As global markets navigate a complex landscape marked by fluctuating interest rates, competitive pressures in the AI sector, and geopolitical uncertainties, investors are seeking stability amidst volatility. With major indices experiencing mixed performance and central banks adjusting their policies to manage inflation and economic growth, dividend stocks offer a compelling option for those looking to balance income with potential capital appreciation. A good dividend stock typically combines a reliable payout history with the resilience to withstand market fluctuations, making it an attractive choice in today's uncertain economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

What's Cooking Group/SA (ENXTBR:WHATS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: What's Cooking Group NV/SA, with a market cap of €184.50 million, operates through its subsidiaries to produce and sell meat products and ready meals.

Operations: The company's revenue is primarily derived from two segments: Savoury, contributing €463.60 million, and Ready Meals, accounting for €384.84 million.

Dividend Yield: 4.2%

What's Cooking Group/SA has consistently delivered reliable dividends over the past decade, with stable and growing payments. The dividend yield of 4.2% is attractive, though not among the highest in Belgium. Dividends are well-covered by both earnings (51.6% payout ratio) and cash flows (15.6% cash payout ratio), indicating sustainability. Trading at a price-to-earnings ratio slightly below the Belgian market average, it offers good relative value compared to peers and industry standards.

- Unlock comprehensive insights into our analysis of What's Cooking Group/SA stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of What's Cooking Group/SA shares in the market.

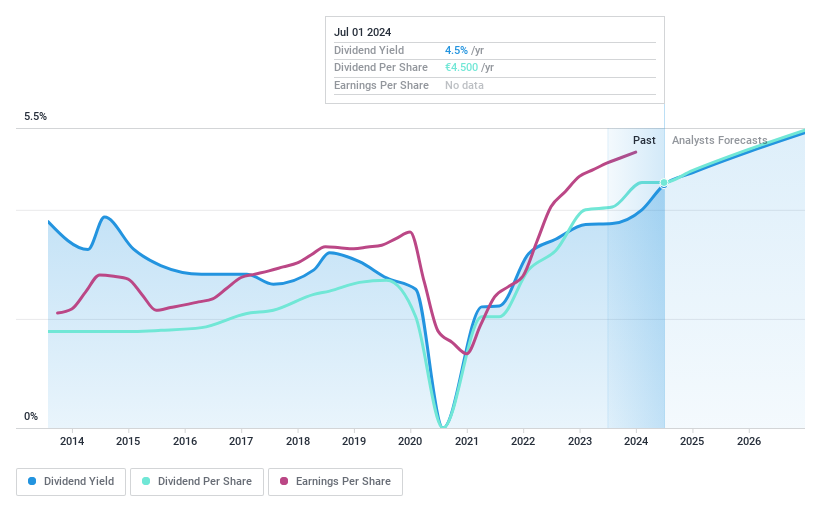

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in concessions, energy, and construction sectors both in France and internationally, with a market capitalization of €59.75 billion.

Operations: Vinci SA's revenue is primarily derived from its segments, including VINCI Construction (Including Eurovia) at €31.83 billion, VINCI Energies at €19.76 billion, Cobra IS at €6.74 billion, Concessions - VINCI Autoroutes at €6.98 billion, and Concessions - VINCI Airports at €4.57 billion.

Dividend Yield: 4.3%

Vinci's dividend payments have been volatile over the past decade, despite recent growth. The payout ratio of 55.8% and cash payout ratio of 34.3% suggest dividends are well-covered by earnings and cash flows, indicating sustainability. Although the dividend yield is lower than France's top quartile at 4.27%, Vinci trades below its estimated fair value, offering good relative value. High debt levels remain a concern for potential investors focusing on stable income streams.

- Get an in-depth perspective on Vinci's performance by reading our dividend report here.

- According our valuation report, there's an indication that Vinci's share price might be on the cheaper side.

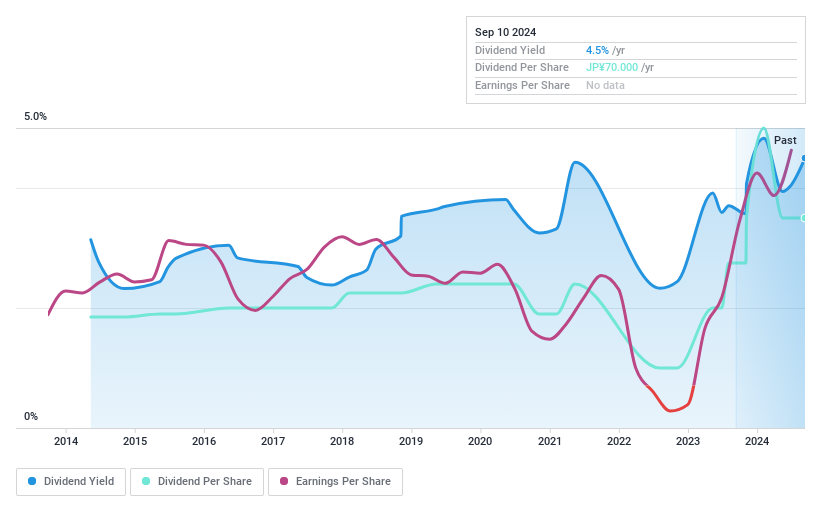

Yushiro Chemical Industry (TSE:5013)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yushiro Chemical Industry Co., Ltd. manufactures and sells metalworking oils, fluids, and building maintenance chemicals globally, with a market cap of ¥28.66 billion.

Operations: Yushiro Chemical Industry Co., Ltd. generates revenue from several regions, including ¥6.49 billion from China, ¥20.91 billion from Japan, ¥7.11 billion from Southeast Asia and India, and ¥22.42 billion from North and South America.

Dividend Yield: 4.6%

Yushiro Chemical Industry's dividend yield is among the top 25% in Japan, supported by a low payout ratio of 29.5%, ensuring coverage by earnings and cash flows. Despite recent increases, dividends have been historically volatile and unreliable over the past decade. The company trades significantly below its estimated fair value, presenting potential value for investors. Recent share buybacks aim to enhance capital efficiency, while profit growth of 42% last year strengthens its financial position for future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Yushiro Chemical Industry.

- Upon reviewing our latest valuation report, Yushiro Chemical Industry's share price might be too pessimistic.

Seize The Opportunity

- Embark on your investment journey to our 1959 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if What's Cooking Group/SA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:WHATS

What's Cooking Group/SA

Produces and sells meat products and ready meals.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives