- Japan

- /

- Consumer Services

- /

- TSE:2749

Discovering Undiscovered Gems on None in November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of policy shifts under the new U.S. administration and fluctuating economic indicators, investors are increasingly focused on the performance of small-cap stocks, particularly those within indices like the S&P 600. Amidst this backdrop, identifying promising small-cap companies that exhibit strong fundamentals and resilience can offer unique opportunities for growth in a challenging market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tohokushinsha Film (TSE:2329)

Simply Wall St Value Rating: ★★★★★★

Overview: Tohokushinsha Film Corporation is a Japanese media company with operations spanning media, properties, content production, and advertising production, and has a market capitalization of ¥77.18 billion.

Operations: The company generates revenue primarily from advertising production (¥28.09 billion) and content production (¥11.21 billion). Media and properties contribute smaller portions, with ¥7.80 billion and ¥2.18 billion respectively.

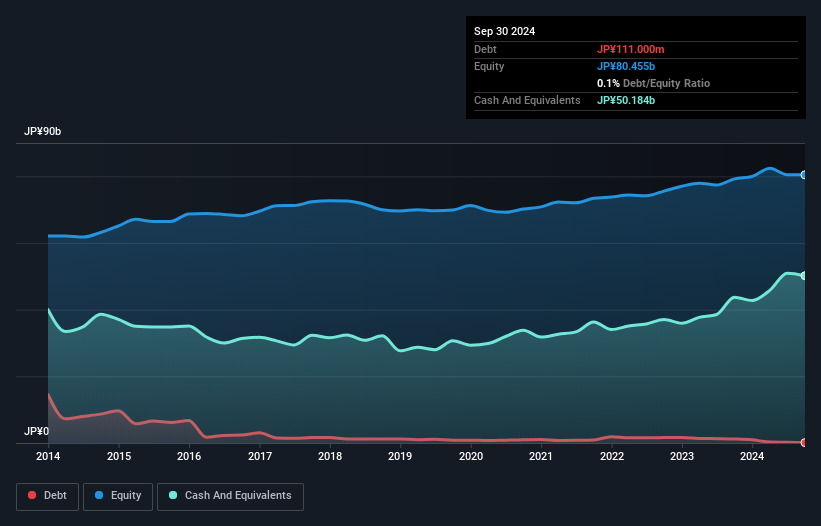

Tohokushinsha Film stands out with its robust financial health, boasting a debt-to-equity ratio reduction from 1.2% to 0.1% over five years, and earnings growth of 36.6% last year, outperforming the industry average of -6.7%. The company enjoys a favorable price-to-earnings ratio of 18.4x compared to the sector's average of 27.3x, indicating potential undervaluation in the entertainment space. However, recent dividend adjustments from ¥19 to ¥6.67 per share suggest caution in cash distribution strategies despite positive free cash flow and profitability indicators amidst volatile share prices recently observed.

- Click to explore a detailed breakdown of our findings in Tohokushinsha Film's health report.

Assess Tohokushinsha Film's past performance with our detailed historical performance reports.

Jp-HoldingsInc (TSE:2749)

Simply Wall St Value Rating: ★★★★★★

Overview: Jp-Holdings, Inc. operates by providing nursery services in Japan and has a market capitalization of approximately ¥55.48 billion.

Operations: Jp-Holdings, Inc. generates revenue primarily through its nursery services in Japan. The company's financial performance can be assessed by examining key metrics such as net profit margin, which provides insight into its profitability after accounting for all expenses.

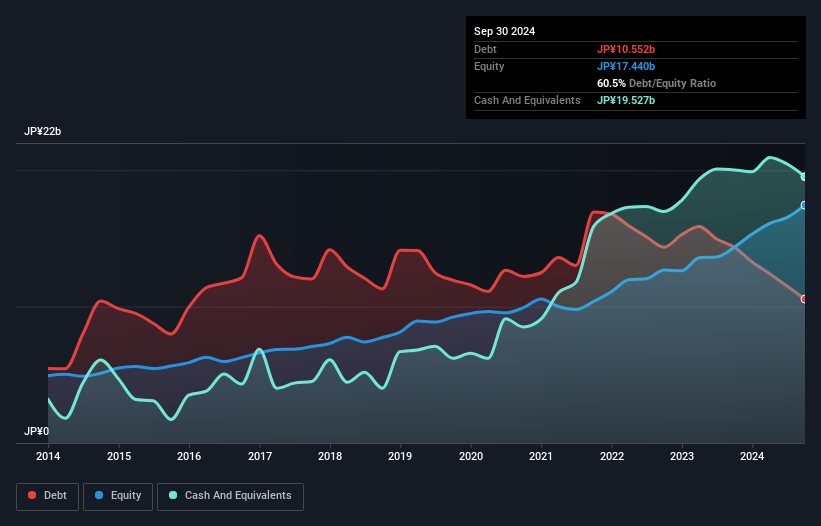

Jp-Holdings Inc. has demonstrated notable financial resilience, with its debt to equity ratio decreasing from 141% to 69.5% over the last five years, indicating a stronger balance sheet position. The company's earnings growth of 22.8% in the past year outpaced the Consumer Services industry average of 10.4%, showcasing robust performance amidst sectoral challenges. Despite recent share price volatility, Jp-Holdings trades at a compelling valuation—54.4% below estimated fair value—which might appeal to investors seeking undervalued opportunities in this space. With high-quality earnings and sufficient cash coverage for interest payments, it seems well-positioned for future growth prospects.

gremzInc (TSE:3150)

Simply Wall St Value Rating: ★★★★★★

Overview: gremz, Inc. operates in Japan providing energy cost solutions, smart house services, and electricity retailing with a market capitalization of ¥60.04 billion.

Operations: The company generates revenue through energy cost solutions, smart house services, and electricity retailing in Japan. It has a market capitalization of ¥60.04 billion.

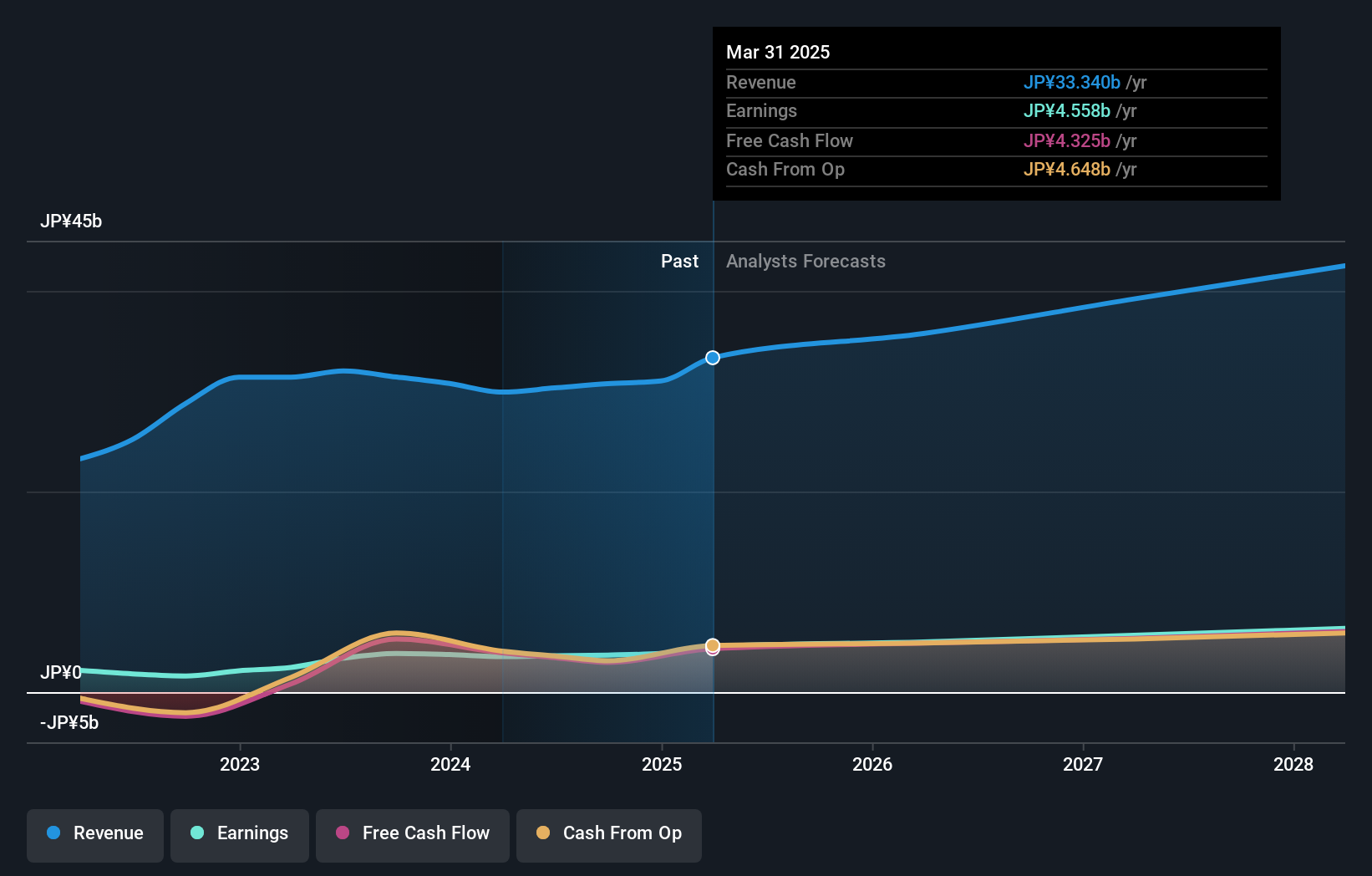

This company, with a promising profile in its sector, has seen its debt to equity ratio slightly improve from 27.6% to 27.2% over five years, reflecting prudent financial management. Despite a modest earnings growth of 0.9% last year compared to the industry’s 9.1%, it boasts high-quality earnings and trades at an attractive valuation—69.5% below estimated fair value. The firm is free cash flow positive and anticipates earnings growth of 21.47% annually moving forward, while recent dividend increases signal confidence in sustained profitability, with payouts set at JPY 20 per share this quarter and JPY 37 for the fiscal year ending March 2025.

- Delve into the full analysis health report here for a deeper understanding of gremzInc.

Gain insights into gremzInc's historical performance by reviewing our past performance report.

Where To Now?

- Embark on your investment journey to our 4627 Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2749

Flawless balance sheet and undervalued.