Is DIC (TSE:4631) Still Undervalued After Its Recent Share Price Gains?

Reviewed by Simply Wall St

DIC (TSE:4631) has been quietly rewarding patient investors, with the share price climbing about 11% year to date and roughly 14% over the past year, outpacing many Japanese materials peers.

See our latest analysis for DIC.

That steady climb reflects improving sentiment around DIC’s gradual earnings growth, with the latest 3.0% one month share price return feeding into a solid 11.0% year to date share price gain and strong three year total shareholder return.

If this kind of steady compounding appeals to you, it could also be worth exploring fast growing stocks with high insider ownership as a way to uncover other potential long term winners.

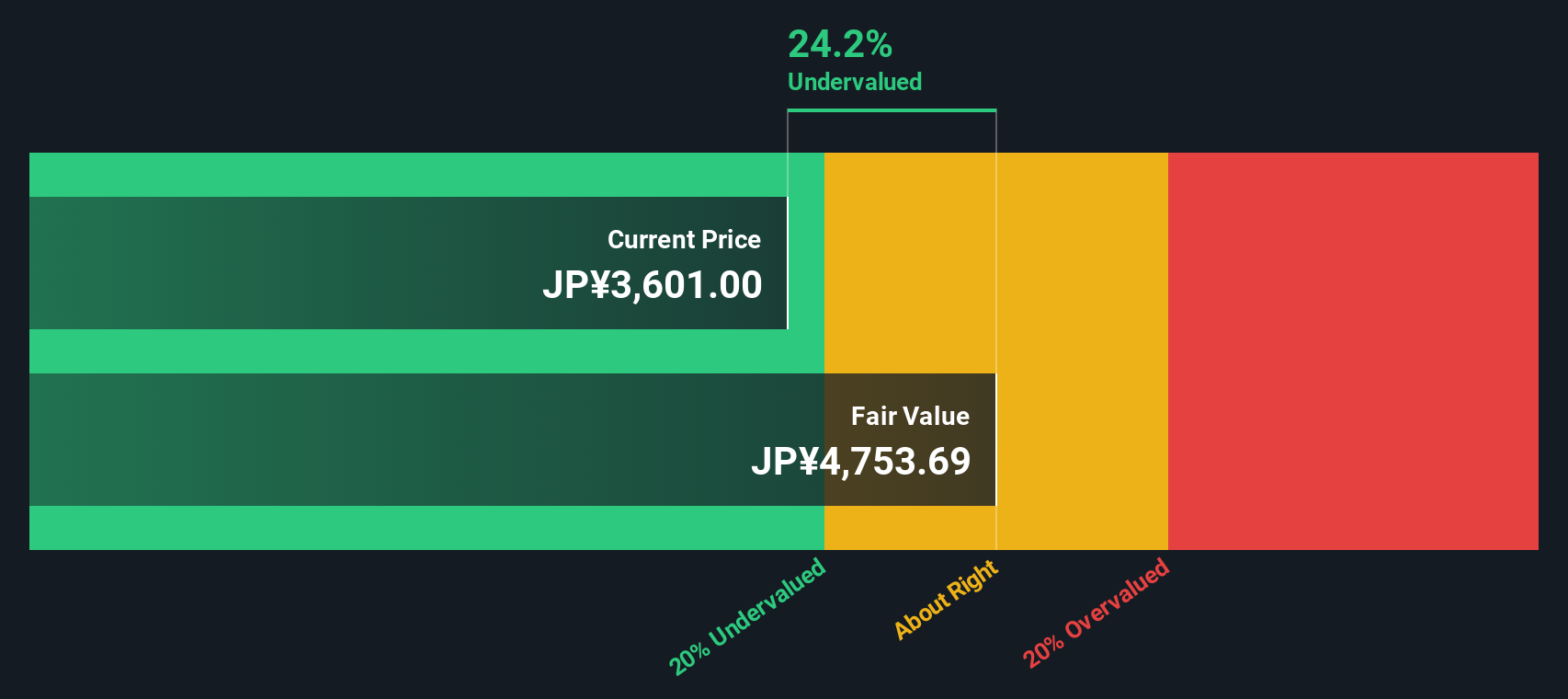

Yet with the shares trading at a modest discount to analyst targets, but a sizeable discount to some intrinsic value estimates, investors must ask: is DIC still undervalued, or is the market already pricing in its future growth?

Price-to-Earnings of 10.9x: Is it justified?

On a simple earnings lens, DIC trades on a 10.9x price to earnings ratio versus a ¥3742 last close, suggesting the market applies a noticeable discount to peers.

The price to earnings multiple compares what investors pay today for each unit of current earnings, a common yardstick for established, profitable chemicals businesses like DIC.

Here, the stock looks attractively priced, with its 10.9x multiple sitting below the peer average of 15.6x and the wider JP Chemicals industry on 12.3x. Our fair price to earnings estimate of 14.4x highlights meaningful room for the market to re rate closer to that level if earnings and profitability trends hold.

By comparison, that gap to both peers and the fair ratio implies investors are still reluctant to pay up for DIC’s recovery, despite forecasts calling for continued profit growth. This makes the current discount stand out more sharply in a sector where valuations often converge toward fair levels over time.

Explore the SWS fair ratio for DIC

Result: Price-to-Earnings of 10.9x (UNDERVALUED)

However, lingering cyclical demand pressures and any setback in DIC’s incremental margin recovery could quickly narrow today’s apparent valuation discount.

Find out about the key risks to this DIC narrative.

Another View: Discounted Cash Flows Point Higher

While earnings multiples suggest DIC is cheap, our DCF model goes further, putting fair value near ¥5457, about 31% above today’s ¥3742. That deeper discount hints at a larger margin of safety, but also raises the question: are the cash flow assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DIC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DIC Narrative

If you feel differently about the numbers, or would rather dig into the figures yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your DIC research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop building their opportunity watchlist. Use the Simply Wall St Screener now so you are not left chasing yesterday’s winners.

- Secure potential multi baggers early by scanning these 3576 penny stocks with strong financials that already back their promise with solid financials.

- Ride powerful technology trends by focusing on these 24 AI penny stocks positioned at the heart of the AI transformation.

- Lock in quality at a discount by targeting these 925 undervalued stocks based on cash flows that the market has yet to fully appreciate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4631

DIC

Manufactures and sells printing inks, organic pigments, and synthetic resins worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026