- Japan

- /

- Entertainment

- /

- TSE:2121

Does MIXI's Recent Share Price Dip Signal a Long-Term Opportunity in 2025?

Reviewed by Bailey Pemberton

If you have MIXI on your watchlist, or even if you've been holding it for a while, you're probably wondering whether now is the right time to make a move. The mix of short-term price dips and strong long-term returns has certainly been grabbing attention. Over the past week, MIXI’s stock price inched up 1.1%, even as it slid 2.0% over the last month. Looking at a broader timeframe reveals some compelling growth stories, with the stock up 8.0% year-to-date, an impressive 19.7% in the last year, and an eye-catching 57.9% over three years.

Some of this movement reflects bigger shifts in Japanese tech and entertainment markets, and it also hints at investors rethinking MIXI’s risk and growth profile. Not every bump in the stock price is tied to a major event, but the backdrop for MIXI seems to be changing as digital trends and new projects get attention. That is worth considering as you evaluate whether the recent small pullback is simply a pause before another climb or something more structural.

Valuation remains a key question. MIXI currently has a value score of 4, meaning it is considered undervalued according to four out of six standard checks. This puts it ahead of many rivals, but does this provide the whole picture? In the next section, we will examine those valuation checks and look at MIXI from several different perspectives. At the end, I will share a smarter way to cut through the noise.

Why MIXI is lagging behind its peers

Approach 1: MIXI Discounted Cash Flow (DCF) Analysis

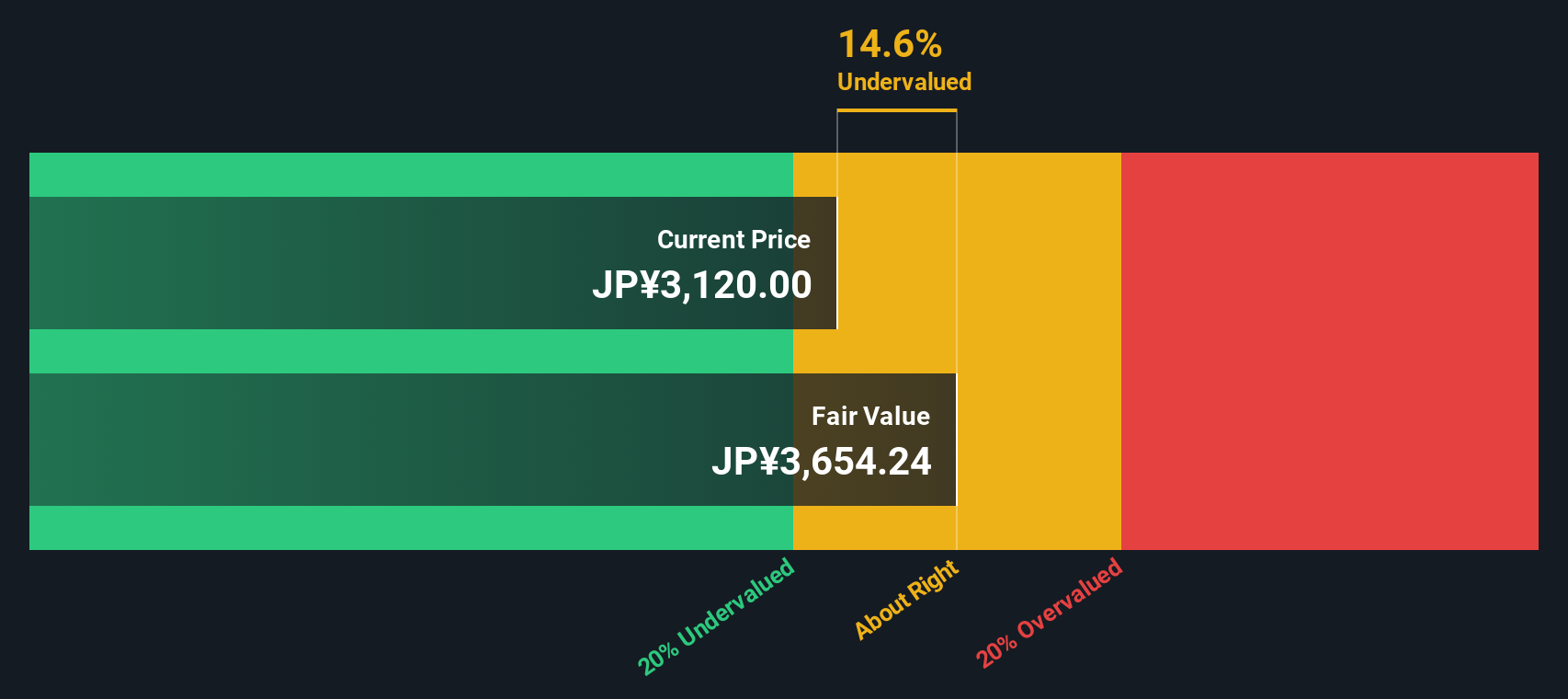

The Discounted Cash Flow (DCF) model projects MIXI's future cash flows, then discounts those amounts back to their present value. This approach gives investors a way to estimate what the company is truly worth today based on expected future performance, not just recent stock price movements.

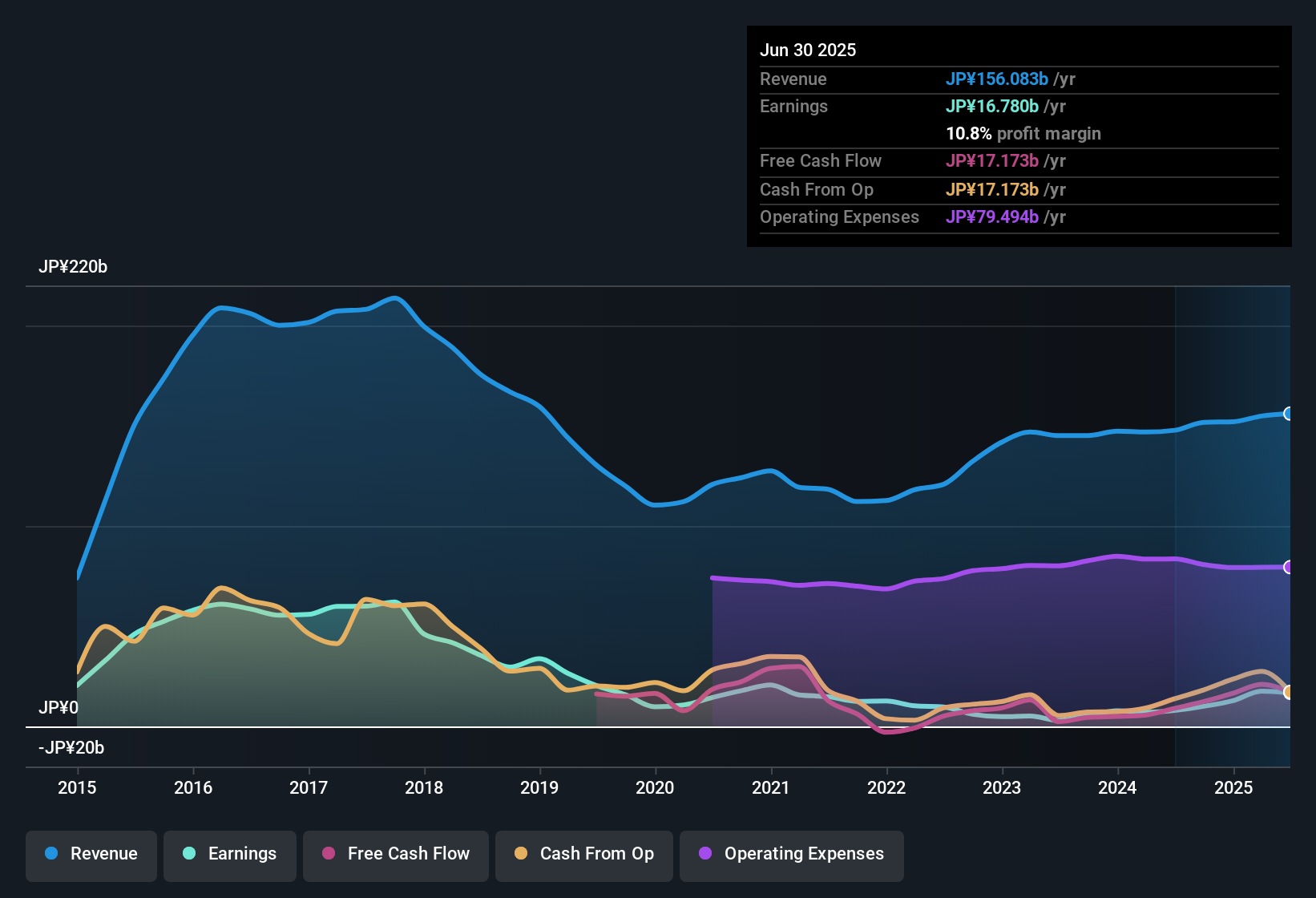

For MIXI, the latest annual Free Cash Flow stands at approximately ¥12.9 billion. Analyst forecasts, covering the next five years, suggest steady growth in cash generation. By 2030, projections indicate MIXI could generate around ¥17 billion in Free Cash Flow. This increase is based on evolving market positions and digital growth initiatives. Beyond these analyst estimates, Simply Wall St extends projections further, but it is important to keep in mind that certainty naturally diminishes the further out these predictions go.

Based on these cash flow extrapolations, the DCF model calculates an intrinsic value per share of approximately ¥3,670. This figure implies MIXI shares are trading at a 12.4% discount relative to their "true" value using these assumptions. In other words, the company is considered undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MIXI is undervalued by 12.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

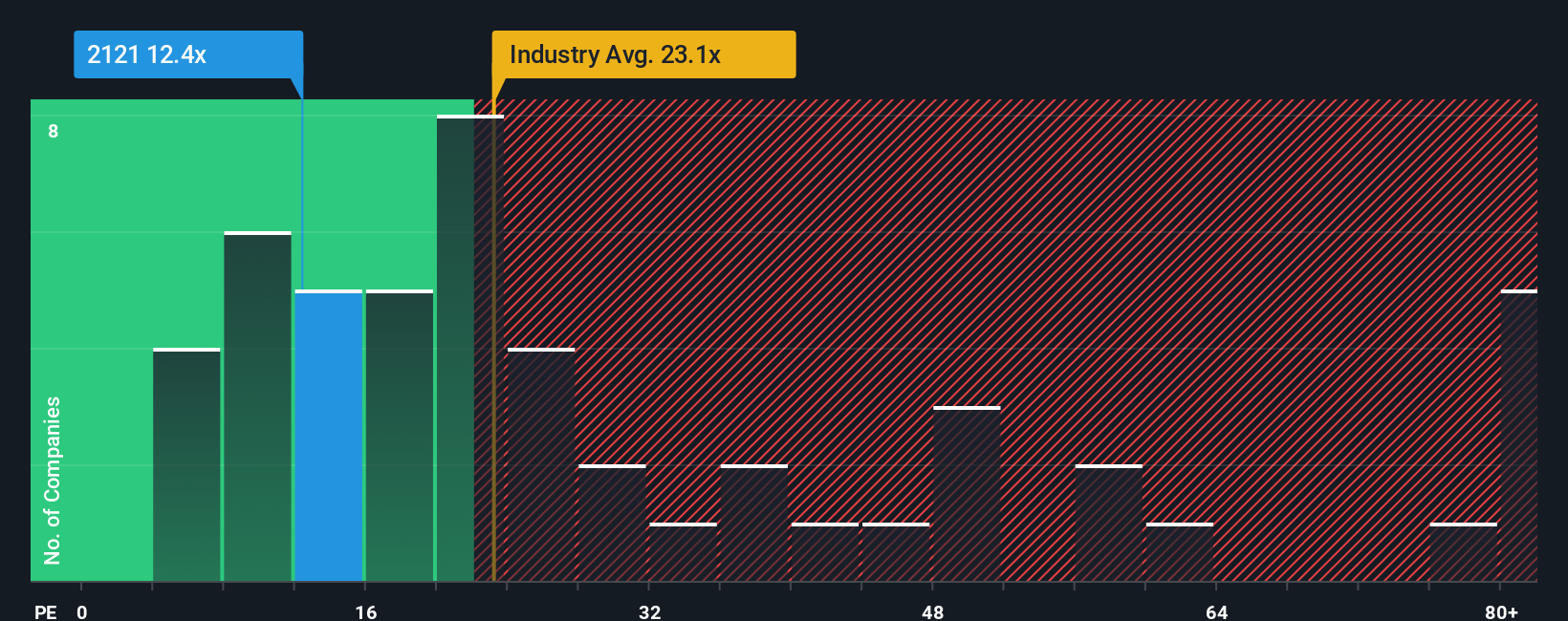

Approach 2: MIXI Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies such as MIXI because it links the company’s current share price with its actual earnings. This makes it especially relevant for investors who want to understand how much they are paying for each yen of profit generated by the business.

A company’s typical or “fair” PE ratio is influenced by expectations for future growth as well as perceived risks. Faster-growing, more stable companies generally command higher PE ratios, while slower growers or riskier businesses tend to trade at lower multiples. Looking at MIXI, the current PE ratio is 12.9x, which is noticeably lower than both the entertainment industry average of 22.3x and the peer group average of 29.5x.

To provide a more precise benchmark, Simply Wall St has developed the “Fair Ratio”, a proprietary PE multiple reflecting factors beyond just peer and industry comparisons. This calculation incorporates elements like MIXI’s projected earnings growth, profit margins, size, industry position and key risks. By weighing these considerations, the Fair Ratio offers a more tailored standard for what MIXI should be valued at in today’s market. For MIXI, the Fair Ratio is 23.8x, which is significantly above the current 12.9x. This suggests MIXI remains undervalued based on a more holistic assessment, even after accounting for growth and risk.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MIXI Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company: the reasons you believe MIXI will grow, the risks you’re watching, and the numbers that back up your fair value estimate. Narratives turn investing from just looking at ratios and forecasts into a complete picture, connecting MIXI’s unique business drivers to a financial forecast and a target value for the shares.

Thanks to Simply Wall St’s platform, creating and using Narratives is both accessible and popular, with millions of investors sharing their perspectives in the Community page. Narratives make it easier to decide when to buy or sell, because you can directly compare your own calculated Fair Value with the current share price, and see how your approach stacks up against others. Narratives are updated automatically as fresh news, results, or company guidance come in, so your analysis stays relevant and grounded in the most recent information.

For MIXI, some investors see major value from AI-powered growth and new acquisitions, setting their fair value as high as ¥3,300. Others, more cautious about dependence on aging titles or international expansion risk, might estimate a much lower fair value, such as ¥2,800.

Do you think there's more to the story for MIXI? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2121

MIXI

Engages in the sports, digital entertainment, lifestyle, and investment businesses in Japan.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives