- Japan

- /

- Metals and Mining

- /

- TSE:5602

Discover January 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate the early days of 2025, optimism is buoyed by hopes for softer tariffs and advancements in artificial intelligence, with major U.S. indices like the S&P 500 reaching record highs. Against this backdrop of economic shifts and investor enthusiasm, dividend stocks continue to capture attention as they offer potential income stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Yurtec (TSE:1934)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yurtec Corporation is a facility engineering company operating in Japan and internationally, with a market cap of ¥101.42 billion.

Operations: Yurtec Corporation's revenue is derived from its operations as a facility engineering company, serving both domestic and international markets.

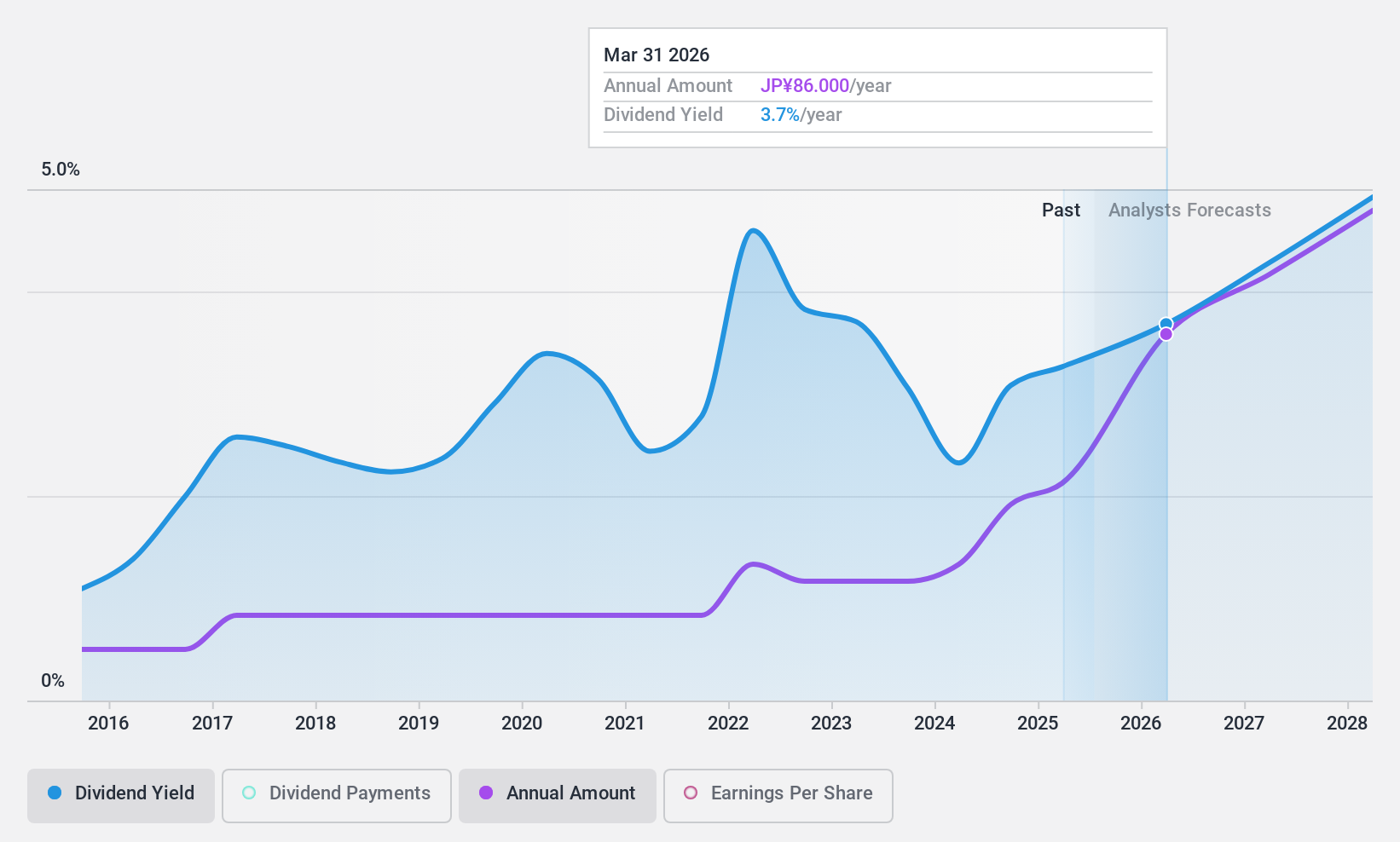

Dividend Yield: 3.3%

Yurtec has seen a steady increase in dividend payments over the past decade, supported by earnings growth of 11% annually over the last five years. The dividends are well-covered by earnings with a payout ratio of 53.6%, though cash flow coverage is tighter at 84.3%. Despite recent volatility in dividend reliability, Yurtec's share buyback program reflects its commitment to returning profits to shareholders, having repurchased shares worth ¥4.51 billion recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Yurtec.

- Our expertly prepared valuation report Yurtec implies its share price may be too high.

Godo Steel (TSE:5410)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Godo Steel, Ltd. manufactures and sells steel products in Japan with a market cap of ¥58.72 billion.

Operations: Godo Steel, Ltd. generates revenue through its Steel Business segment, which accounts for ¥196.17 billion, and its Agricultural Materials Business segment, contributing ¥11.82 billion.

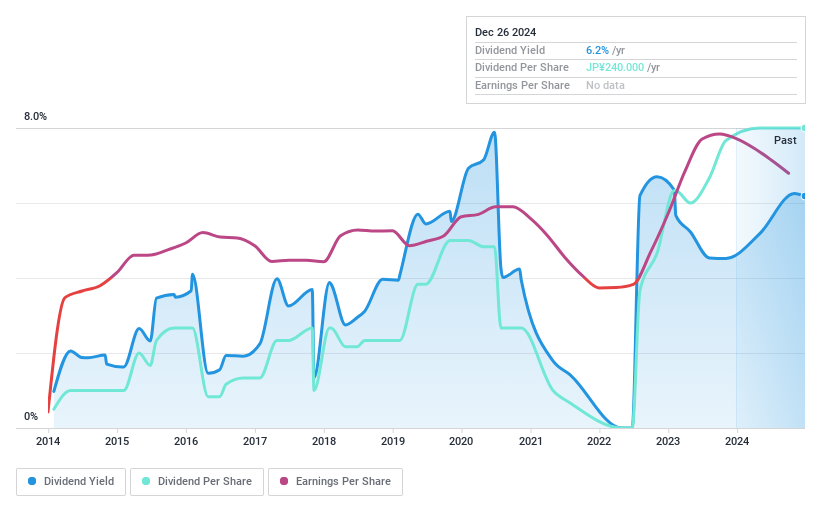

Dividend Yield: 5.9%

Godo Steel's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 28.6% and a cash payout ratio of 22.4%. Despite this coverage, the dividends have been unreliable and volatile over the past decade, experiencing significant fluctuations. However, its current dividend yield is in the top 25% of Japanese market payers at 5.93%, suggesting attractive income potential despite historical instability in payouts.

- Unlock comprehensive insights into our analysis of Godo Steel stock in this dividend report.

- Our valuation report here indicates Godo Steel may be undervalued.

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurimoto Ltd. is a company that manufactures and sells ductile iron pipes, valves, industrial equipment, materials, and construction materials both in Japan and internationally, with a market cap of ¥52.03 billion.

Operations: Kurimoto Ltd.'s revenue is derived from its production and sale of ductile iron pipes and accessories, valves, industrial equipment and materials, as well as construction materials.

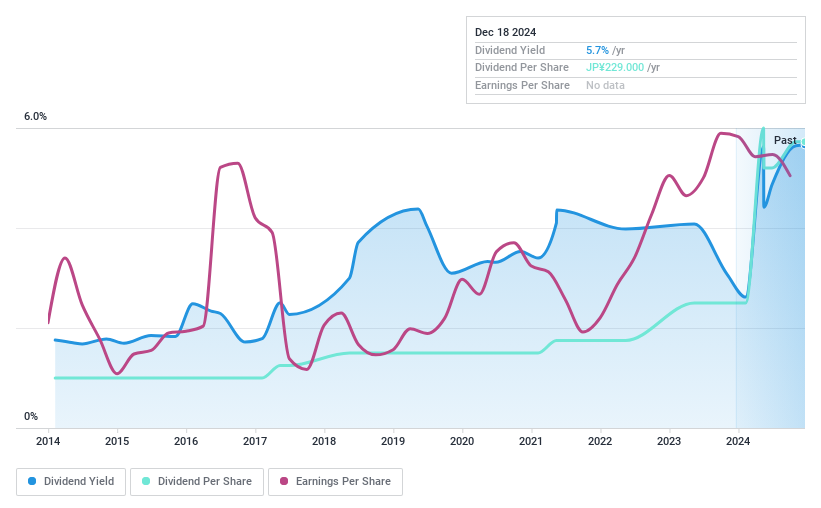

Dividend Yield: 5.1%

Kurimoto Ltd. offers a compelling dividend yield of 5.08%, placing it among the top 25% in Japan, with stable and growing dividends over the past decade. The payout ratio of 40.4% indicates dividends are well-covered by earnings, yet not supported by free cash flows, raising sustainability concerns despite consistent payments. Its price-to-earnings ratio of 10.7x suggests good value compared to the broader market's 13.7x, enhancing its appeal for income-focused investors seeking stability and growth potential.

- Take a closer look at KurimotoLtd's potential here in our dividend report.

- The analysis detailed in our KurimotoLtd valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1951 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KurimotoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5602

KurimotoLtd

Manufactures and sells ductile iron pipes and accessories, valves, industrial equipment and materials, and construction materials in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives