- Japan

- /

- Metals and Mining

- /

- TSE:5401

Will a US$733 Million Joint Venture Secure Nippon Steel's (TSE:5401) Long-Term Supply Narrative?

Reviewed by Sasha Jovanovic

- On October 7, 2025, Rio Tinto, Mitsui, and Nippon Steel announced a joint investment of US$733 million to develop new iron ore deposits at the West Angelas Sustaining Project in Western Australia, securing all required government approvals.

- This partnership not only extends mining operations and supports local job creation but also reinforces Nippon Steel’s efforts to secure a long-term and reliable supply of raw materials for its steel production.

- We’ll examine how this significant iron ore investment shapes Nippon Steel’s investment narrative through a focus on long-term supply security.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Nippon Steel's Investment Narrative?

For investors considering Nippon Steel, the big picture centers on exposure to long-term steel demand and supply security, particularly as global industry shifts toward more sustainable practices and reliable supply chains. The recent $733 million joint investment with Rio Tinto and Mitsui in the West Angelas Sustaining Project may represent a meaningful shift in short-term catalysts, as it directly addresses Nippon Steel's access to a steady flow of iron ore, key amid ongoing volatility in raw material costs and supply. Previously, risks included ongoing losses, tight dividend coverage, and an uncertain regulatory environment tied to overseas expansion. Now, the new project could lessen fears about input scarcity, potentially reducing immediate cost risk and reinforcing supply stability, but core financial issues and execution risks around expansion remain unresolved, especially with upcoming earnings reports offering fresh short-term catalysts. However, governance questions and concerns about profit turnaround haven't gone away.

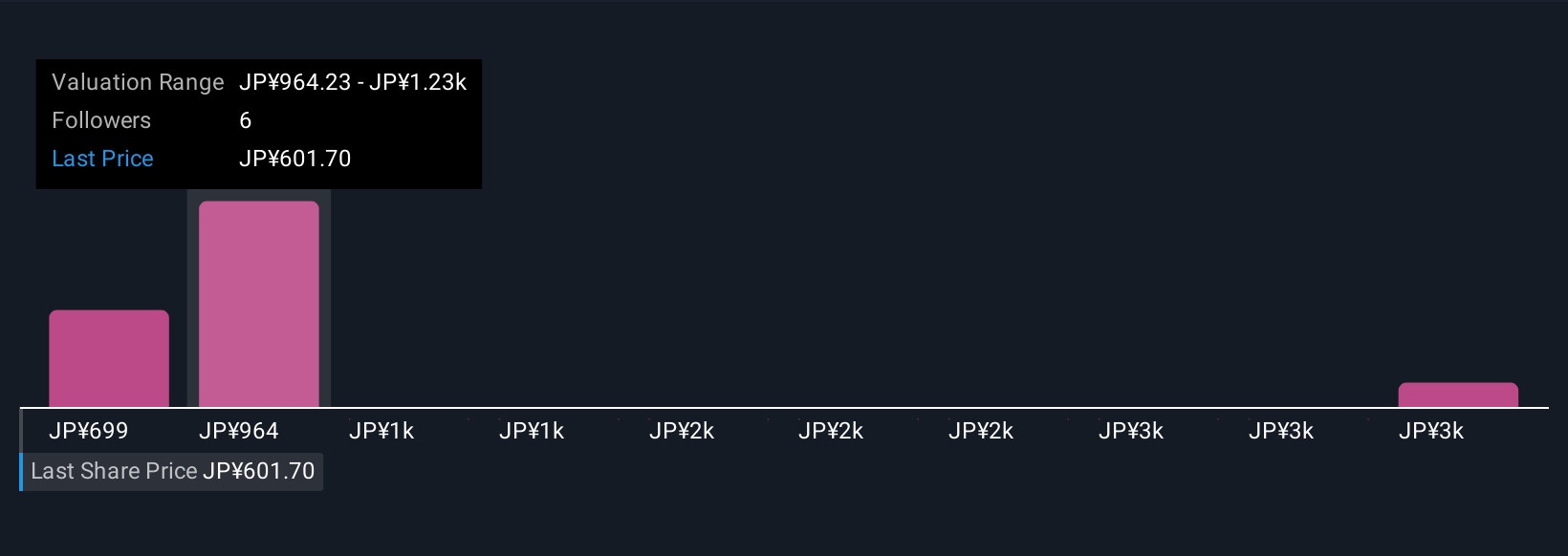

Nippon Steel's shares have been on the rise but are still potentially undervalued by 41%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Nippon Steel - why the stock might be worth just ¥699!

Build Your Own Nippon Steel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nippon Steel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nippon Steel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nippon Steel's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives