- Japan

- /

- Metals and Mining

- /

- TSE:5411

Does JFE’s Planned India Integrated Steel JV with JSW Steel Change The Bull Case For JFE Holdings (TSE:5411)?

Reviewed by Sasha Jovanovic

- JFE Holdings recently held a special call to discuss an integrated steel plant joint venture in India with JSW Steel, signaling a major development in its overseas operations.

- This potential collaboration with one of India’s largest steel producers highlights JFE Holdings’ effort to deepen its presence in a key growth market for steel demand.

- We’ll now examine how this planned integrated steel plant joint venture in India may influence JFE Holdings’ broader investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is JFE Holdings' Investment Narrative?

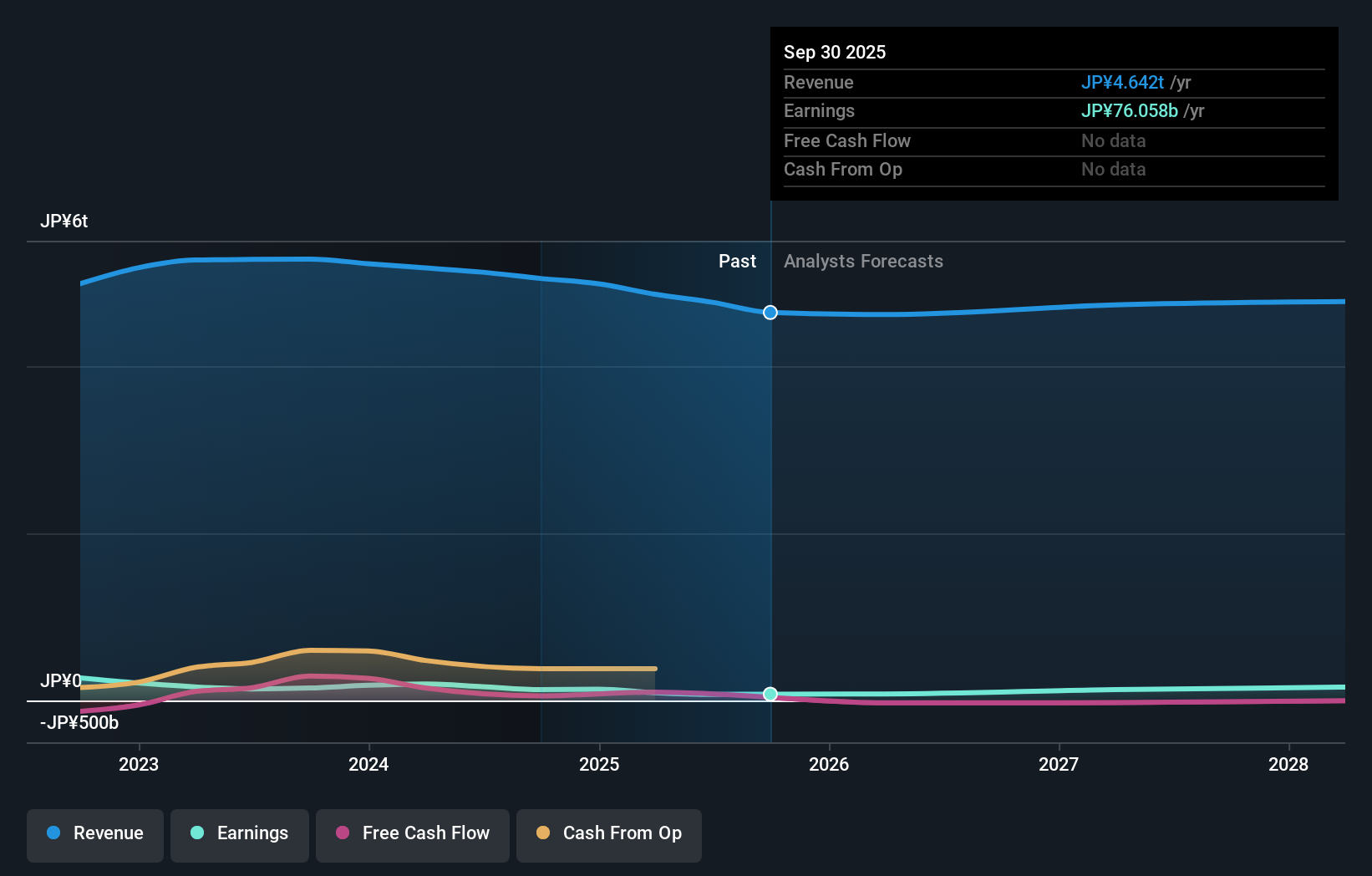

To own JFE Holdings, you have to be comfortable with a mature, cyclical steel business that is working through weaker profitability, lower revenue guidance and a reduced dividend, while management and the board are still relatively new. The recent special call on the potential integrated steel plant joint venture in India with JSW Steel fits into that story as a possible long‑term growth lever rather than a clear short‑term catalyst, especially given current guidance and the stock’s modest outperformance this year. In the near term, investor focus is likely to stay on margin pressure, high debt, one‑off items that complicate earnings quality and whether the lowered dividend signals a more cautious capital allocation stance. If the India project progresses, it could gradually shift the balance between these risks and growth optionality.

However, one emerging risk around earnings quality and leverage is easy to overlook. JFE Holdings' shares are on the way up, but they could be overextended by 23%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on JFE Holdings - why the stock might be worth as much as ¥1588!

Build Your Own JFE Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JFE Holdings research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free JFE Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JFE Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5411

JFE Holdings

Through its subsidiaries, engages in steel, engineering, and trading businesses in Japan and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026