- Japan

- /

- Interactive Media and Services

- /

- TSE:2371

Exploring High Growth Tech Stocks Including Three Promising Picks

Reviewed by Simply Wall St

In a week marked by economic turbulence and cautious earnings reports, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 hit record highs before retreating, highlighting the volatility that has characterized recent trading. Despite this backdrop, small-cap stocks have shown resilience compared to their larger counterparts, presenting opportunities for investors seeking high-growth potential in technology sectors. In such an environment, identifying promising tech stocks involves looking for companies with strong fundamentals and innovative capabilities that can thrive amid macroeconomic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sharetronic Data Technology Co., Ltd. is a global solution provider specializing in wireless networks and smart terminals, with a market cap of CN¥22.51 billion.

Operations: The company focuses on providing solutions in wireless networks and smart terminals globally. It generates revenue primarily through its specialized technology offerings, contributing to its market capitalization of CN¥22.51 billion.

Sharetronic Data Technology has demonstrated robust financial growth with a notable increase in sales to CNY 5.39 billion, up from CNY 3.23 billion the previous year, and a surge in net income to CNY 557.03 million from CNY 195.82 million. This performance is underpinned by a strategic focus on R&D, investing significantly to innovate and stay competitive within the tech sector. The company's commitment to research has positioned it well for sustained growth, reflected in its earnings forecast of an annual increase of 29.1%. Moreover, with revenue expected to grow at 22.8% annually, Sharetronic is outpacing market averages, indicating strong future prospects despite its highly volatile share price over recent months.

- Delve into the full analysis health report here for a deeper understanding of Sharetronic Data Technology.

Gain insights into Sharetronic Data Technology's past trends and performance with our Past report.

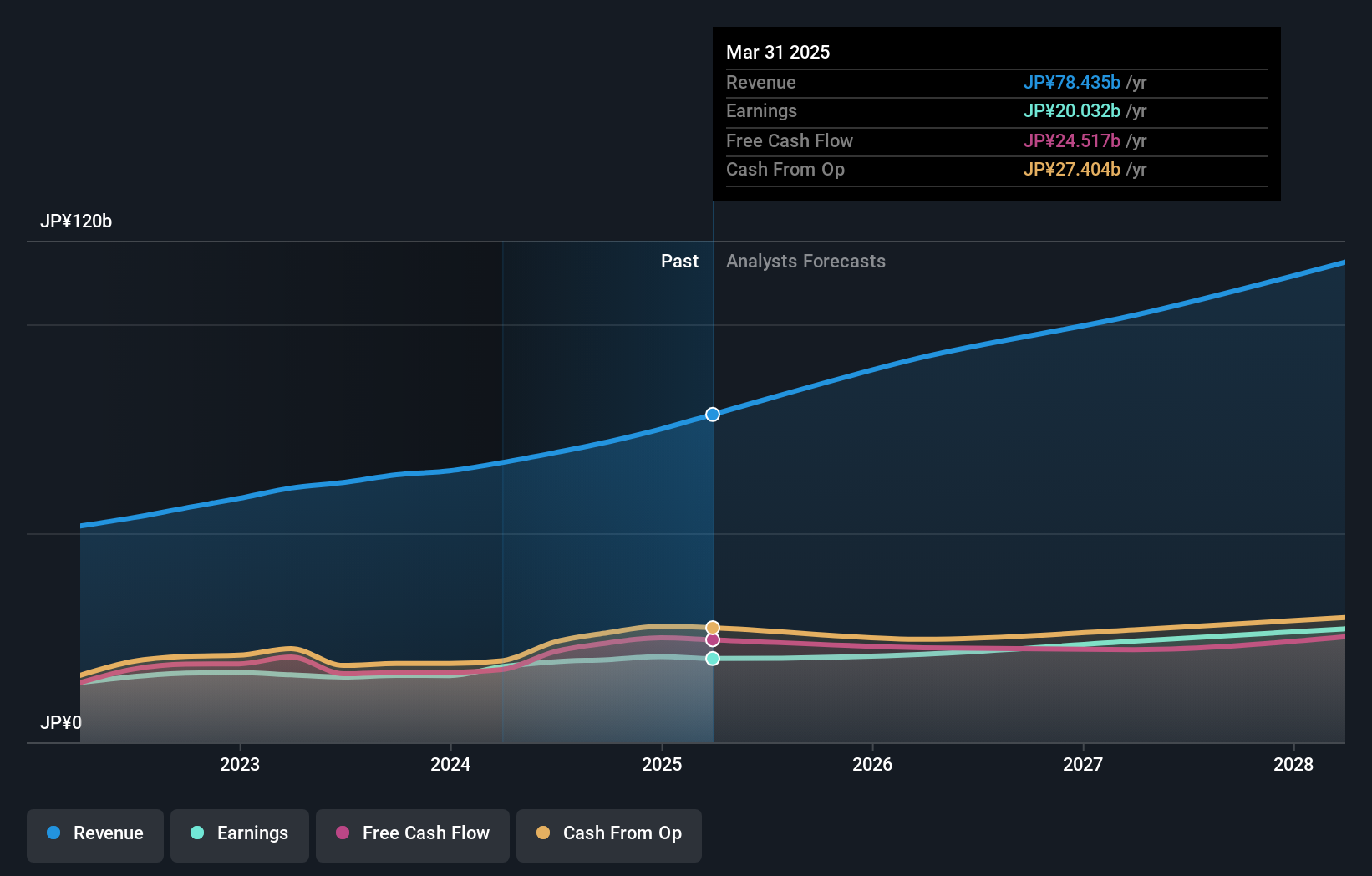

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan and has a market cap of approximately ¥489.49 billion.

Operations: Kakaku.com generates revenue primarily through its purchase support and restaurant review services in Japan. The company focuses on leveraging its online platforms to connect consumers with products and dining options, which contributes significantly to its financial performance.

Kakaku.com has demonstrated a solid trajectory in the competitive landscape of tech, with its revenue forecast to expand by 9.2% annually, outpacing the Japanese market's growth of 4.2%. This growth is supported by a robust R&D investment strategy, which not only fuels innovation but also enhances its service offerings in interactive media and services—a sector where it has already surpassed industry earnings growth over the past year by 23.5%. Despite this performance, earnings are expected to grow at a more modest rate of 10% per year, slightly above the market average of 8.9%, indicating careful balancing between expansion and profitability. The company’s strategic focus on evolving its technological capabilities while maintaining strong market relevance underscores its potential for sustained advancement in a rapidly shifting digital environment.

- Navigate through the intricacies of Kakaku.com with our comprehensive health report here.

Evaluate Kakaku.com's historical performance by accessing our past performance report.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. is a company that offers cloud-based subscription software solutions for supply chain operations across the United States, Europe, Asia, and Canada, with a market capitalization of CA$4.81 billion.

Operations: Kinaxis generates revenue primarily from its software and programming segment, amounting to $471.17 million. The company focuses on providing cloud-based solutions for supply chain management across various regions, including the United States, Europe, Asia, and Canada.

Kinaxis, a leader in supply chain management software, is reinforcing its market position through strategic client acquisitions and innovative partnerships. With recent announcements like the adoption by Stanley 1913 and co-development with ExxonMobil, Kinaxis is set to enhance operational efficiencies across diverse industries. The company's commitment to R&D is evident from its increased spending which supports continuous innovation—critical in maintaining competitive advantage. Moreover, Kinaxis' recent earnings report shows a robust 42.8% forecasted annual profit growth and a steady revenue increase at 12.9% per year, underscoring its financial health amidst aggressive market expansion strategies. This trajectory is complemented by a share repurchase program that underscores confidence in its long-term value proposition, further solidifying Kinaxis as a formidable entity in tech-driven supply chain solutions.

- Unlock comprehensive insights into our analysis of Kinaxis stock in this health report.

Review our historical performance report to gain insights into Kinaxis''s past performance.

Taking Advantage

- Embark on your investment journey to our 1287 High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kakaku.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2371

Kakaku.com

Engages in the provision of purchase support, restaurant review, and other services in Japan.

Very undervalued with outstanding track record and pays a dividend.