- Japan

- /

- Metals and Mining

- /

- TSE:5922

Investors Still Aren't Entirely Convinced By Nasu Denki-Tekko Co., Ltd.'s (TSE:5922) Earnings Despite 25% Price Jump

Those holding Nasu Denki-Tekko Co., Ltd. (TSE:5922) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

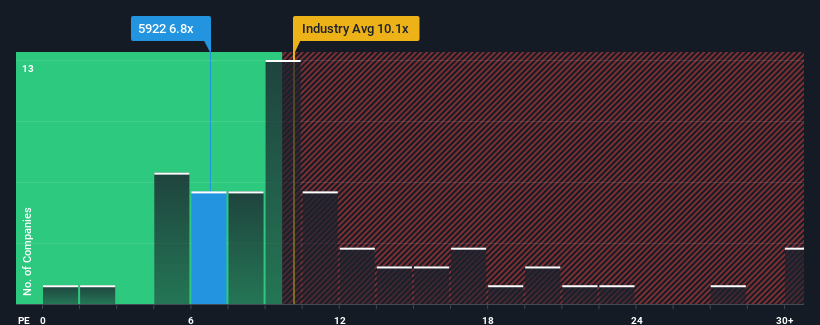

Even after such a large jump in price, Nasu Denki-Tekko's price-to-earnings (or "P/E") ratio of 6.8x might still make it look like a strong buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 14x and even P/E's above 22x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Nasu Denki-Tekko has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Nasu Denki-Tekko

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Nasu Denki-Tekko's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. The strong recent performance means it was also able to grow EPS by 59% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Nasu Denki-Tekko is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Nasu Denki-Tekko's P/E

Shares in Nasu Denki-Tekko are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Nasu Denki-Tekko currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Nasu Denki-Tekko (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Nasu Denki-Tekko. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nasu Denki-Tekko might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5922

Nasu Denki-Tekko

Manufactures and sells steel towers, steel structures, transportation system materials, overhead wire hardware products, and underground wire materials in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives