flows and discounting them accordingly, the DCF model produces an estimated fair value per share of ¥1,864. However, given NEXON's current market price, this implies the stock is trading at a 76.2% premium to its intrinsic value, suggesting NEXON is significantly overvalued using this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NEXON may be overvalued by 76.2%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NEXON Price vs Earnings (P/E)

For established and profitable companies like NEXON, the Price-to-Earnings (P/E) ratio is a well-recognized measure of value. It tells investors how much they are paying for each yen of earnings, making it especially useful when the company has a consistent profit track record.

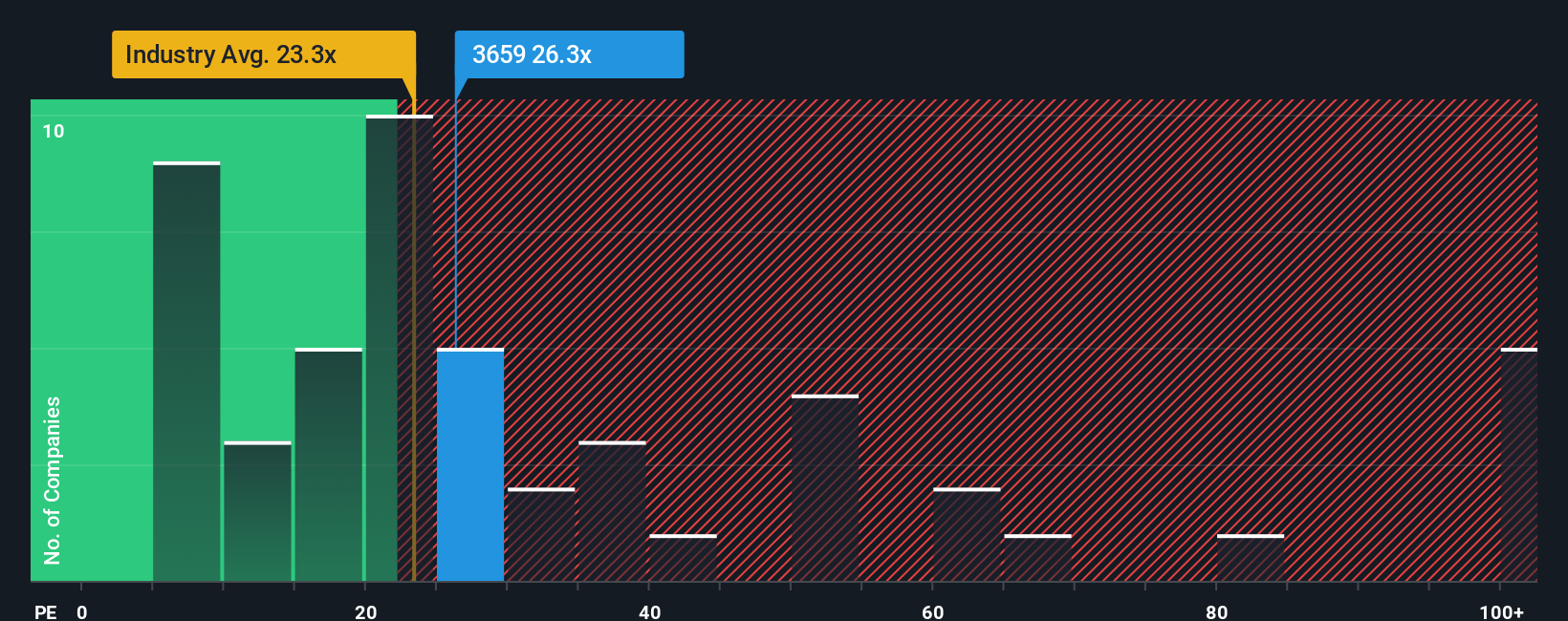

Interpreting P/E ratios depends on growth expectations and risk profiles. Typically, high-growth companies or those with strong competitive advantages command higher P/E multiples, while riskier or slower-growing firms trade at lower ratios. When looking at NEXON, its current P/E ratio stands at 25x.

This figure puts NEXON above the Entertainment industry average of 22.7x, but still well below the peer average of 36.7x. To dig deeper, Simply Wall St introduces the “Fair Ratio,” a proprietary benchmark that blends growth and industry averages as well as NEXON’s profit margin, risk level, market cap, and sector trends. For NEXON, the Fair Ratio is 32.1x.

Unlike standard comparisons with peers or the broader industry, the Fair Ratio offers a more tailored indicator of what investors should reasonably pay for NEXON shares today. It factors in all the essential variables that matter when determining the appropriate valuation multiple for this specific business.

Comparing NEXON’s actual P/E of 25x to its Fair Ratio of 32.1x suggests that, by this measure, the stock is undervalued and potentially offering a margin of safety for investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NEXON Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your investment story behind a company, which provides a simple way to connect your perspective on NEXON’s potential (such as estimates of future revenue, profits, and margins) to a financial forecast and a fair value, all in one place. Narratives on Simply Wall St’s Community page let millions of investors link the latest facts, industry trends, and their own beliefs with the numbers. This allows you to clearly see how your view compares to the market or other investors.

Narratives make it easy to decide when to buy or sell by comparing your calculated Fair Value with the current share price, and they automatically update when new information, like earnings or news, becomes available. For example, some investors now see NEXON’s fair value as high as ¥3,700, factoring in robust new releases and global expansion. Others take a more cautious view at ¥1,900, emphasizing heavy reliance on legacy games and rising costs.

With Narratives, you can build, test, and refine your investment thinking as NEXON’s story evolves, helping you make smarter and more confident portfolio decisions.

Do you think there's more to the story for NEXON? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NEXON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3659

NEXON

Produces, develops, distributes, and services PC online and mobile games in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion