- Japan

- /

- Metals and Mining

- /

- TSE:5713

Sumitomo Metal Mining (TSE:5713) Jumps 9.4% After Toyota Cathode Supply Pact for Solid-State Batteries

Reviewed by Sasha Jovanovic

- Toyota and Sumitomo Metal Mining recently announced a collaboration to advance the mass production of cathode materials for all-solid-state batteries, aiming for production as early as the 2028 financial year and prioritizing supply to Toyota.

- This groundbreaking partnership positions Sumitomo Metal Mining as a key contributor to next-generation electric vehicle technologies, leveraging both innovation and global automotive demand for advanced batteries.

- We'll explore how Sumitomo Metal Mining's prioritized supply agreement with Toyota enhances the company's investment narrative in high-growth EV markets.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Sumitomo Metal Mining's Investment Narrative?

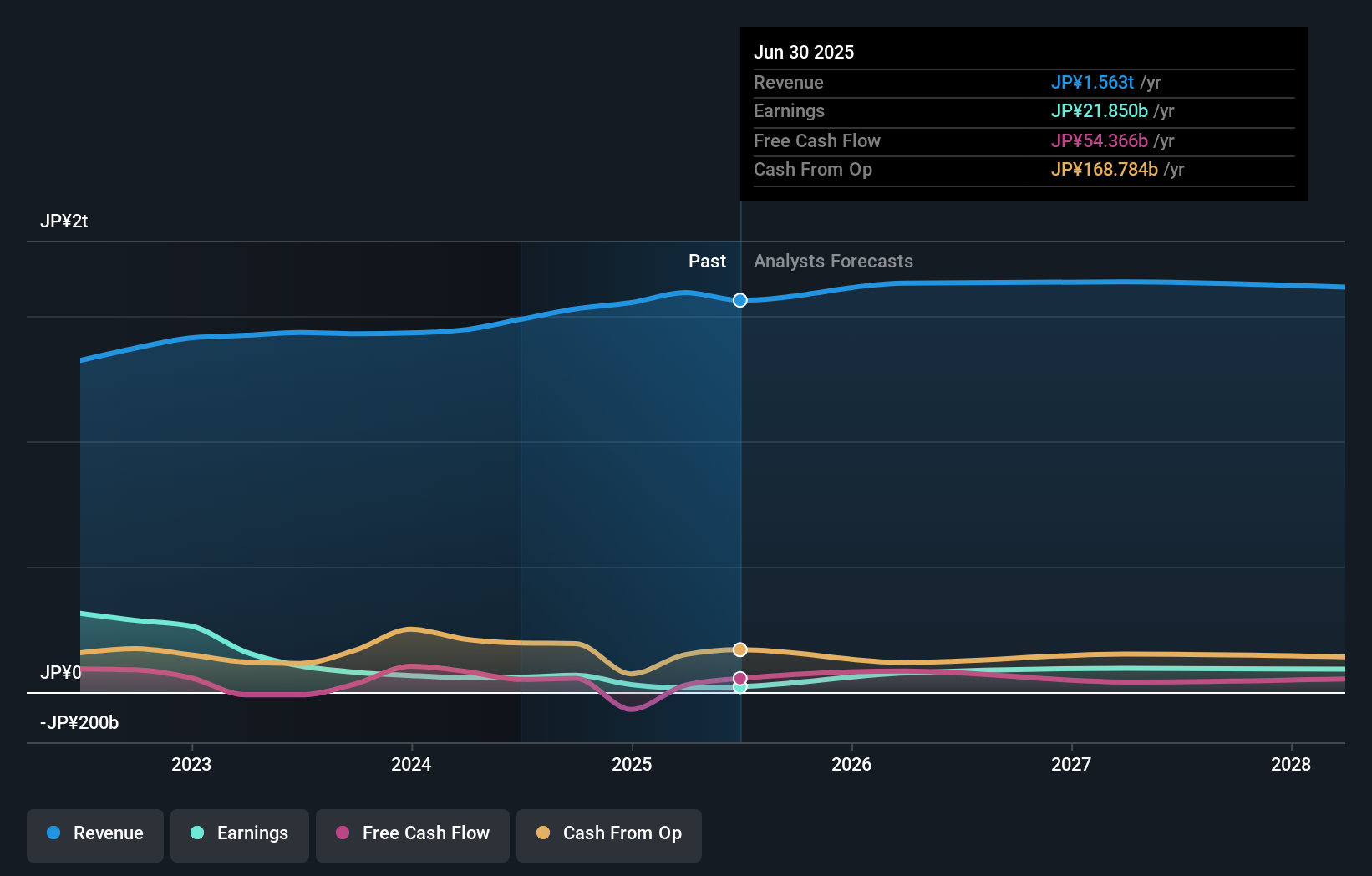

For those considering Sumitomo Metal Mining, the investment case now hinges even more on whether innovations in battery materials pay off amid ongoing challenges. The fresh collaboration with Toyota could emerge as a major catalyst, opening up exposure to the next wave of electric vehicle battery technology and signaling potential for stronger long-term demand. That said, this partnership does not negate Sumitomo’s current risks: revenue is forecast to dip over the next three years, returns on equity remain low, and recent impairment losses and volatile earnings still weigh on investor sentiment. The company’s high price-to-earnings ratio and less experienced management further complicate the outlook, with new catalysts needed to offset declining profit margins and a generally expensive share price. Short-term, excitement around the Toyota deal may buoy optimism, but core financial risks remain relevant.

But on the flip side, volatility and board turnover are still key issues to keep in mind. Sumitomo Metal Mining's shares are on the way up, but they could be overextended by 15%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Sumitomo Metal Mining - why the stock might be worth as much as 37% more than the current price!

Build Your Own Sumitomo Metal Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sumitomo Metal Mining research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sumitomo Metal Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sumitomo Metal Mining's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5713

Sumitomo Metal Mining

Engages in mining, smelting, and refining non-ferrous metals in Japan and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives