What You Can Learn From Mipox Corporation's (TSE:5381) P/S After Its 26% Share Price Crash

To the annoyance of some shareholders, Mipox Corporation (TSE:5381) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 14% share price drop.

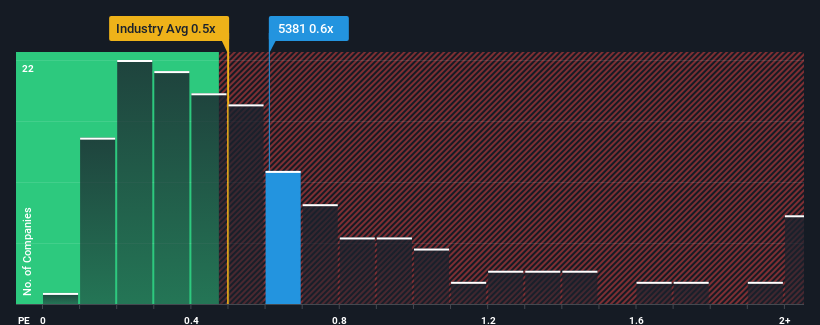

In spite of the heavy fall in price, it's still not a stretch to say that Mipox's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Japan, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Mipox

How Has Mipox Performed Recently?

With revenue growth that's superior to most other companies of late, Mipox has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Mipox will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Mipox's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. As a result, it also grew revenue by 10% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.0% as estimated by the only analyst watching the company. With the industry predicted to deliver 5.2% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Mipox's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Mipox's P/S

Following Mipox's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Mipox's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Mipox (of which 1 is concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5381

Medium-low risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026