- Japan

- /

- Metals and Mining

- /

- TSE:5714

Dowa Holdings' (TSE:5714) five-year earnings growth trails the decent shareholder returns

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. Unfortunately for shareholders, while the Dowa Holdings Co., Ltd. (TSE:5714) share price is up 58% in the last five years, that's less than the market return. Zooming in, the stock is up a respectable 13% in the last year.

Since it's been a strong week for Dowa Holdings shareholders, let's have a look at trend of the longer term fundamentals.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

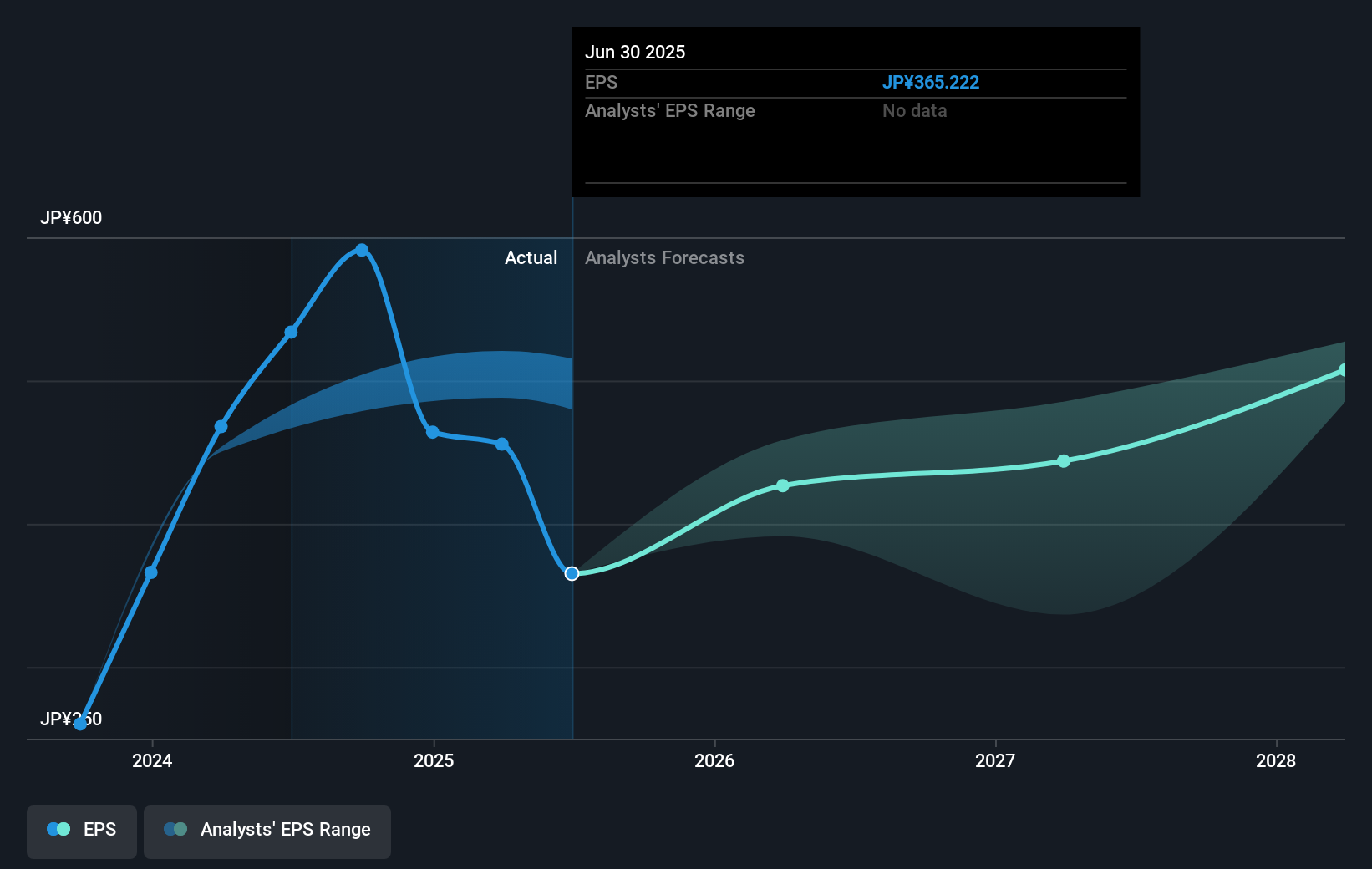

During five years of share price growth, Dowa Holdings achieved compound earnings per share (EPS) growth of 11% per year. So the EPS growth rate is rather close to the annualized share price gain of 10% per year. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Dowa Holdings' TSR for the last 5 years was 80%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Dowa Holdings shareholders are up 17% for the year (even including dividends). But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 12% per year over five year. It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Dowa Holdings .

We will like Dowa Holdings better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5714

Dowa Holdings

Engages in the environmental management and recycling, nonferrous metals, electronic materials, metal processing, and heat treatment businesses.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives