KeePer Technical Laboratory Co., Ltd.'s (TSE:6036) P/E Is Still On The Mark Following 37% Share Price Bounce

KeePer Technical Laboratory Co., Ltd. (TSE:6036) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

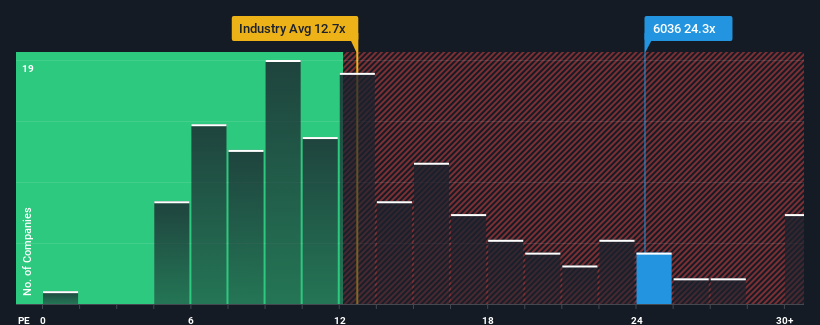

Since its price has surged higher, KeePer Technical Laboratory may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 24.3x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent earnings growth for KeePer Technical Laboratory has been in line with the market. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for KeePer Technical Laboratory

Is There Enough Growth For KeePer Technical Laboratory?

There's an inherent assumption that a company should far outperform the market for P/E ratios like KeePer Technical Laboratory's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's bottom line. The latest three year period has also seen an excellent 114% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 18% each year over the next three years. That's shaping up to be materially higher than the 9.4% each year growth forecast for the broader market.

In light of this, it's understandable that KeePer Technical Laboratory's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From KeePer Technical Laboratory's P/E?

Shares in KeePer Technical Laboratory have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that KeePer Technical Laboratory maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for KeePer Technical Laboratory that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if KeePer Technical Laboratory might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6036

KeePer Technical Laboratory

Develops, manufactures, and sells car coatings, car washing chemicals and equipment, and other products in Japan.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026