DIC Corporation (TSE:4631) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Those holding DIC Corporation (TSE:4631) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

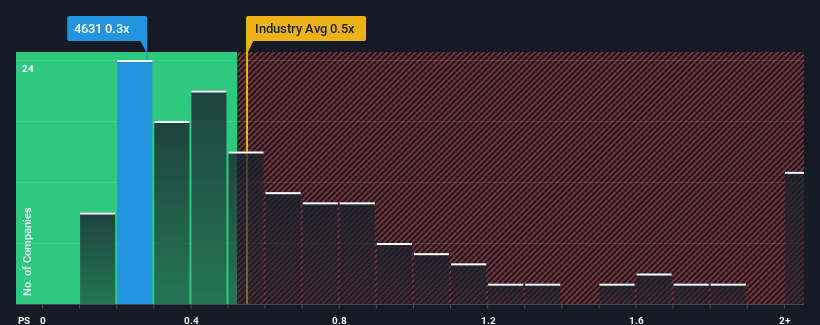

Even after such a large jump in price, it's still not a stretch to say that DIC's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Chemicals industry in Japan, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for DIC

How DIC Has Been Performing

Recent times have been pleasing for DIC as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on DIC will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think DIC's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, DIC would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 42% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 2.3% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 6.0% per annum, which is noticeably more attractive.

In light of this, it's curious that DIC's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From DIC's P/S?

DIC's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that DIC's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You need to take note of risks, for example - DIC has 2 warning signs (and 1 which is significant) we think you should know about.

If you're unsure about the strength of DIC's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4631

DIC

Manufactures and sells printing inks, organic pigments, and synthetic resins worldwide.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives