- Hong Kong

- /

- Life Sciences

- /

- SEHK:1548

Asian Market Insights: 3 Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Share

As global markets grapple with inflation concerns and trade uncertainties, the Asian market presents a unique landscape where opportunities for investment can still be found. In this environment, identifying stocks that are potentially undervalued compared to their intrinsic value becomes crucial for investors seeking to navigate the complexities of current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Kexin Mechanical and Electrical EquipmentLtd (SZSE:300092) | CN¥13.07 | CN¥25.75 | 49.2% |

| CS Wind (KOSE:A112610) | ₩38100.00 | ₩75868.66 | 49.8% |

| Cosmax (KOSE:A192820) | ₩179900.00 | ₩356090.86 | 49.5% |

| S Foods (TSE:2292) | ¥2586.00 | ¥5084.09 | 49.1% |

| Takara Bio (TSE:4974) | ¥853.00 | ¥1696.74 | 49.7% |

| APAC Realty (SGX:CLN) | SGD0.43 | SGD0.85 | 49.6% |

| JSHLtd (TSE:150A) | ¥558.00 | ¥1106.93 | 49.6% |

| Sunny Optical Technology (Group) (SEHK:2382) | HK$88.50 | HK$175.51 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1120.00 | ¥2205.09 | 49.2% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16000.00 | ₩31633.38 | 49.4% |

We'll examine a selection from our screener results.

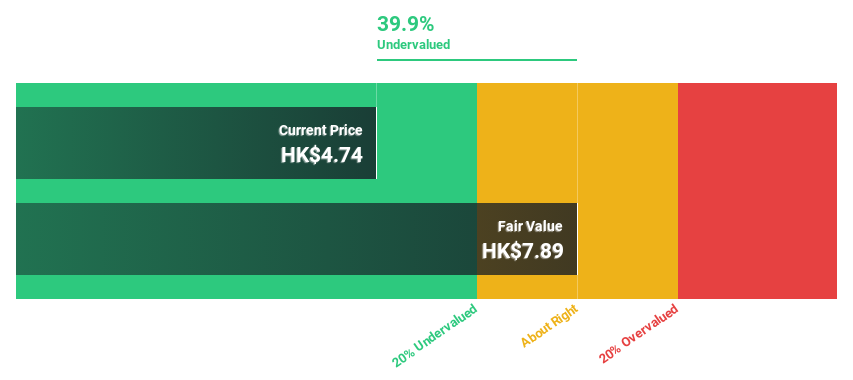

Genscript Biotech (SEHK:1548)

Overview: Genscript Biotech Corporation is an investment holding company that manufactures and sells life science research products and services globally, with a market cap of approximately HK$28.56 billion.

Operations: The company's revenue is primarily derived from Life Science Services and Products at $454.95 million, followed by Biologics Development Services at $95.02 million, Industrial Synthetic Biology Products at $53.69 million, and Operation Unit activities contributing $56.89 million.

Estimated Discount To Fair Value: 34.6%

Genscript Biotech is trading significantly below its estimated fair value, with a current price of HK$13.3 compared to an estimated fair value of HK$20.33, suggesting potential undervaluation based on cash flows. The company reported substantial net income growth for 2024, indicating improved financial health and profitability prospects over the next three years. Despite slower revenue growth forecasts than 20% annually, it still surpasses the Hong Kong market average, highlighting its competitive edge in revenue generation.

- Our comprehensive growth report raises the possibility that Genscript Biotech is poised for substantial financial growth.

- Get an in-depth perspective on Genscript Biotech's balance sheet by reading our health report here.

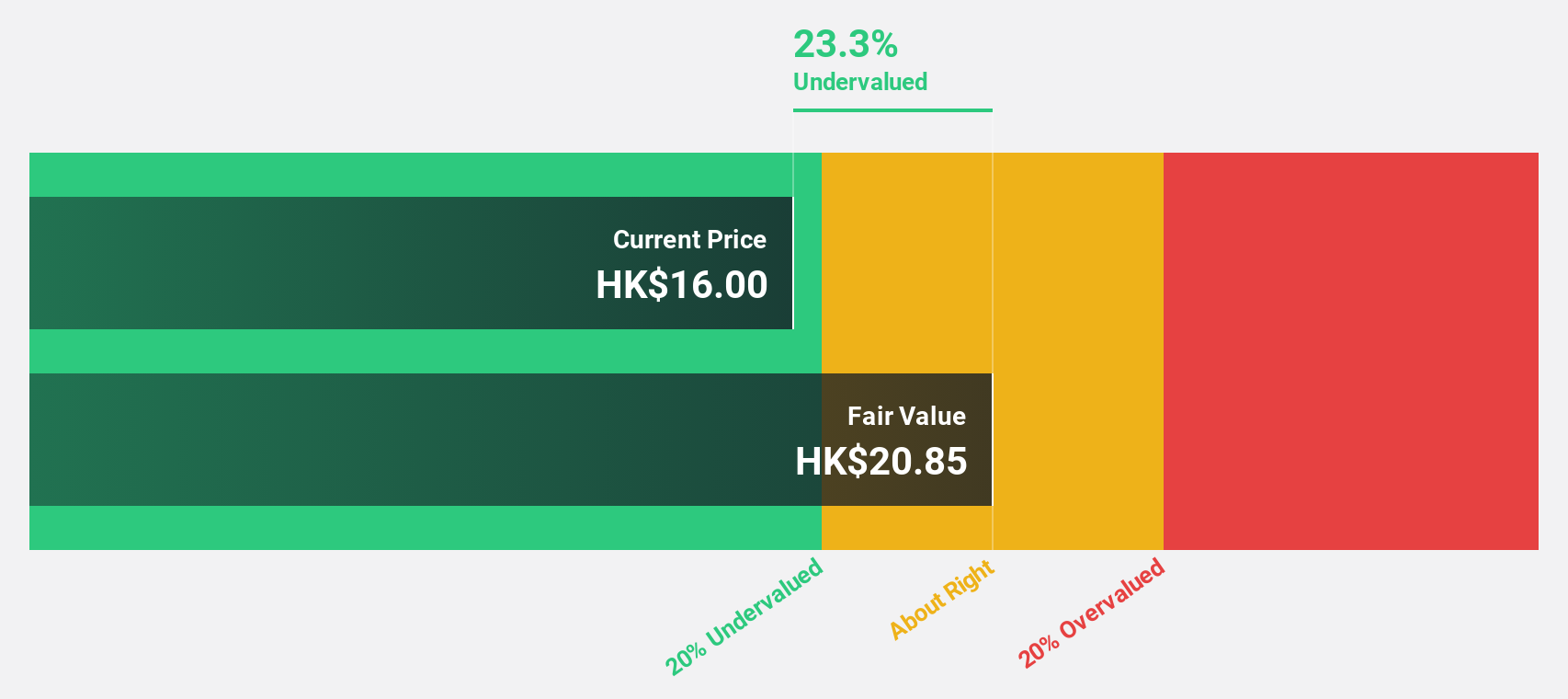

Newborn Town (SEHK:9911)

Overview: Newborn Town Inc. is an investment holding company that operates in the social networking sector globally, with a market capitalization of HK$9.26 billion.

Operations: The company's revenue is primarily derived from its Social Networking Business, which generated CN¥3.80 billion, along with an Innovative Business segment contributing CN¥406.28 million.

Estimated Discount To Fair Value: 10.2%

Newborn Town, trading at HK$6.56, is slightly below its estimated fair value of HK$7.3, reflecting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 22.4% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.5%. Recent guidance indicates robust revenue growth driven by social networking expansion and innovative business ventures, though past shareholder dilution could be a concern for investors.

- The analysis detailed in our Newborn Town growth report hints at robust future financial performance.

- Dive into the specifics of Newborn Town here with our thorough financial health report.

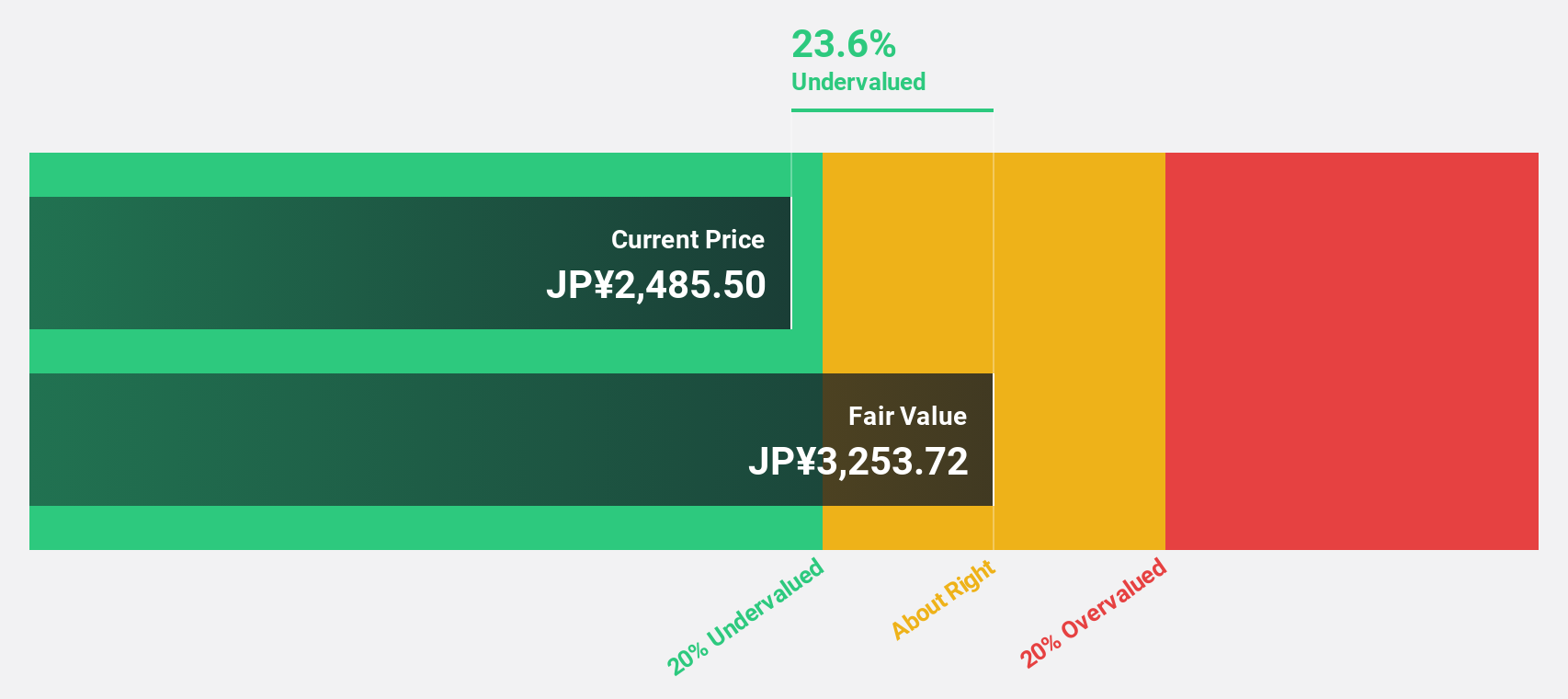

Kakaku.com (TSE:2371)

Overview: Kakaku.com, Inc., along with its subsidiaries, provides purchase support and restaurant review services in Japan, with a market cap of ¥449.54 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through purchase support and restaurant review services in Japan.

Estimated Discount To Fair Value: 18.9%

Kakaku.com, trading at ¥2273.5, is undervalued relative to its estimated fair value of ¥2803.71 based on cash flows. Earnings are projected to grow at 9.82% annually, outpacing the Japanese market's 8% growth rate, with revenue also expected to rise faster than the market average. The company pays a reliable dividend of 2.64% and recently announced a special dividend of ¥30 per share for fiscal year-end March 2025 amidst ongoing board-level organizational changes and strategic acquisitions.

- Insights from our recent growth report point to a promising forecast for Kakaku.com's business outlook.

- Click to explore a detailed breakdown of our findings in Kakaku.com's balance sheet health report.

Summing It All Up

- Access the full spectrum of 276 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Genscript Biotech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1548

Genscript Biotech

An investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, the People’s Republic of China, Japan, the other Asia Pacific regions, and internationally.

Reasonable growth potential with adequate balance sheet.