- Japan

- /

- Entertainment

- /

- TSE:2121

Undiscovered Gems And 2 Other Hidden Stocks With Strong Potential

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. stock indexes nearing record highs and growth stocks outperforming value shares, small-cap stocks have lagged behind their larger counterparts, as evidenced by the Russell 2000 Index's recent performance. In this environment of heightened inflation expectations and cautious monetary policy outlooks, identifying undiscovered gems in the small-cap space can offer unique opportunities for investors seeking potential growth. A good stock in this context often combines strong fundamentals with strategic positioning in a market segment that may be underappreciated or overlooked by broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sonix TechnologyLtd | NA | -10.07% | -16.54% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

We'll examine a selection from our screener results.

MIXI (TSE:2121)

Simply Wall St Value Rating: ★★★★★☆

Overview: MIXI, Inc. operates in Japan across sports, digital entertainment, lifestyle, and investment sectors with a market cap of ¥253.10 billion.

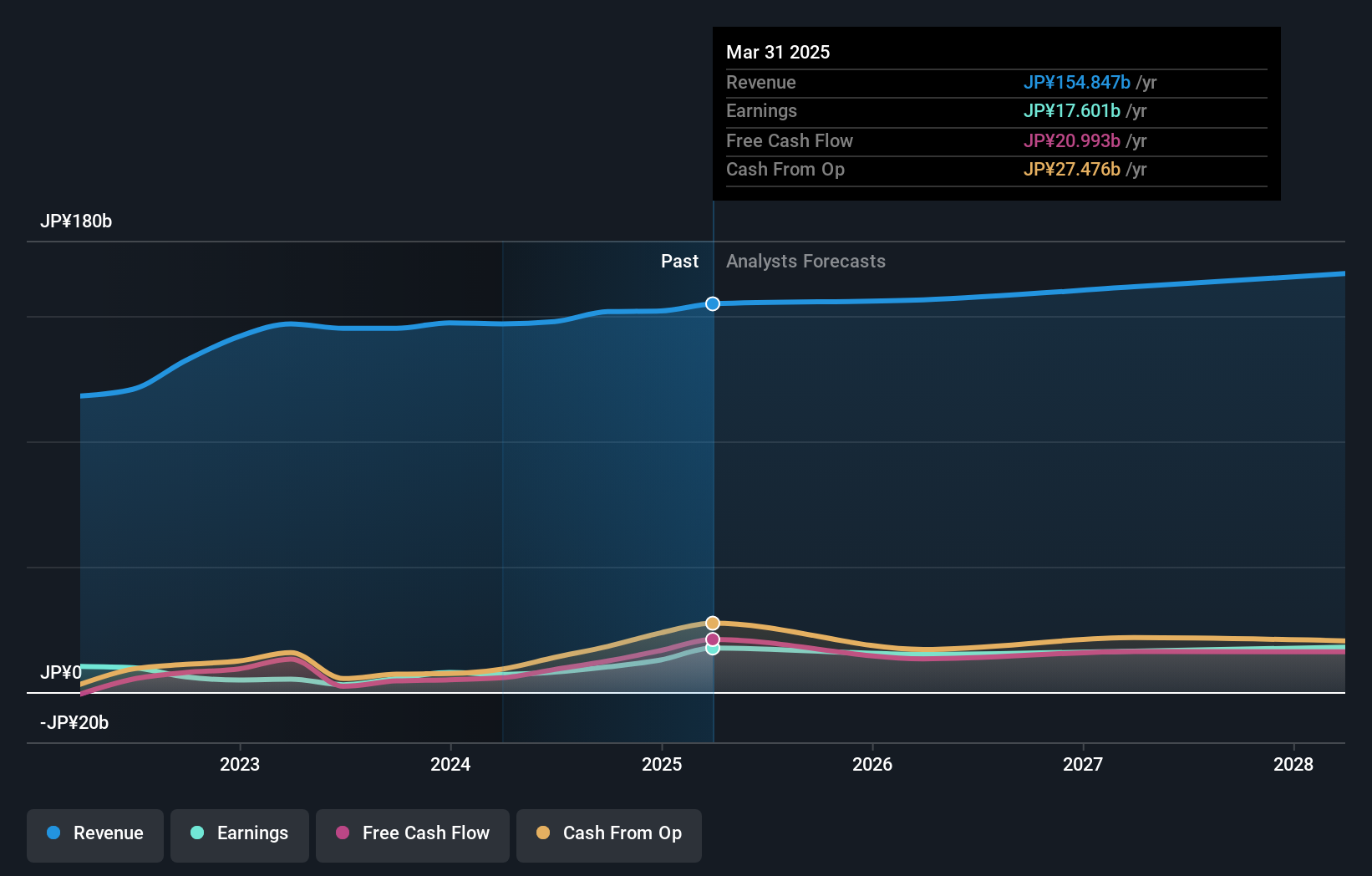

Operations: MIXI generates revenue primarily through its digital entertainment and sports segments. The company reported a net profit margin of 15%, reflecting its ability to convert a significant portion of its revenue into profit.

MIXI, a dynamic player in the digital entertainment sector, has seen its TIPSTAR platform flourish with a 37% sales boost from product upgrades. The FamilyAlbum segment is thriving, boasting over 25 million users thanks to new digital offerings. Despite fewer active users for Monster Strike, average revenue per user is climbing due to strategic partnerships. The launch of mixi2 attracted 1.2 million users quickly, hinting at future earnings potential. Recently, MIXI repurchased over 770,000 shares for ¥2.15 billion as part of a broader buyback strategy totaling ¥6.68 billion for nearly 3.41% of outstanding shares since May 2024.

Sinfonia TechnologyLtd (TSE:6507)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinfonia Technology Co., Ltd. is a company engaged in the manufacturing and sale of diverse equipment, with a market capitalization of approximately ¥183.54 billion.

Operations: Sinfonia Technology generates revenue primarily from Motion Equipment, Engineering & Services, Clean Conveyance System, and Power Electronics Equipment segments, with Motion Equipment contributing ¥40.33 billion and Engineering & Services adding ¥28.15 billion. The company has a market capitalization of approximately ¥183.54 billion.

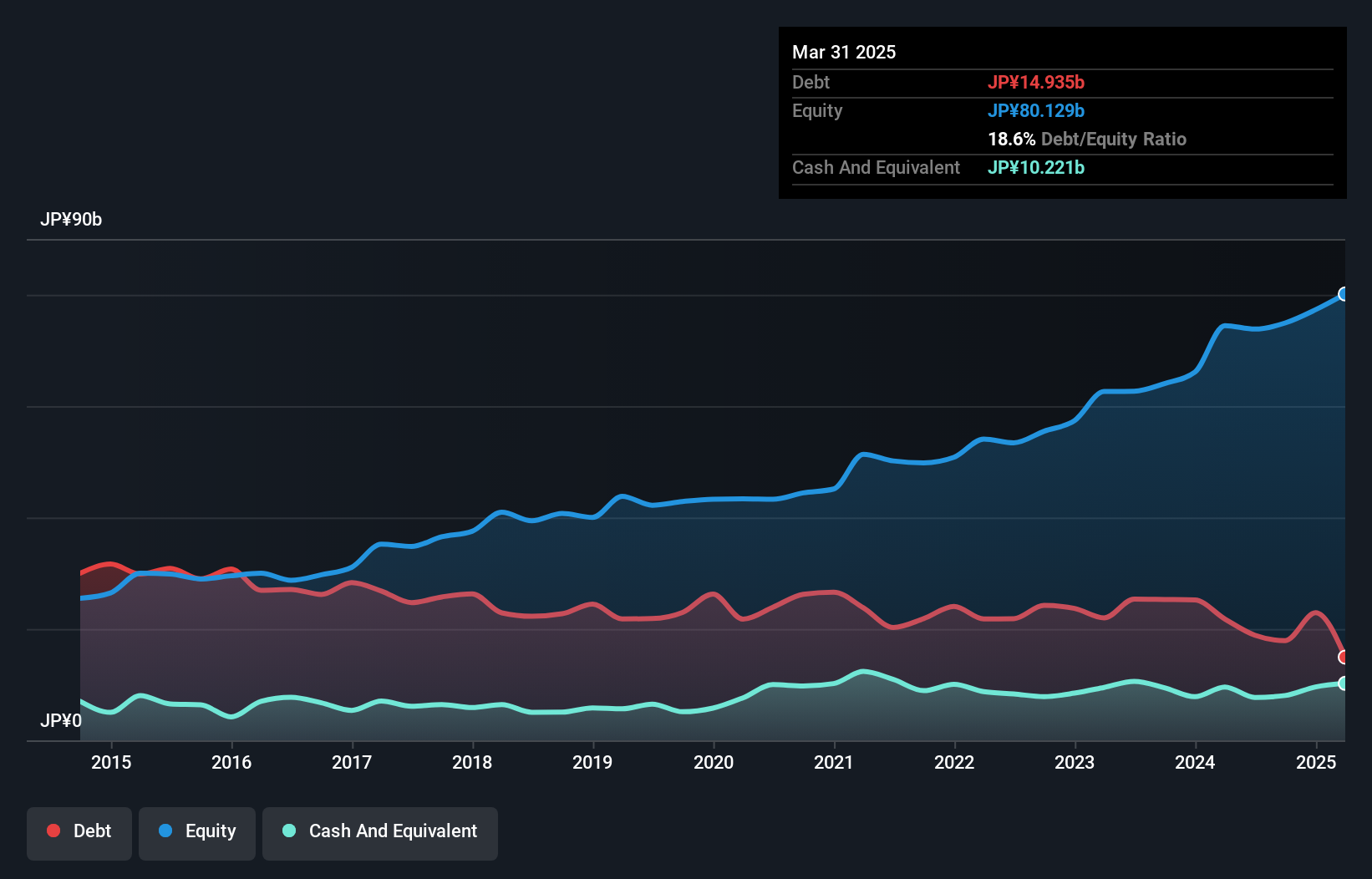

Sinfonia Technology, a smaller player in the electrical industry, has shown impressive financial discipline with its debt to equity ratio dropping from 60.6% to 29.6% over five years. The company is trading slightly below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. Its net debt to equity ratio of 17.2% is considered satisfactory, reflecting prudent financial management. Sinfonia's earnings have surged by 51%, outpacing the industry's growth of 19%. With high-quality earnings and positive free cash flow, it seems well-positioned for continued profitability and growth in the coming years.

- Delve into the full analysis health report here for a deeper understanding of Sinfonia TechnologyLtd.

Evaluate Sinfonia TechnologyLtd's historical performance by accessing our past performance report.

Hwang Chang General Contractor (TWSE:2543)

Simply Wall St Value Rating: ★★★★★★

Overview: Hwang Chang General Contractor Co., Ltd operates as a contractor for civil engineering projects in Taiwan, with a market capitalization of NT$44.31 billion.

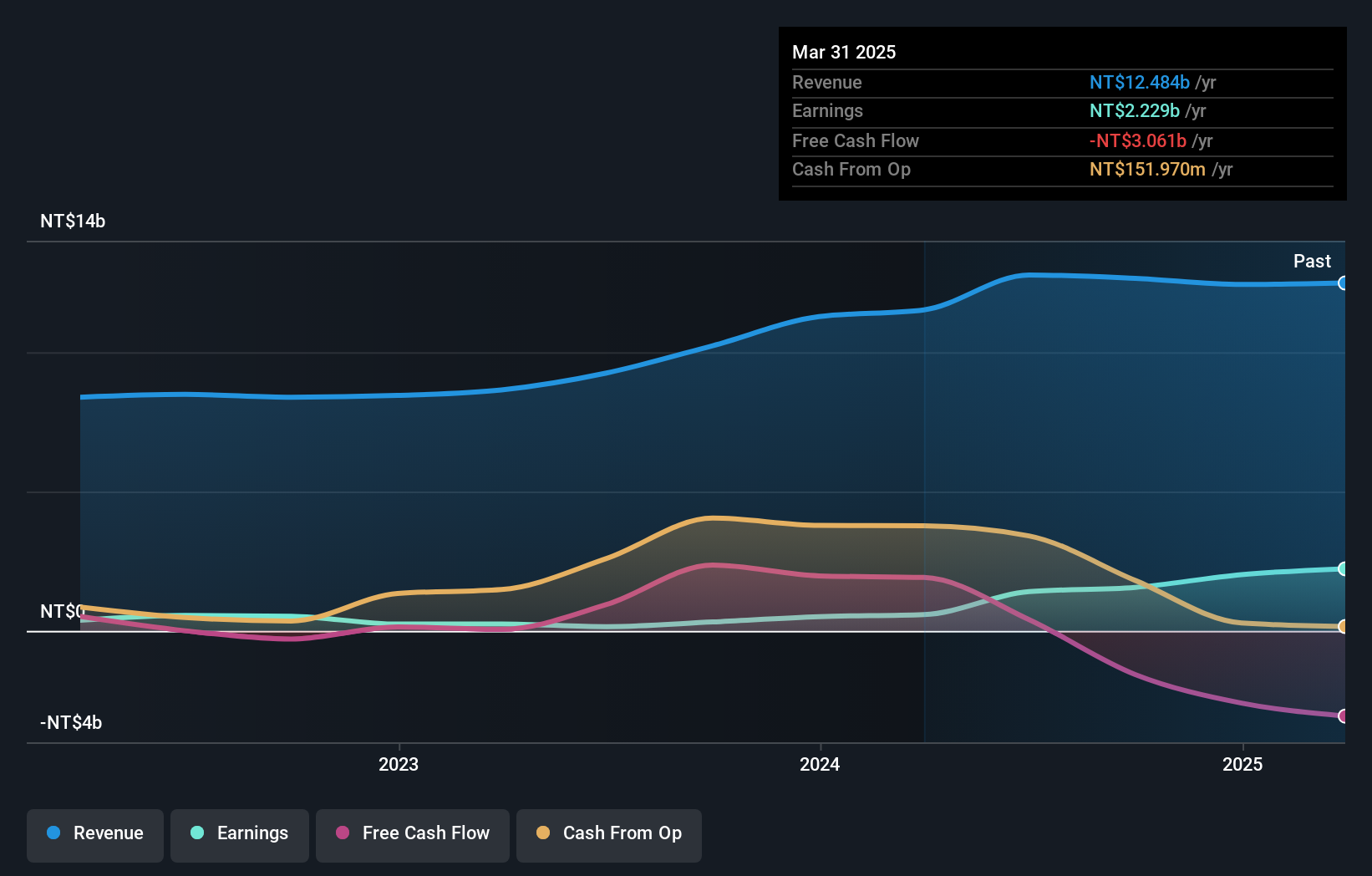

Operations: Hwang Chang General Contractor generates revenue primarily from its Construction Engineering Division, contributing NT$11.47 billion, and the Concrete Department, adding NT$1.95 billion. The company recorded an adjustment and write-off of NT$774.25 million in its financials.

Hwang Chang General Contractor's recent performance highlights its potential, with earnings surging 388% over the past year, outpacing the construction industry's 9.3% growth. The company's debt to equity ratio has impressively decreased from 73.8% to 31.5% in five years, indicating improved financial health. Despite a volatile share price recently, its interest payments are well covered by EBIT at a robust 46x coverage, showcasing strong operational efficiency. However, free cash flow remains negative and shareholder dilution occurred last year, suggesting areas for improvement as it navigates future opportunities in the construction sector.

Key Takeaways

- Navigate through the entire inventory of 4711 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2121

MIXI

Engages in the sports, digital entertainment, lifestyle, and investment businesses in Japan.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)