- Japan

- /

- Metals and Mining

- /

- TSE:5707

Toho Zinc (TSE:5707) shareholders are up 10% this past week, but still in the red over the last three years

Toho Zinc Co., Ltd. (TSE:5707) shareholders will doubtless be very grateful to see the share price up 32% in the last quarter. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 57% in that period. So it's good to see it climbing back up. While many would remain nervous, there could be further gains if the business can put its best foot forward.

While the last three years has been tough for Toho Zinc shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Toho Zinc

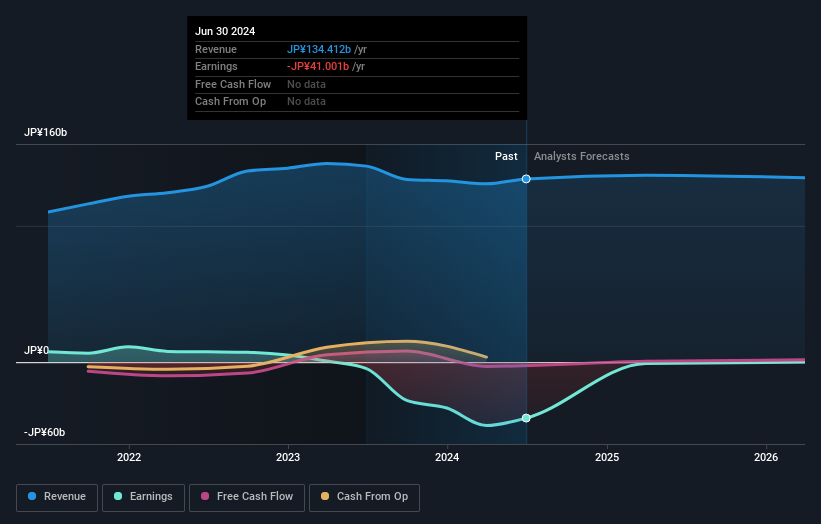

Given that Toho Zinc didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Toho Zinc grew revenue at 5.5% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 16% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Toho Zinc's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Toho Zinc's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Toho Zinc's TSR, which was a 55% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 18% in the last year, Toho Zinc shareholders lost 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Toho Zinc better, we need to consider many other factors. Even so, be aware that Toho Zinc is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Of course Toho Zinc may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Toho Zinc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5707

Toho Zinc

Operates in the smelting and refining, mineral resources, electronic components, advanced materials, and environment and recycling businesses in Japan.

Undervalued with moderate growth potential.