As global markets navigate the uncertainties surrounding policy changes in the incoming Trump administration, investors are witnessing significant sector shifts, with financials and energy gaining traction while healthcare and electric vehicle stocks face headwinds. In this dynamic environment, dividend stocks can offer a measure of stability and income potential for investors seeking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

La Kaffa International (TPEX:2732)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: La Kaffa International Co., Ltd. operates a franchise of chain restaurants in Taiwan and internationally, with a market cap of NT$4.67 billion.

Operations: La Kaffa International Co., Ltd. generates revenue through its franchise operations of chain restaurants both domestically in Taiwan and on an international scale.

Dividend Yield: 5.4%

La Kaffa International's dividend yield of 5.43% ranks in the top 25% of Taiwan's market, but its sustainability is questionable due to a high payout ratio of 109.5%, not well-covered by earnings. Although dividends have grown over the past decade, they have been volatile and unreliable, with an 81.6% cash payout ratio indicating coverage by cash flows. Recent earnings show declining net income and EPS, raising concerns about future dividend reliability.

- Dive into the specifics of La Kaffa International here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that La Kaffa International is trading beyond its estimated value.

Toyo Seikan Group Holdings (TSE:5901)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyo Seikan Group Holdings, Ltd. is a company that manufactures and sells packaging containers both in Japan and internationally, with a market cap of ¥375.56 billion.

Operations: Toyo Seikan Group Holdings, Ltd. generates revenue through the manufacturing and sale of packaging containers across various markets in Japan and internationally.

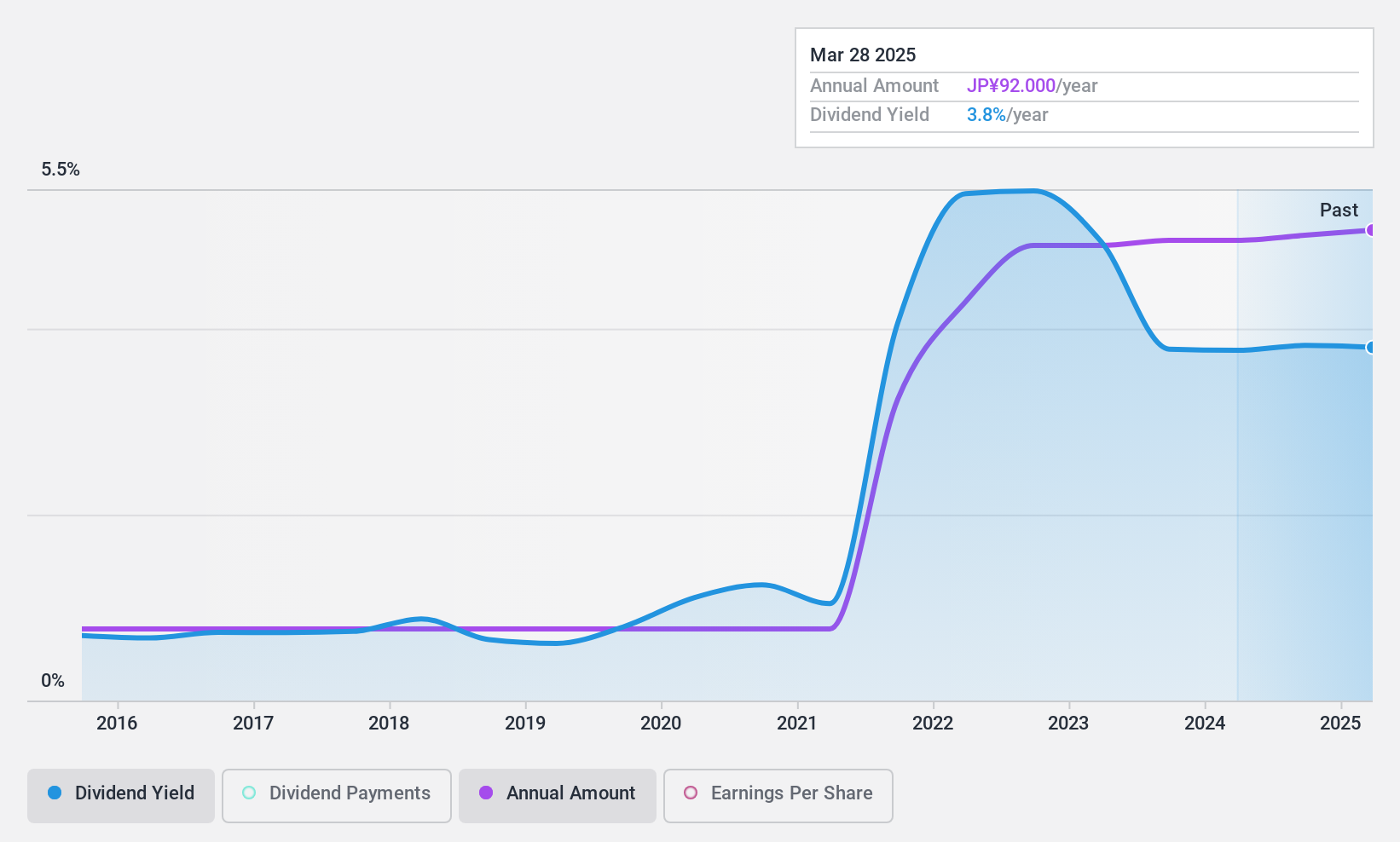

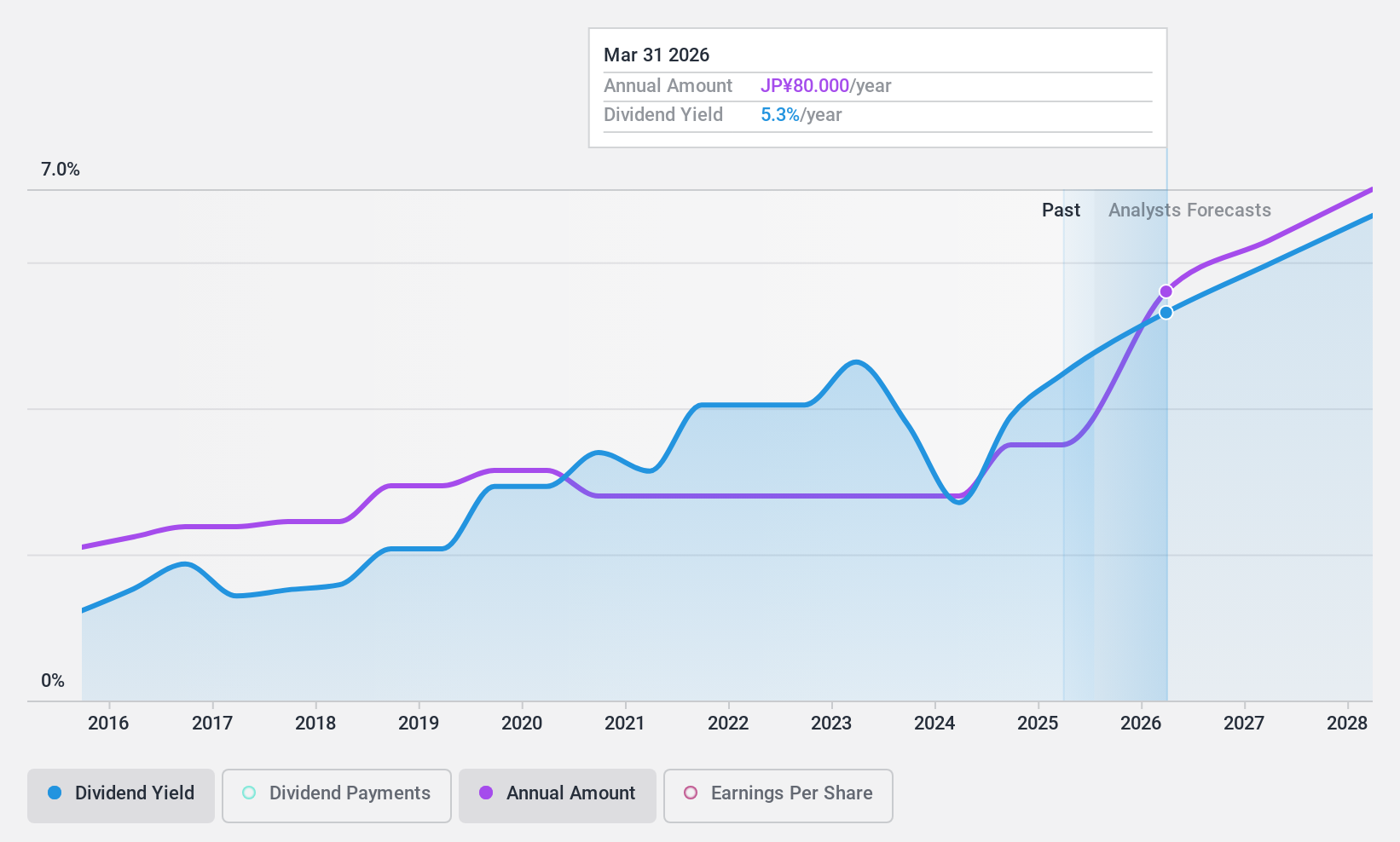

Dividend Yield: 4%

Toyo Seikan Group Holdings offers a dividend yield in the top 25% of Japan's market, supported by a low payout ratio of 37.8%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility over the past decade. The company recently completed a share buyback for ¥12.75 billion, which may enhance shareholder value despite an unreliable dividend track record.

- Delve into the full analysis dividend report here for a deeper understanding of Toyo Seikan Group Holdings.

- According our valuation report, there's an indication that Toyo Seikan Group Holdings' share price might be on the expensive side.

Nippon Seiki (TSE:7287)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Seiki Co., Ltd. manufactures and sells instruments for automobiles, motorcycles, agricultural and construction machines, and boats across Japan, the Americas, Europe, and Asia with a market cap of ¥62.16 billion.

Operations: Nippon Seiki Co., Ltd. generates revenue through the production and distribution of instruments for various vehicles, including automobiles, motorcycles, agricultural and construction machinery, and boats across multiple regions such as Japan, the Americas, Europe, and Asia.

Dividend Yield: 4.7%

Nippon Seiki's dividend yield is in the top 25% of Japan's market, yet it struggles with sustainability as dividends are not covered by free cash flows. Despite a stable and growing dividend history over the past decade, recent earnings growth has been overshadowed by large one-off items. The company completed a share buyback for ¥1.05 billion, aimed at enhancing shareholder returns and corporate value but does not address underlying cash flow issues impacting dividend coverage.

- Click to explore a detailed breakdown of our findings in Nippon Seiki's dividend report.

- Our valuation report unveils the possibility Nippon Seiki's shares may be trading at a premium.

Make It Happen

- Navigate through the entire inventory of 1957 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyo Seikan Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5901

Toyo Seikan Group Holdings

Manufactures and sells packaging containers in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.