Assessing Takasago International’s (TSE:4914) Valuation Following Sustained Share Price Strength

Reviewed by Simply Wall St

Price-to-Earnings of 13.1x: Is it justified?

Based on a Price-to-Earnings ratio of 13.1x, Takasago International appears to be priced in line with its industry peers but slightly more expensive than the sector average. However, when set against the broader market and comparable companies, this figure is near the average for firms of its size and profile.

The Price-to-Earnings (P/E) ratio is a common metric that compares a company's current share price to its per-share earnings. For chemical sector companies, the P/E ratio is often used to assess how much the market is willing to pay for current and future earnings streams. This makes it especially relevant in cyclical and growth-sensitive sectors such as chemicals.

Although Takasago trades at a P/E marginally above the industry average of 13x, its multiple is below many of its direct peers. This could suggest the market expects slightly higher or more stable earnings from Takasago compared to others. Still, the premium is minimal and may be reflective of the company’s strong earnings growth over the last year.

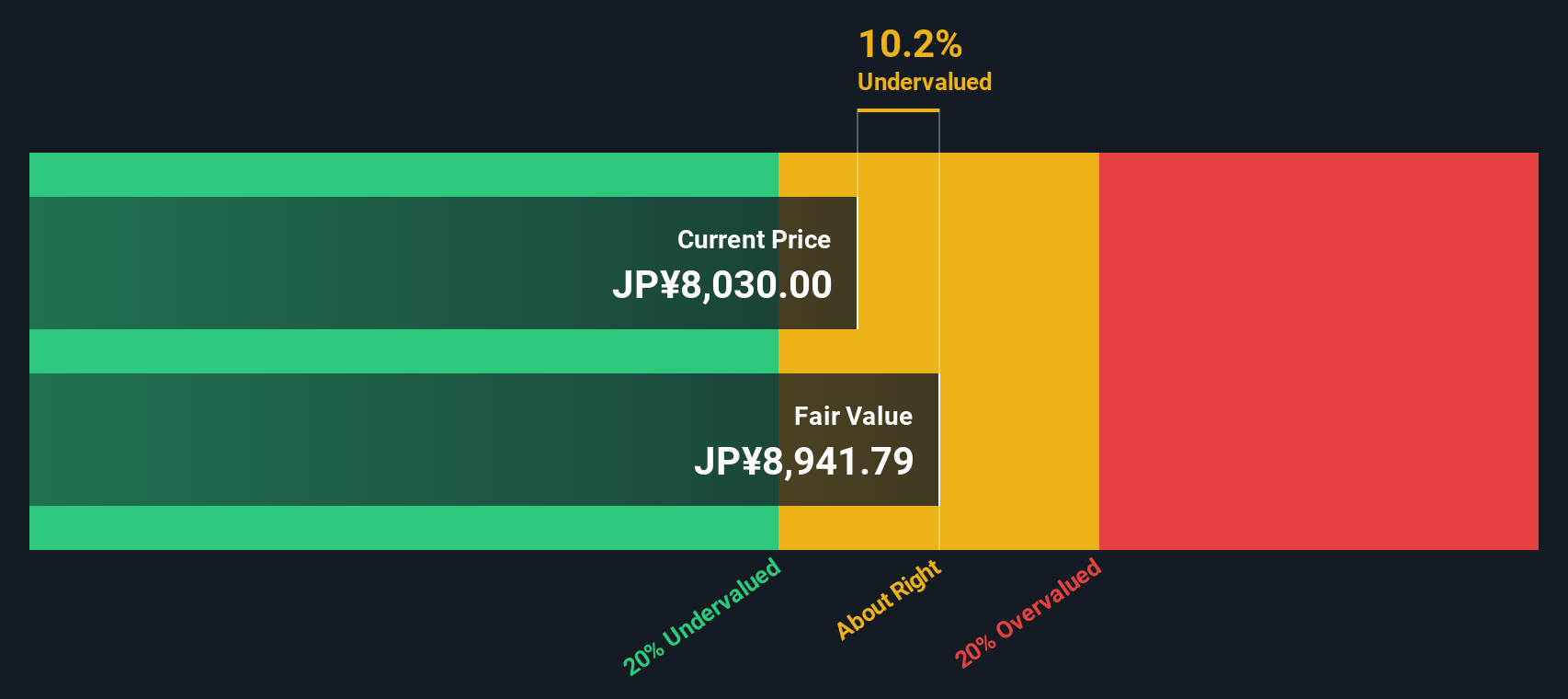

Result: Fair Value of ¥8,982.16 (UNDERVALUED)

See our latest analysis for Takasago International.However, unpredictable market shifts or weaker-than-expected earnings could quickly change sentiment around Takasago International’s valuation and recent momentum.

Find out about the key risks to this Takasago International narrative.Another View: What Does the DCF Model Suggest?

Looking beyond earnings multiples, our DCF model reviews Takasago International’s cash flow outlook and arrives at the same conclusion. This suggests the stock is undervalued. But can both methods really be right at the same time?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Takasago International Narrative

If you have a different perspective or simply want to see how your interpretation stacks up, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Takasago International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizon and seize new opportunities by targeting stocks with strong momentum, stable income, and future-oriented potential that others may have overlooked.

- Spot hidden value in overlooked opportunities by scanning for undervalued stocks based on cash flows if you want to catch stocks the market has mispriced.

- Unlock steady cash flow for your portfolio by searching for companies offering robust yields with dividend stocks with yields > 3% and keep your income streams growing.

- Catch the next tech wave by handpicking trailblazing innovators in computing with quantum computing stocks and stay ahead of tomorrow's trends today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takasago International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4914

Takasago International

Manufactures and sells flavors, fragrances, aroma ingredients, and other fine chemicals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives