3 Leading Dividend Stocks Including Dawnrays Pharmaceutical Holdings

Reviewed by Simply Wall St

As global markets react to the Trump administration's policy shifts and the optimism surrounding AI investments, major indices like the S&P 500 have reached new highs, reflecting a positive investor sentiment. In this dynamic environment, dividend stocks continue to attract attention as reliable income sources, providing stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.98% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

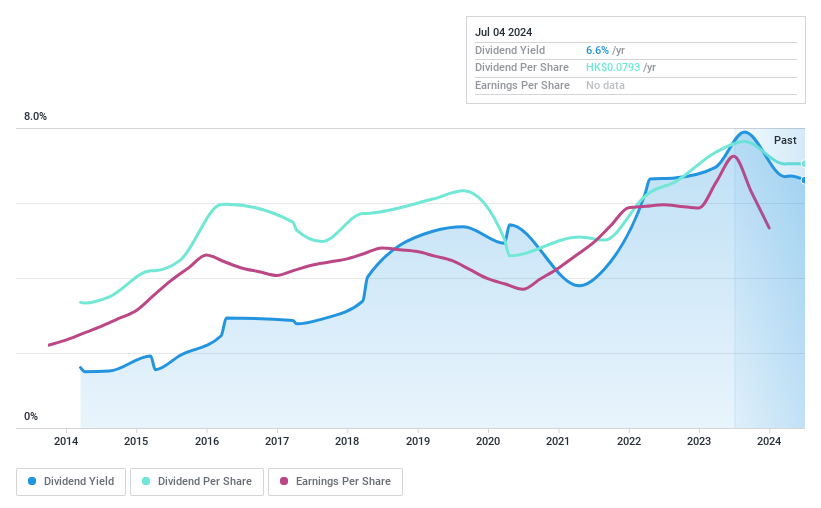

Dawnrays Pharmaceutical (Holdings) (SEHK:2348)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally, with a market cap of HK$1.80 billion.

Operations: Dawnrays Pharmaceutical (Holdings) Limited generates revenue from Finished Drugs amounting to CN¥1.04 billion and Intermediates and Bulk Medicines totaling CN¥130.31 million.

Dividend Yield: 6.5%

Dawnrays Pharmaceutical's dividend yield of 6.46% is below the top tier in Hong Kong, and its dividend history has been unreliable with volatility over the past decade. However, dividends are well-covered by earnings with a low payout ratio of 19.4%, though cash flow coverage is tighter at 86.4%. The company's earnings have grown by 27.3% recently, and its price-to-earnings ratio of 3x suggests it may be undervalued compared to the market average.

- Click to explore a detailed breakdown of our findings in Dawnrays Pharmaceutical (Holdings)'s dividend report.

- Our comprehensive valuation report raises the possibility that Dawnrays Pharmaceutical (Holdings) is priced higher than what may be justified by its financials.

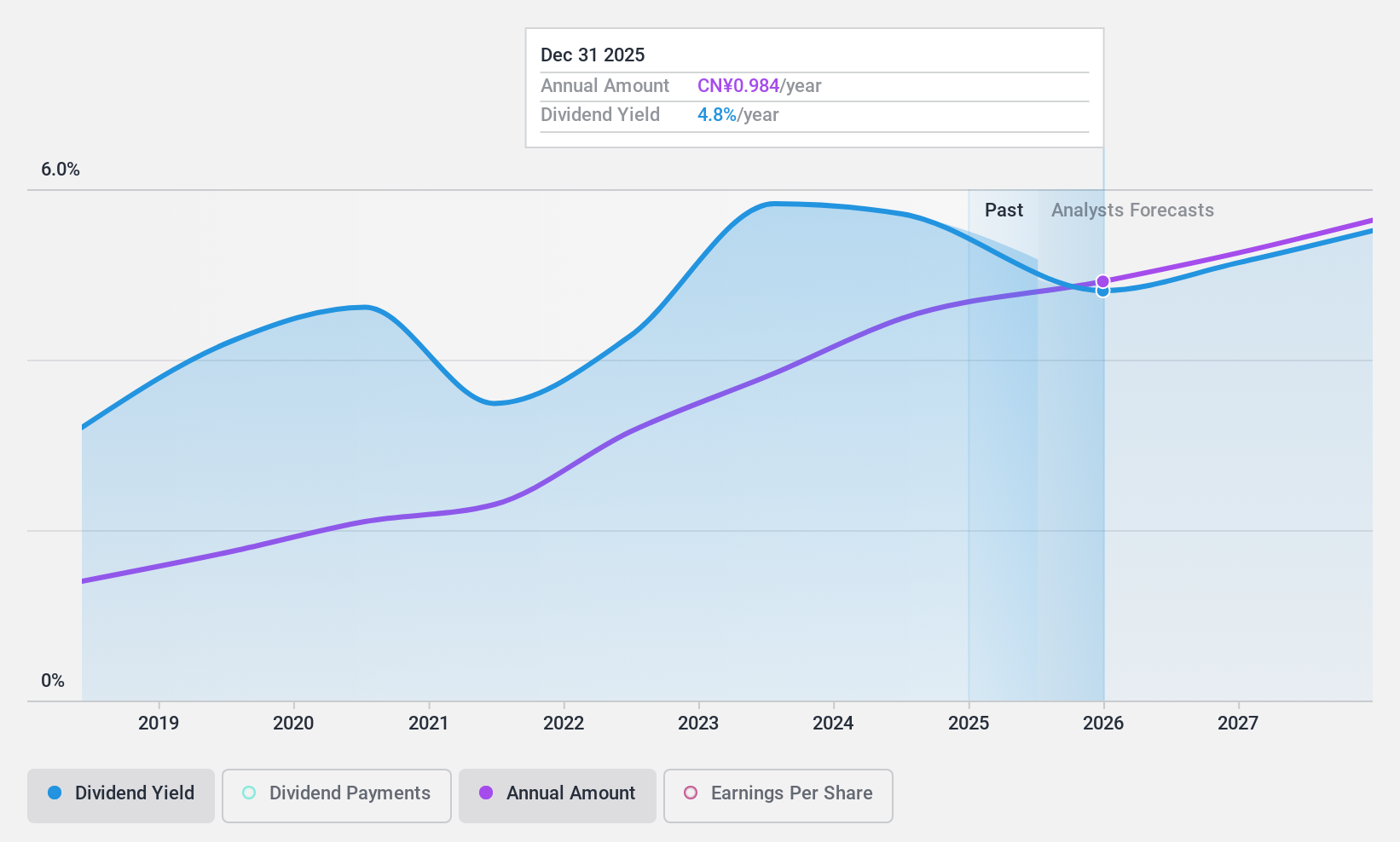

Bank of Chengdu (SHSE:601838)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Chengdu Co., Ltd. offers a range of commercial banking products and services in China, with a market cap of CN¥71.68 billion.

Operations: I'm sorry, but there is no specific revenue segment information provided in the text for Bank of Chengdu Co., Ltd.

Dividend Yield: 5.2%

Bank of Chengdu's dividend yield of 5.22% ranks in the top 25% in China, with stable payments over its seven-year history. The dividend is well-covered by earnings, reflected in a low payout ratio of 27.9%, and is expected to remain sustainable with a forecasted payout ratio of 29.7%. Trading at a significant discount to its estimated fair value, the bank's earnings are projected to grow by 11.06% annually, supporting future dividend stability.

- Click here to discover the nuances of Bank of Chengdu with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Bank of Chengdu is trading behind its estimated value.

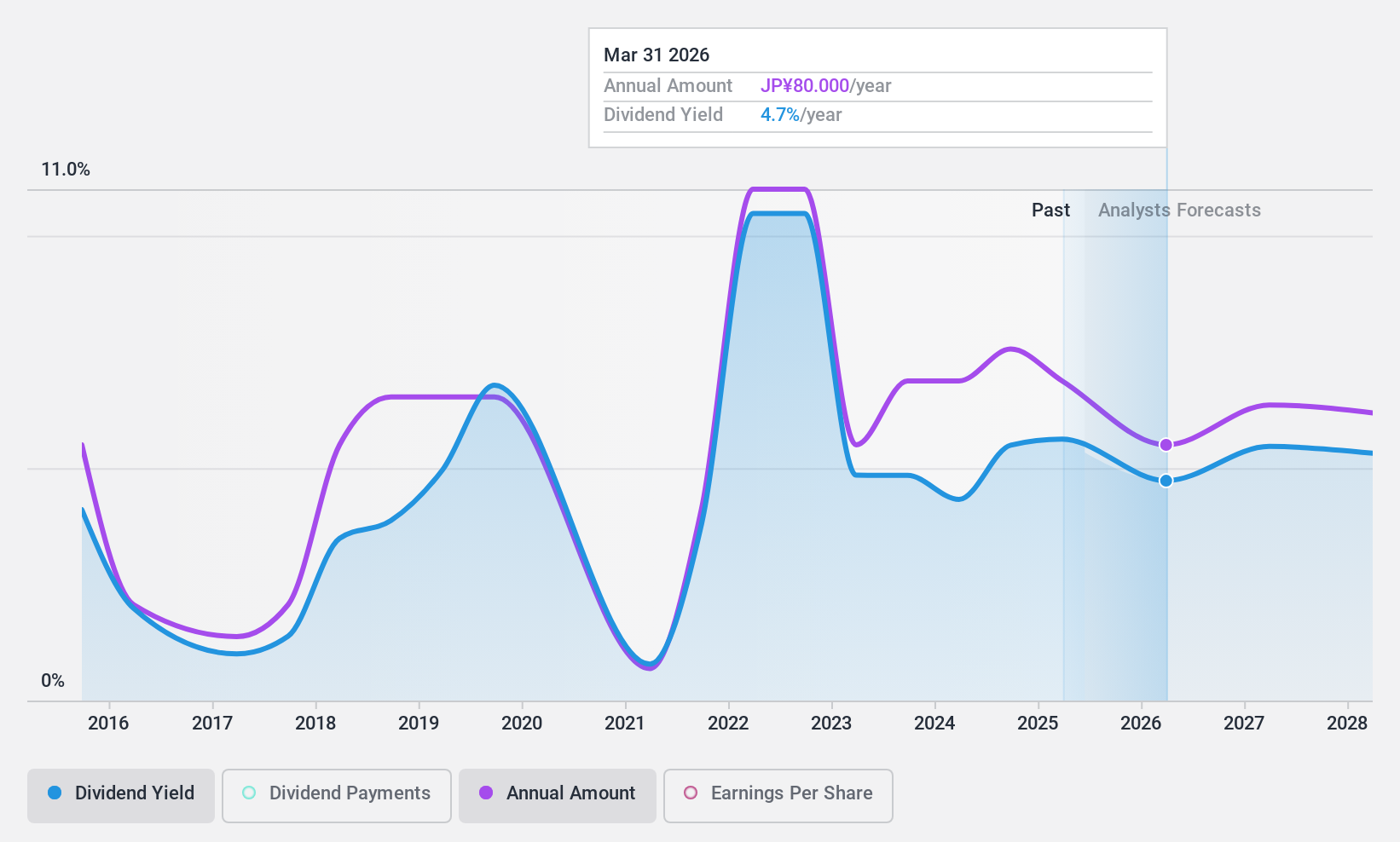

JFE Holdings (TSE:5411)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JFE Holdings, Inc. operates through its subsidiaries in steel, engineering, and trading businesses both in Japan and internationally, with a market capitalization of approximately ¥1.14 trillion.

Operations: JFE Holdings generates revenue from its steel segment at ¥3.58 billion, engineering at ¥561.04 million, and trading company operations at ¥1.45 billion.

Dividend Yield: 5.6%

JFE Holdings' dividend yield of 5.59% ranks in the top 25% within Japan, though its payments have been volatile over the past decade. Recent adjustments saw a reduction in the annual dividend forecast to ¥50 per share, reflecting challenges in earnings and cash flow coverage. Despite high debt levels and one-off items affecting results, JFE maintains dividends at previous fiscal levels while trading near fair value compared to peers, indicating potential value for investors seeking high yields.

- Delve into the full analysis dividend report here for a deeper understanding of JFE Holdings.

- Our comprehensive valuation report raises the possibility that JFE Holdings is priced lower than what may be justified by its financials.

Make It Happen

- Embark on your investment journey to our 1949 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2348

Dawnrays Pharmaceutical (Holdings)

An investment holding company, develops, manufactures, and sells non-patented pharmaceutical medicines in Mainland China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives