- Japan

- /

- Metals and Mining

- /

- TSE:5463

Maruichi Steel Tube (TSE:5463): A Fresh Look at Valuation as Shares Climb 21% This Year

Reviewed by Simply Wall St

Is Maruichi Steel Tube (TSE:5463) Entering a New Growth Phase?

If you have been watching Maruichi Steel Tube (TSE:5463) lately, you might be curious about the steady upswing in its share price over recent months. The movement has caught the attention of investors who are weighing whether the company’s combination of slow but steady earnings and revenue growth could mean it is undervalued, or if the current momentum is set to continue. While there have not been any dramatic headlines or single major events to point to, that is often when the most interesting opportunities and risks can arise.

Maruichi Steel Tube’s stock has gained 21% over the year, and more than 12% since January, with a strong 13% rise in the past 3 months. This run stands out against the company’s modest annual revenue and profit growth, showing that momentum has been building for some time. Investors are likely taking notice of performance trends that do not always make front-page news but are significant over the long haul.

With the share price climbing and the growth story still playing out, do current valuations reflect all the company’s future promise, or is there still a window for investors to buy into Maruichi Steel Tube’s next phase?

Price-to-Earnings of 11.9x: Is it justified?

Maruichi Steel Tube trades at a Price-to-Earnings (P/E) ratio of 11.9 times, notably lower than the JP Metals and Mining industry average of 12.9x and below its peer average of 12.7x. On this basis, the stock appears undervalued compared to similar companies in its sector.

The P/E ratio is a key valuation figure that shows how much investors are willing to pay for each yen of the company’s earnings. For industrials like Maruichi, it often signals how confident the market is in the company's consistent earnings profile and its ability to generate future profits.

Given the company’s long-term profit growth and steady financials, the market may be underestimating its resilience or future growth prospects. At this multiple, Maruichi appears attractively priced for value-focused investors, particularly when compared to industry peers.

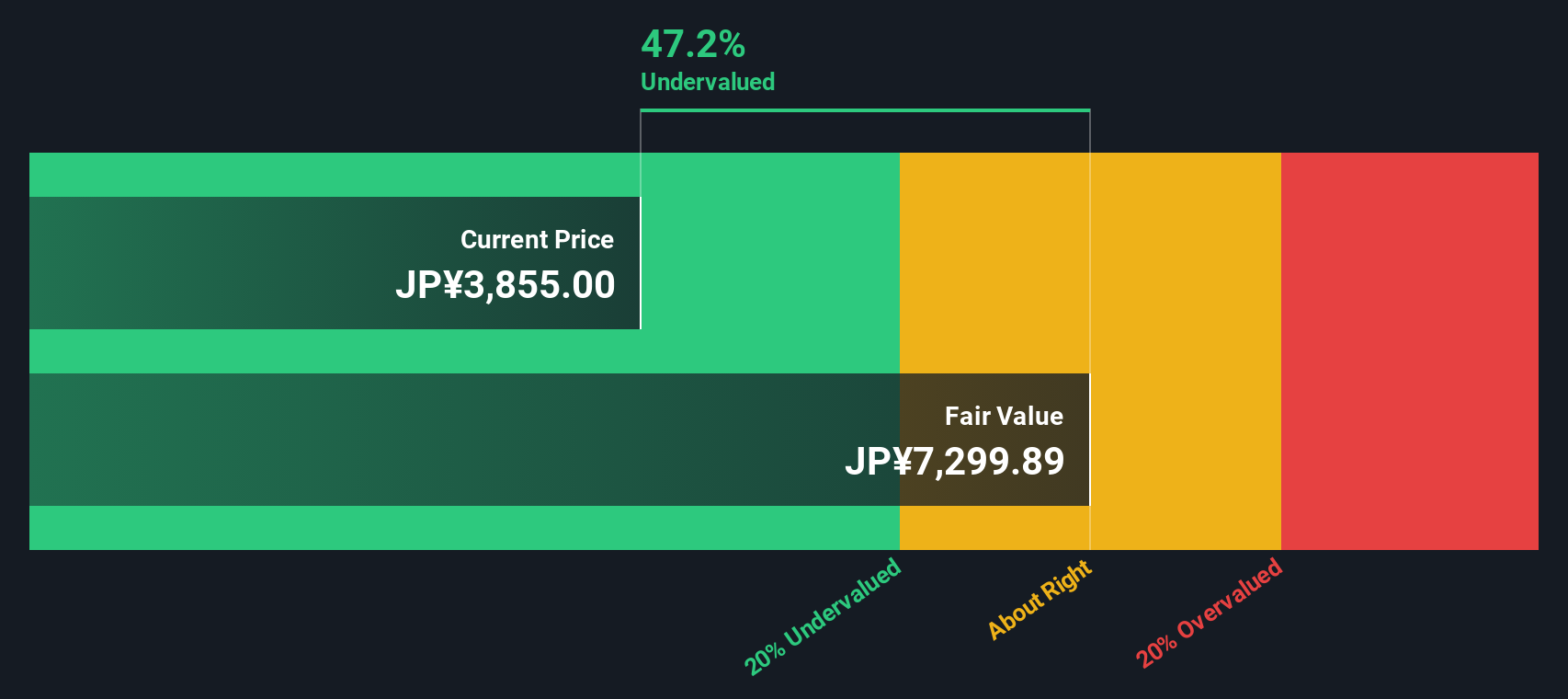

Result: Fair Value of ¥7,310.36 (UNDERVALUED)

See our latest analysis for Maruichi Steel Tube.However, risks remain, as slow annual revenue and net income growth could limit upside if industry conditions soften or investor sentiment shifts unexpectedly.

Find out about the key risks to this Maruichi Steel Tube narrative.Another View: What Does the SWS DCF Model Say?

Looking deeper, our DCF model supports the idea that Maruichi Steel Tube is undervalued. This view aligns with what we observed using traditional valuation ratios. Could this agreement mean the market is truly missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Maruichi Steel Tube Narrative

If you see things differently or would rather dive into the numbers yourself, you can quickly build your own perspective and share it in just a few minutes. Do it your way

A great starting point for your Maruichi Steel Tube research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on new opportunities. Don’t rely on just one stock, spot trends and build a powerful watchlist with these tailored picks:

- Uncover exceptional income prospects by targeting stocks with strong yields. Find your next opportunity with dividend stocks with yields > 3%.

- Tap into the future of finance by tracking innovators at the forefront of digital currencies, all accessible through cryptocurrency and blockchain stocks.

- Get ahead of the market by seeking undervalued gems based on cash flow insights. Start screening now with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5463

Maruichi Steel Tube

Manufactures and sells steel tubes, surface treated steel sheets, and poles in Japan, North America, and Asia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives