- Japan

- /

- Hospitality

- /

- TSE:6412

DaikyoNishikawa And 2 More Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of emerging policy changes and economic shifts, major indices like the S&P 500 have reached new highs, buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence. In this dynamic environment, dividend stocks continue to attract investors seeking stable returns through regular income streams, making them a compelling consideration for those looking to balance growth with reliability in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

DaikyoNishikawa (TSE:4246)

Simply Wall St Dividend Rating: ★★★★★★

Overview: DaikyoNishikawa Corporation develops, manufactures, and sells automotive and housing synthetic plastic parts in Japan, with a market cap of ¥44.82 billion.

Operations: DaikyoNishikawa Corporation's revenue segments are ¥11.28 billion from ASEAN, ¥106.86 billion from Japan, ¥9.55 billion from China and South Korea, and ¥44.02 billion from Central America/North America.

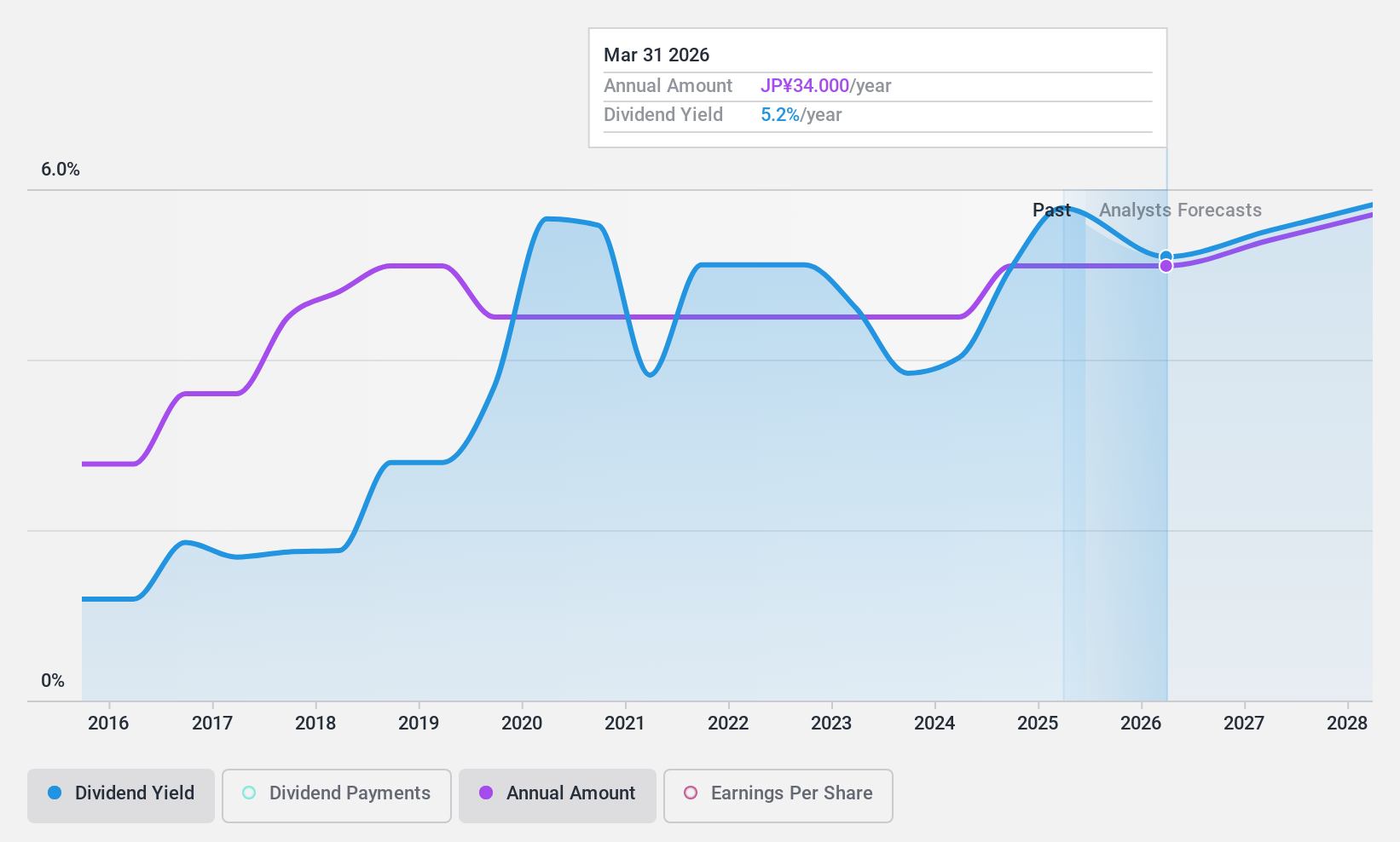

Dividend Yield: 5.3%

DaikyoNishikawa offers a compelling dividend profile, trading at 80.4% below its estimated fair value. The company maintains a sustainable dividend payout with a low earnings payout ratio of 37.4% and cash payout ratio of 18.8%. Its dividends have been stable and growing over the past decade, placing it in the top 25% of dividend payers in Japan with a yield of 5.33%. Earnings growth further supports future dividend reliability.

- Get an in-depth perspective on DaikyoNishikawa's performance by reading our dividend report here.

- According our valuation report, there's an indication that DaikyoNishikawa's share price might be on the cheaper side.

Kyoei Steel (TSE:5440)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyoei Steel Ltd. manufactures, processes, and sells billets and steel products in Japan, Vietnam, North America, and internationally with a market cap of ¥85.96 billion.

Operations: Kyoei Steel Ltd.'s revenue is primarily derived from its Domestic Steel Business at ¥152.49 billion, Overseas Steel Business at ¥162.63 billion, and Environmental Recycling Business at ¥7.04 billion.

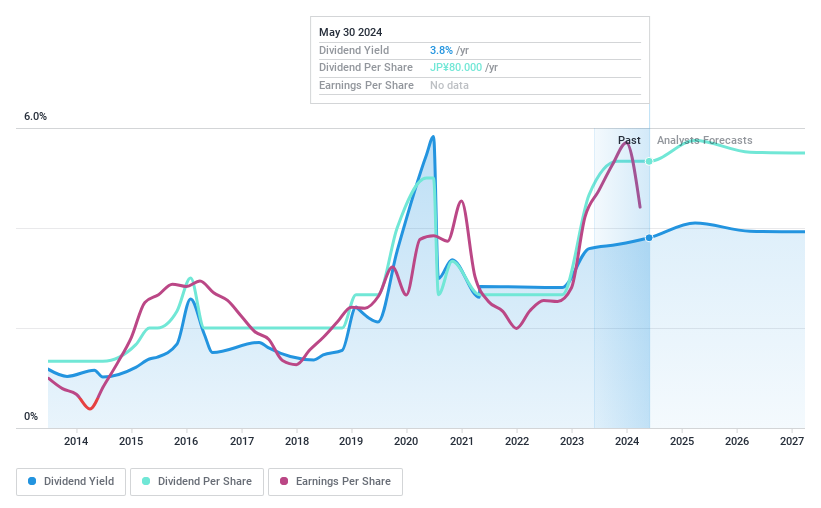

Dividend Yield: 4.5%

Kyoei Steel's dividend yield of 4.51% places it in the top 25% of Japanese dividend payers, supported by a low cash payout ratio of 21.4%, indicating strong coverage by free cash flow. However, its dividends have been volatile over the past decade, with no consistent growth trend. Despite trading at a significant discount to estimated fair value and offering good relative value compared to peers, its profit margins have recently declined from last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Kyoei Steel.

- The analysis detailed in our Kyoei Steel valuation report hints at an deflated share price compared to its estimated value.

Heiwa (TSE:6412)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heiwa Corporation develops, manufactures, and sells pachinko and pachislot machines in Japan, with a market cap of ¥229.21 billion.

Operations: Heiwa Corporation's revenue primarily comes from its Pachislot and Pachinko Machine Business, generating ¥43.30 billion, and its Golf Business, contributing ¥98.16 million.

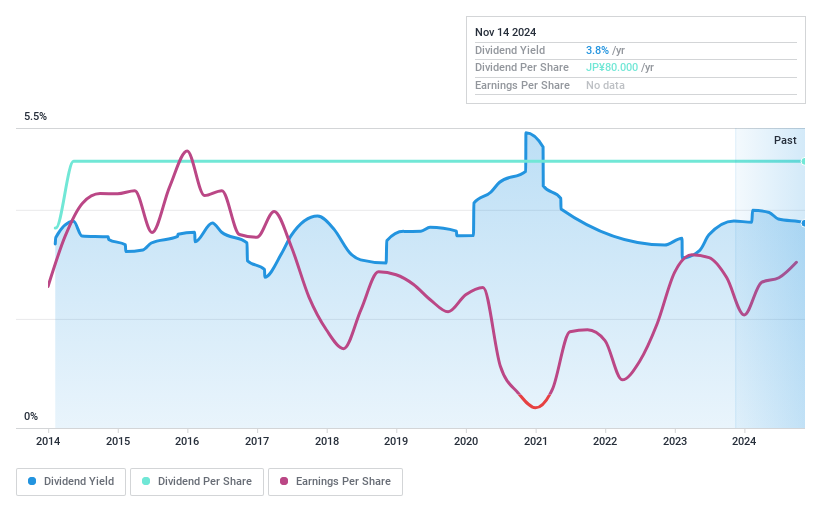

Dividend Yield: 3.4%

Heiwa's dividend yield of 3.41% is lower than the top quartile of Japanese dividend payers, and its high cash payout ratio of 138.6% indicates poor coverage by free cash flow, though earnings cover it well with a 40.3% payout ratio. Dividends have been stable and growing over the past decade despite this issue. The company trades at a good value with a price-to-earnings ratio of 11.8x, below the market average, supported by strong earnings growth of 21.8% annually over five years.

- Delve into the full analysis dividend report here for a deeper understanding of Heiwa.

- Our valuation report unveils the possibility Heiwa's shares may be trading at a discount.

Summing It All Up

- Explore the 1955 names from our Top Dividend Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Heiwa, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Heiwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6412

Heiwa

Develops, manufactures, and sells pachinko and pachislot machines in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives