- Japan

- /

- Metals and Mining

- /

- TSE:5401

Nippon Steel (TSE:5401): Examining Valuation After Major West Angelas Project Investment Approval

Reviewed by Kshitija Bhandaru

Nippon Steel (TSE:5401) is taking a big step forward by partnering with Rio Tinto and Mitsui for a $733 million investment in the West Angelas Sustaining Project in Western Australia. With all regulatory approvals secured, this move is set to strengthen the company's access to iron ore for years ahead.

See our latest analysis for Nippon Steel.

Over the past year, Nippon Steel’s share price has seen some swings but remains supported by steady progress, including involvement in the West Angelas project and recent presentations to the auto industry. Short-term share price returns have been mixed, yet a 1-year total shareholder return of 3.43% and a remarkable 66.6% over three years highlight the company’s durable growth story. Momentum appears to be building again following strategic moves like this latest alliance.

If this surge in strategic investment has you looking for fresh ideas, now's the perfect moment to uncover See the full list for free.

But with shares still trading at a notable discount to analyst targets and strong three-year returns on the books, is Nippon Steel undervalued right now? Or has the market already factored in its future growth prospects?

Price-to-Sales of 0.4x: Is it Justified?

Nippon Steel's shares are currently trading at a price-to-sales (P/S) ratio of 0.4x, noticeably lower than its industry peers and the company's own estimated fair P/S ratio. At its last close of ¥606.1, the stock appears attractively priced based on sales performance.

The price-to-sales ratio divides a company's market capitalization by its total sales. This serves as a quick indicator of how much investors are willing to pay for each yen of revenue generated. For large manufacturers like Nippon Steel, the P/S multiple can spotlight perceived growth opportunities or highlight undervaluation if future revenues look poised to rise.

Compared to the Japanese Metals and Mining industry average P/S of 0.4x, Nippon Steel sits at par. When compared to the fair P/S ratio of 0.9x, which is calculated from growth potential and market dynamics, there is significant room for market re-rating. The stock’s valuation signals a potential disconnect between current price and what ongoing strategic progress could justify if future revenues materialize as expected.

Explore the SWS fair ratio for Nippon Steel

Result: Price-to-Sales of 0.4x (UNDERVALUED)

However, slower revenue growth or ongoing net losses could present challenges to the case for Nippon Steel’s undervaluation in the near term.

Find out about the key risks to this Nippon Steel narrative.

Another View: What Does the SWS DCF Model Say?

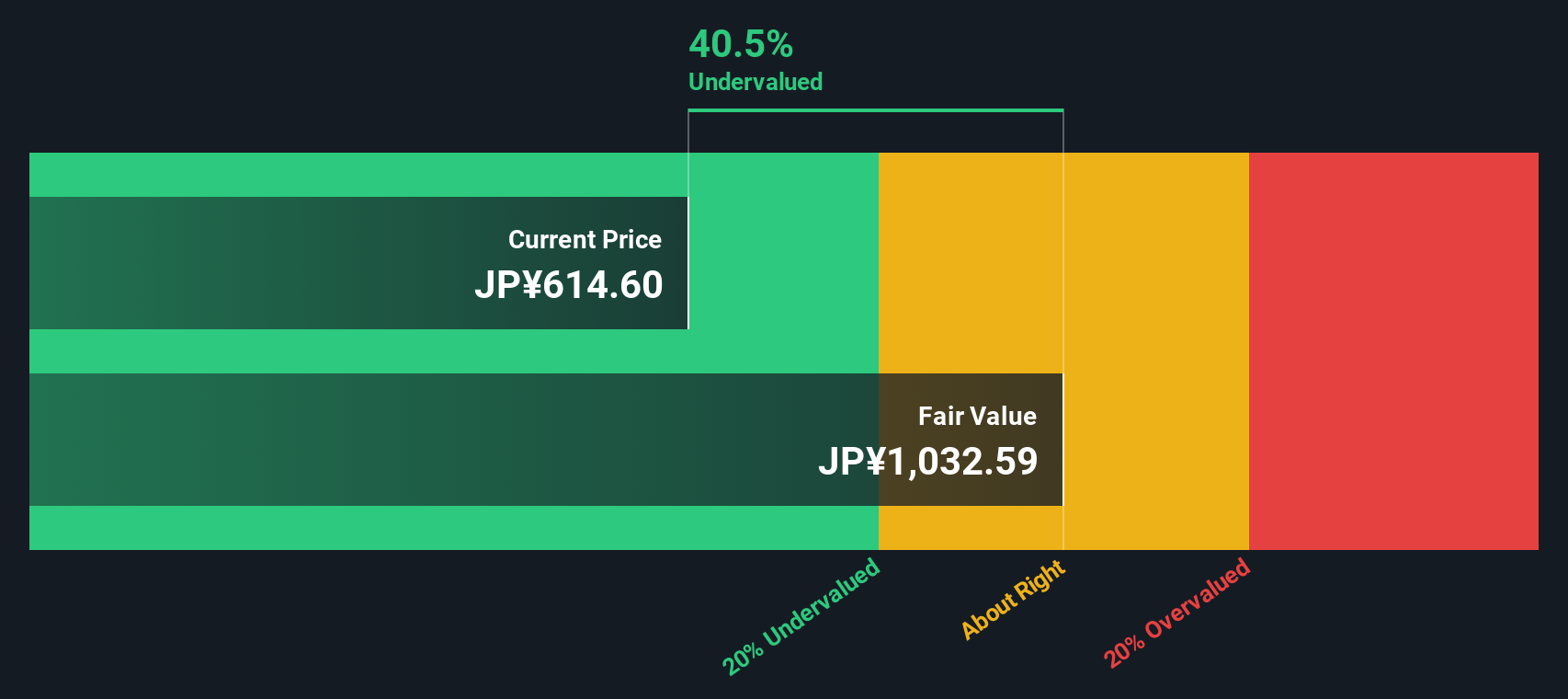

While Nippon Steel looks undervalued on a sales basis, the SWS DCF model adds another perspective. Our DCF suggests the shares are also trading at a steep 40.6% discount to fair value, signaling potential upside. However, could this discount persist, or is the market overlooking key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Steel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Steel Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own view from the ground up in just a few minutes. Do it your way

A great starting point for your Nippon Steel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle. Broaden your search and spot fresh opportunities before others catch on by checking out these uniquely positioned stock themes below:

- Spot stocks with strong fundamentals powering sustainable yields when you scan these 18 dividend stocks with yields > 3% right now.

- Unlock the biggest trends transforming healthcare with cutting-edge companies from these 33 healthcare AI stocks.

- Catch undervalued gems primed for long-term potential by browsing these 871 undervalued stocks based on cash flows while prices hold steady.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives